Nevada Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Design Agreement - Self-Employed Independent Contractor?

You can spend time online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that have been evaluated by experts.

You can easily download or print the Nevada Design Agreement - Self-Employed Independent Contractor from our service.

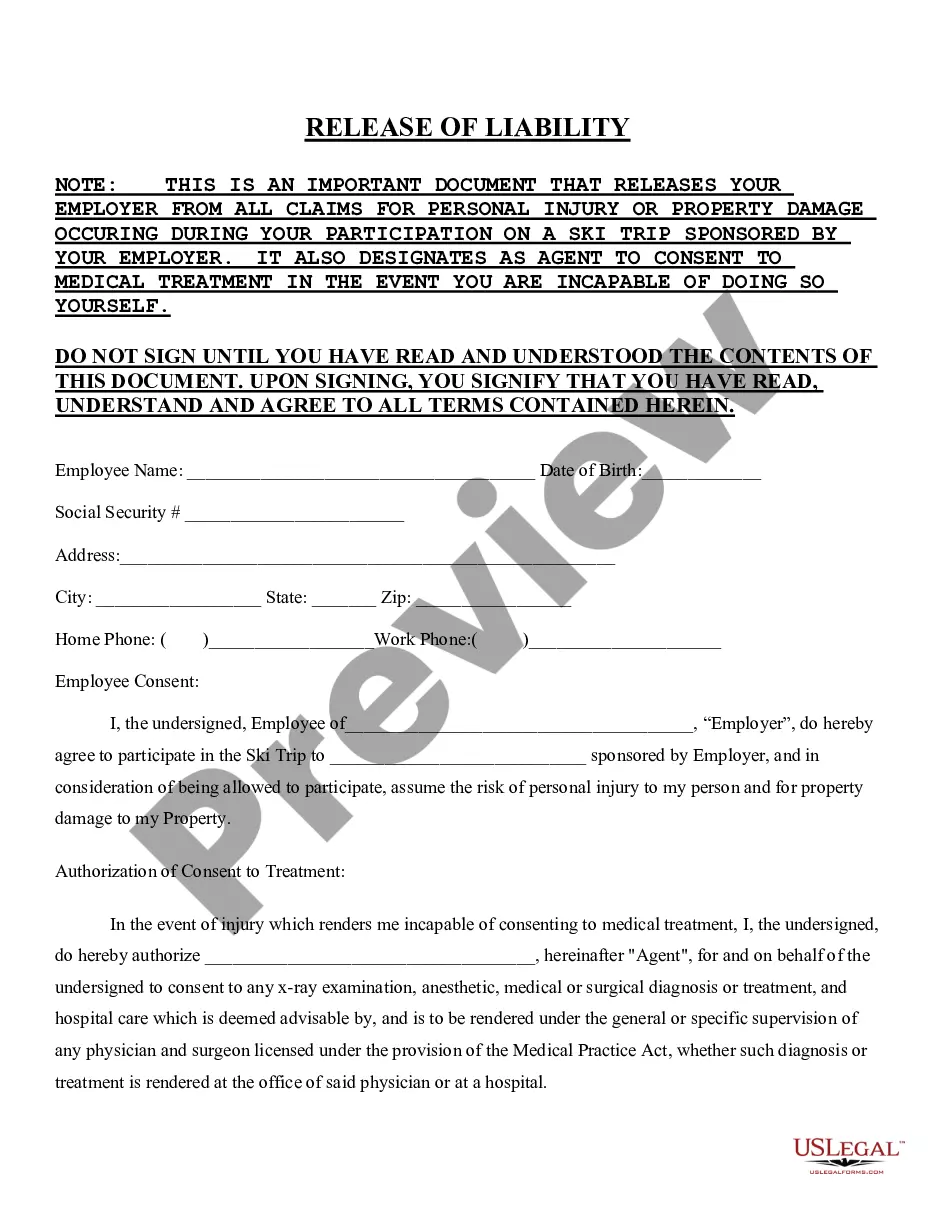

If available, use the Review button to examine the document template as well. If you want to find another version of your form, use the Lookup field to locate the template that fits your needs and requirements. Once you have found the template you want, click Purchase now to proceed. Select the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal document. Choose the format of your document and download it to your device. Make changes to the document if necessary. You can complete, edit, sign, and print the Nevada Design Agreement - Self-Employed Independent Contractor. Access and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Nevada Design Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- To access another copy of a purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your desired area/town.

- Check the form description to make sure you have chosen the right document.

