Nevada Self-Employed Supplier Services Contract

Description

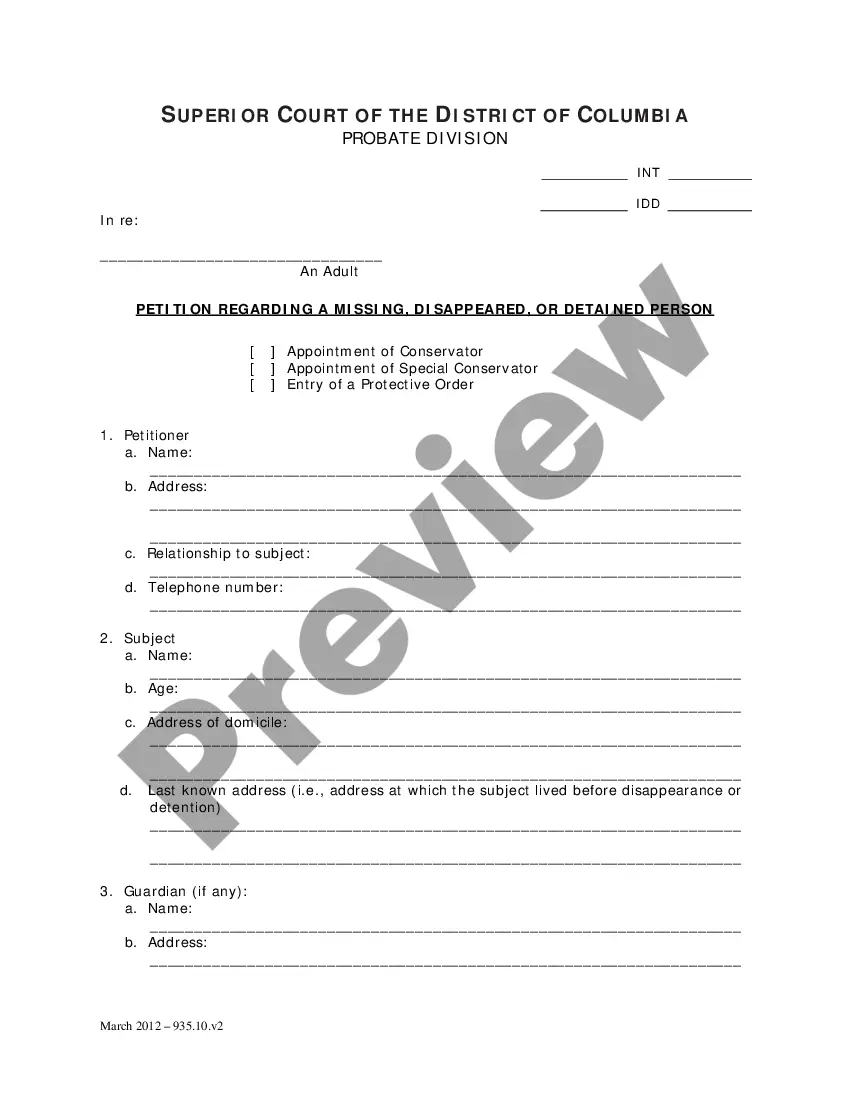

How to fill out Self-Employed Supplier Services Contract?

US Legal Forms - one of the largest collections of authentic templates in the United States - provides a range of legitimate document templates that you can download or print. Through the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of documents like the Nevada Self-Employed Supplier Services Contract within moments.

If you already have a subscription, Log In and retrieve the Nevada Self-Employed Supplier Services Contract from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved documents in the My documents tab of your account.

To utilize US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct document for your city/state. Click the Preview button to review the content of the form. Check the document description to confirm that you have chosen the right template. If the document does not meet your requirements, utilize the Search area at the top of the screen to find one that does. When you are satisfied with the document, confirm your choice by clicking the Acquire now button. Then, select your preferred pricing plan and provide your details to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the document to your device. Make edits. Complete, modify, print, and sign the downloaded Nevada Self-Employed Supplier Services Contract. Each template you added to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the document you desire.

US Legal Forms stands out as a crucial resource for anyone needing legitimate document templates, offering a vast array of options tailored for various situations.

Whether for professional or personal use, US Legal Forms has you covered with comprehensive templates that streamline your document creation process.

- Access the Nevada Self-Employed Supplier Services Contract with US Legal Forms, the most extensive library of authentic document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Download or print documents as needed without concern for expiration.

- Easily manage your templates within your account.

- Find documents sorted by categories or through a quick search.

- Securely process your payments through various methods.

Form popularity

FAQ

Yes, self-employed individuals benefit greatly from having a contract. A well-drafted contract outlines expectations, payment terms, and deliverables, providing clarity for both parties. For those using a Nevada Self-Employed Supplier Services Contract, this document helps protect your interests and minimizes the risk of misunderstandings.

A vendor qualifies as an independent contractor when they provide services under their own direction and control, rather than being managed by another party. Key factors include the level of independence in performing tasks and the nature of the relationship with the client. When drafting a Nevada Self-Employed Supplier Services Contract, clearly define the independence of the vendor to establish the nature of your working relationship.

While Nevada does not legally require an operating agreement for an LLC, having one is highly recommended. An operating agreement serves as a roadmap for your business operations and clarifies the management structure. It can also help establish guidelines for your Nevada Self-Employed Supplier Services Contract, ensuring all members understand their roles and responsibilities.

In Nevada, a contract is legally binding when it includes essential elements such as mutual consent, consideration, and a lawful purpose. Both parties must agree to the terms, providing something of value in exchange for the other party's performance. When you create a Nevada Self-Employed Supplier Services Contract, ensure it clearly outlines the obligations and rights of each party to avoid disputes.

Yes, a self-employed person can certainly have a contract. In fact, a Nevada Self-Employed Supplier Services Contract is an essential tool for defining the terms of your services and protecting your rights. This not only benefits you but also builds trust with your clients as it shows professionalism and commitment to your work.

To get authorized as an independent contractor in the US, you should first check the specific requirements in your state, including any business licenses needed. Creating a Nevada Self-Employed Supplier Services Contract can help solidify your status as a legitimate contractor. Additionally, ensure you comply with tax obligations to operate lawfully.

To set up as a self-employed contractor, start by registering your business and obtaining any necessary licenses. Next, consider using a Nevada Self-Employed Supplier Services Contract to outline your service agreements with clients. This contract will provide clarity and protect your interests as you establish your independent business.

Self-employed individuals run their own businesses, while contracted workers provide services under a contract for another business. A Nevada Self-Employed Supplier Services Contract highlights this relationship but ensures that you maintain independence as a self-employed supplier. Knowing this distinction can help you determine the right path for your career.

The legal requirements for self-employed individuals can vary by state. In Nevada, you need to obtain the necessary business licenses, comply with tax regulations, and possibly secure a Nevada Self-Employed Supplier Services Contract. Understanding these requirements will help you operate your business smoothly and avoid legal issues.

Yes, contract work does count as self-employment. When you enter into a Nevada Self-Employed Supplier Services Contract, you are essentially running your own business and providing services independently. This means you are responsible for your own taxes and benefits, which is a key aspect of being self-employed.