New Jersey Lien and Tax Search Checklist

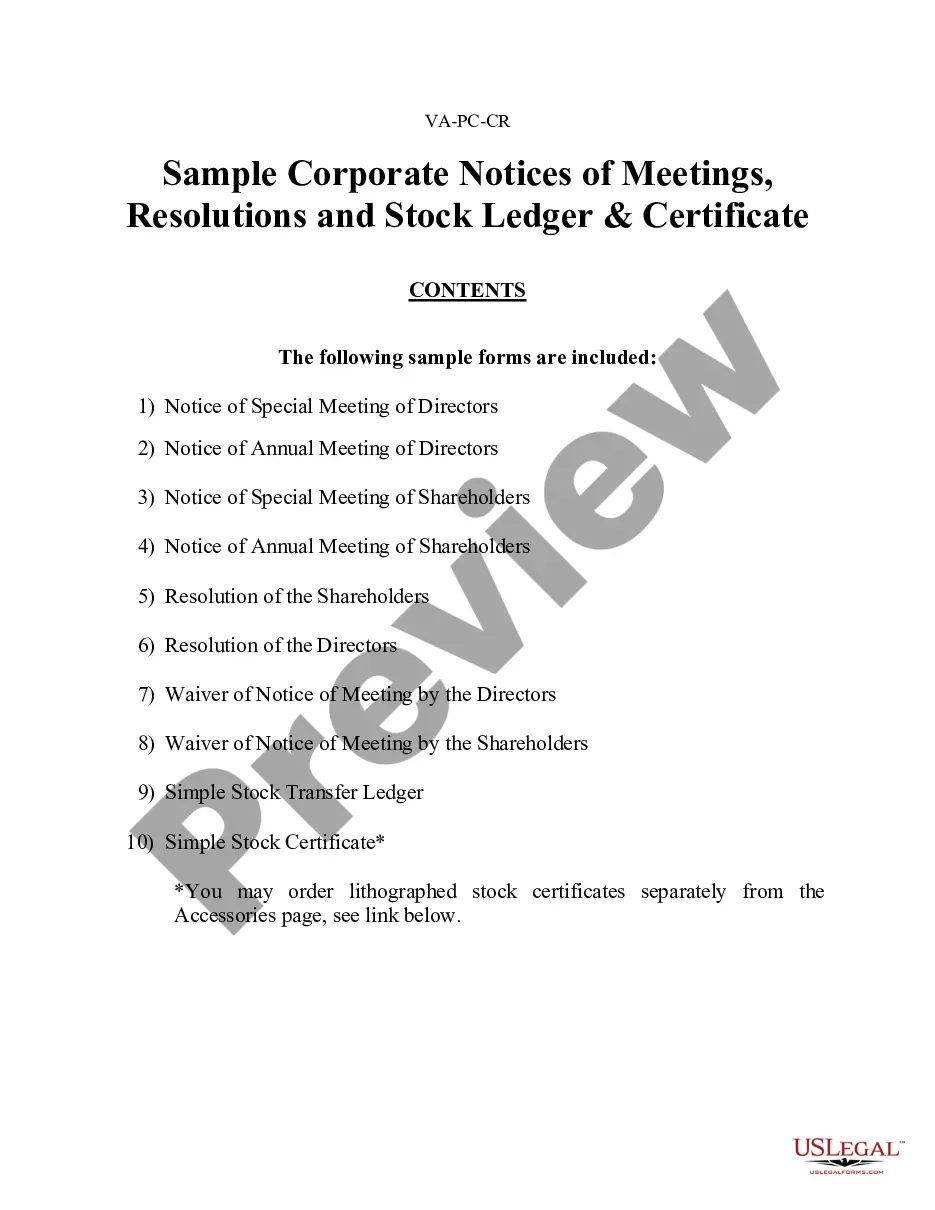

Description

How to fill out Lien And Tax Search Checklist?

Finding the right authorized file format could be a have a problem. Naturally, there are a lot of templates available on the net, but how will you find the authorized kind you want? Utilize the US Legal Forms website. The service offers 1000s of templates, including the New Jersey Lien and Tax Search Checklist, which can be used for enterprise and personal needs. Every one of the varieties are checked by specialists and meet state and federal requirements.

When you are currently registered, log in in your accounts and then click the Acquire key to get the New Jersey Lien and Tax Search Checklist. Make use of your accounts to search from the authorized varieties you might have purchased previously. Proceed to the My Forms tab of your accounts and obtain an additional copy from the file you want.

When you are a brand new consumer of US Legal Forms, listed below are easy recommendations for you to stick to:

- Very first, ensure you have chosen the appropriate kind to your city/region. It is possible to check out the shape utilizing the Review key and study the shape description to ensure this is the right one for you.

- In the event the kind does not meet your needs, make use of the Seach field to get the appropriate kind.

- When you are positive that the shape is acceptable, go through the Get now key to get the kind.

- Pick the rates prepare you would like and enter in the necessary info. Create your accounts and pay money for an order with your PayPal accounts or credit card.

- Pick the submit file format and acquire the authorized file format in your product.

- Complete, modify and print out and signal the attained New Jersey Lien and Tax Search Checklist.

US Legal Forms may be the largest library of authorized varieties for which you can see various file templates. Utilize the company to acquire appropriately-produced files that stick to state requirements.

Form popularity

FAQ

Interest rates for liens sold may be as high as 18%. Depending on the amount of the lien sold there are additional penalties of 2, 4 or 6% charged.

In New Jersey, property taxes are a continuous lien on the real estate. Property taxes are due in four installments during the year: February 1, May 1, August 1, and November 1. Delinquency on a property may accrue interest at up to 8 per cent for the first $1,500 due, and 18 per cent for any amount over $1,500.

Benefits and risks of tax lien investing Tax liens can be a higher-yielding investment, but not always. From a mere profit standpoint, most investors make their money based on the tax lien's interest rate. ... Tax liens come with an expiration date. ... Tax lien investing requires thorough research.

To apply for a release or subordination of your tax lien, contact your caseworker or email the Judgments Unit at judgments.taxation@treas.nj.gov. There is no official form to request release or lien subordination in New Jersey. You may want to work with a tax professional to get help with this process.

The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. If you do not pay your property taxes, a lien will be sold against the property for any unpaid taxes owed from the previous year. This includes sewer charges or any other municipal charges.

Judgments and Liens in New Jersey Federal Tax Liens will only be found in the county's land records. HOA Liens can be recorded in the county's land records, or they may be filed in superior court records. All other judgments and liens, including foreclosure cases, are filed in superior court records.

Redemption Period If No One Bought the Lien If no one bids on the lien at the tax lien sale, the municipality must wait for six months before starting the foreclosure. (N.J. Stat. Ann. § -86).