Form popularity

FAQ

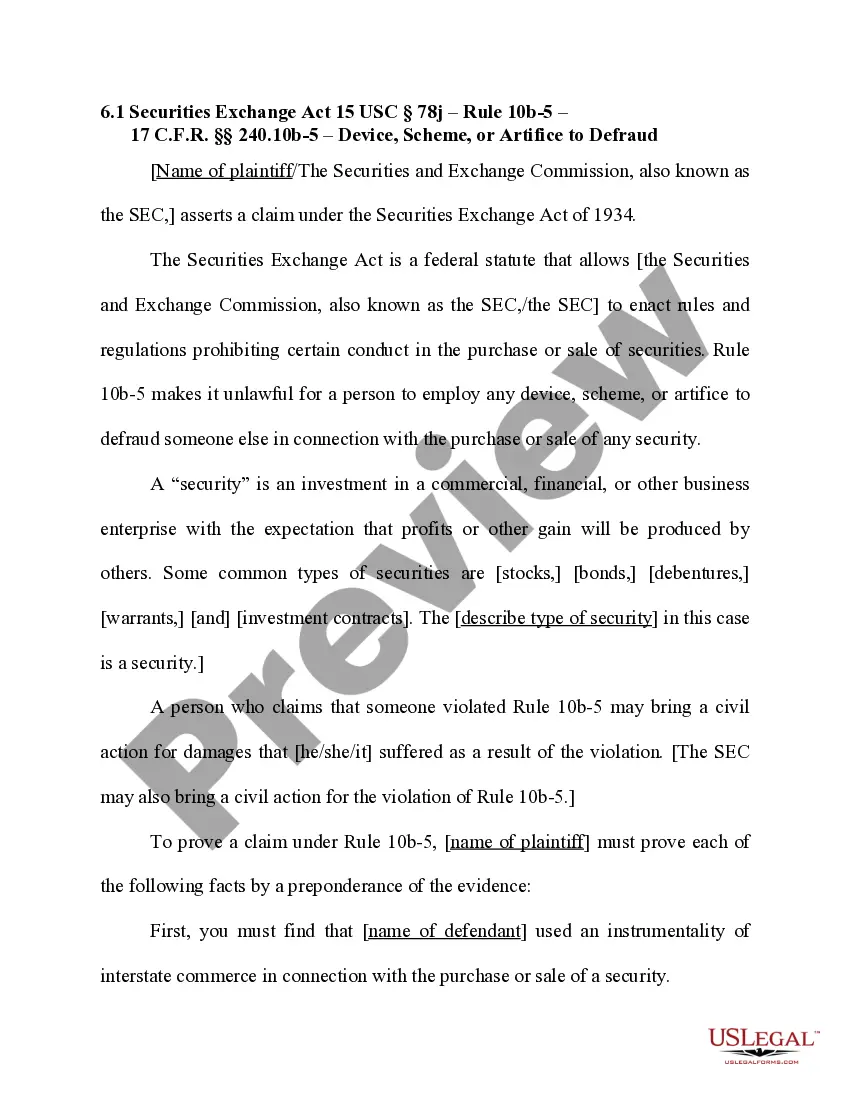

The independent contractor agreement can be written by either party involved in the contract—the contractor or the hiring entity. However, it is advisable to use a clear and professional format to avoid misunderstandings. You can find templates for a Nevada Design Agreement - Self-Employed Independent Contractor on uslegalforms, which can assist in drafting an agreement that meets legal standards and clarifies expectations.

Yes, an independent contractor in Nevada typically needs a business license, especially if you are operating a business or providing services. This requirement helps ensure compliance with state regulations and local laws. To streamline your licensing process, consider consulting resources or services available through uslegalforms to navigate the necessary paperwork and requirements effectively.

Creating a Nevada Design Agreement - Self-Employed Independent Contractor involves several key steps. First, outline the essential terms and conditions, including payment details, work scope, and deadlines. Next, ensure both parties understand their rights and responsibilities before signing the agreement. You can use platforms like uslegalforms to access template agreements that simplify this process and provide guidance.

In Nevada, the independent contractor law emphasizes the distinction between employees and independent contractors based on control and independence in work performance. Independent contractors operate under their terms, meaning they drive their work processes and can often work with multiple clients. It is crucial for independent contractors to have a clear agreement in place, such as a Nevada Design Agreement - Self-Employed Independent Contractor, to outline their rights and obligations. For further legal guidance, consider exploring resources provided by US Legal Forms.

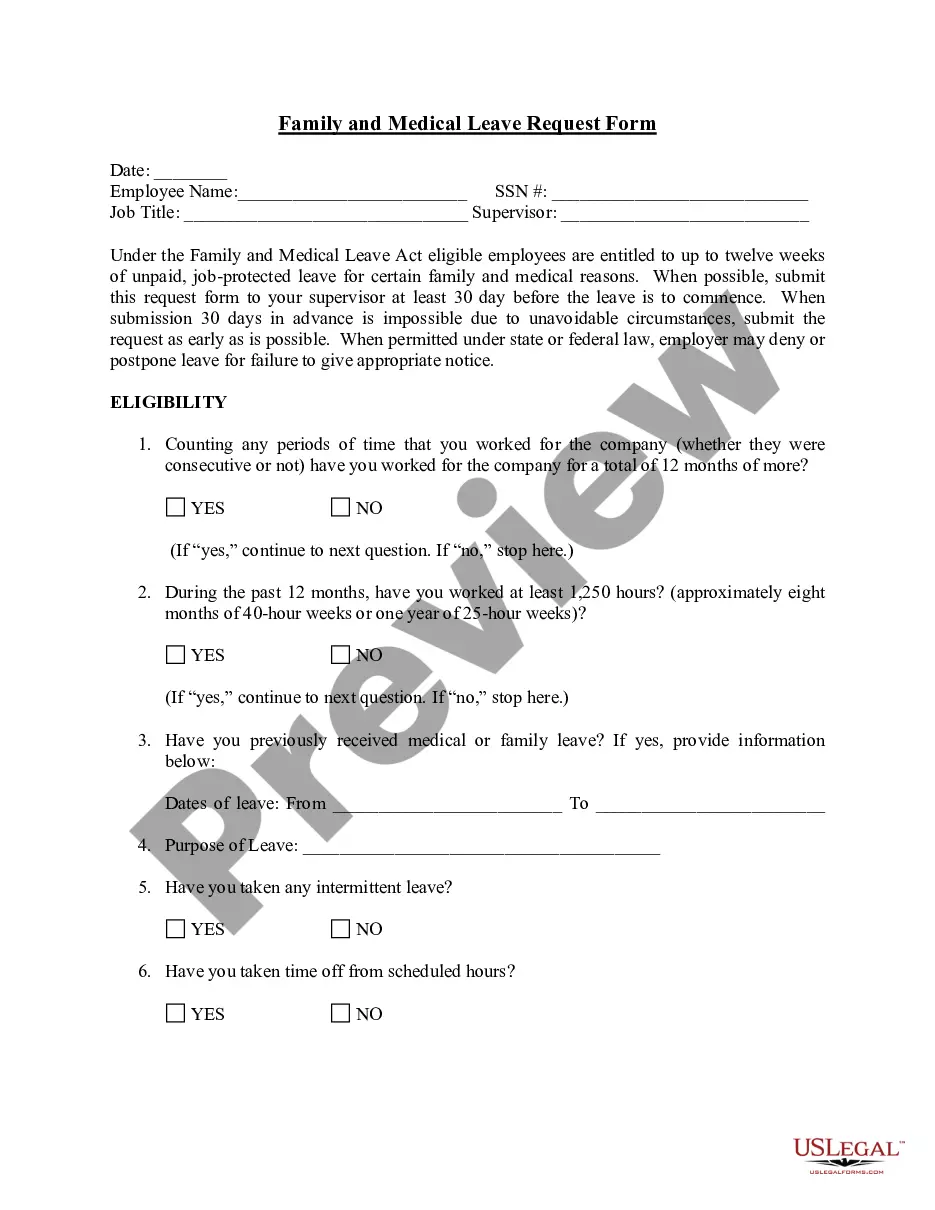

Filling out an independent contractor agreement involves outlining essential elements such as the contractor's name, the nature of the work, and terms of compensation. Clearly define the responsibilities and expectations for both parties to avoid misunderstandings. Additionally, make sure to include details about deadlines and ownership of work produced. Utilize the Nevada Design Agreement - Self-Employed Independent Contractor available on US Legal Forms for a thorough and legally sound document.

To fill out an independent contractor form, start by entering your personal information, including your name, address, and contact details. Next, include specific details about the project, such as the scope of work and expected completion dates. Also, provide payment terms and any other relevant clauses. For a comprehensive approach, consider using a Nevada Design Agreement - Self-Employed Independent Contractor template from US Legal Forms to ensure compliance with local laws.

A basic independent contractor agreement outlines the working relationship between the contractor and the client. Key elements include the scope of work, payment terms, and the duration of the contract. A Nevada Design Agreement - Self-Employed Independent Contractor can provide a solid foundation, ensuring both parties understand their rights and obligations.

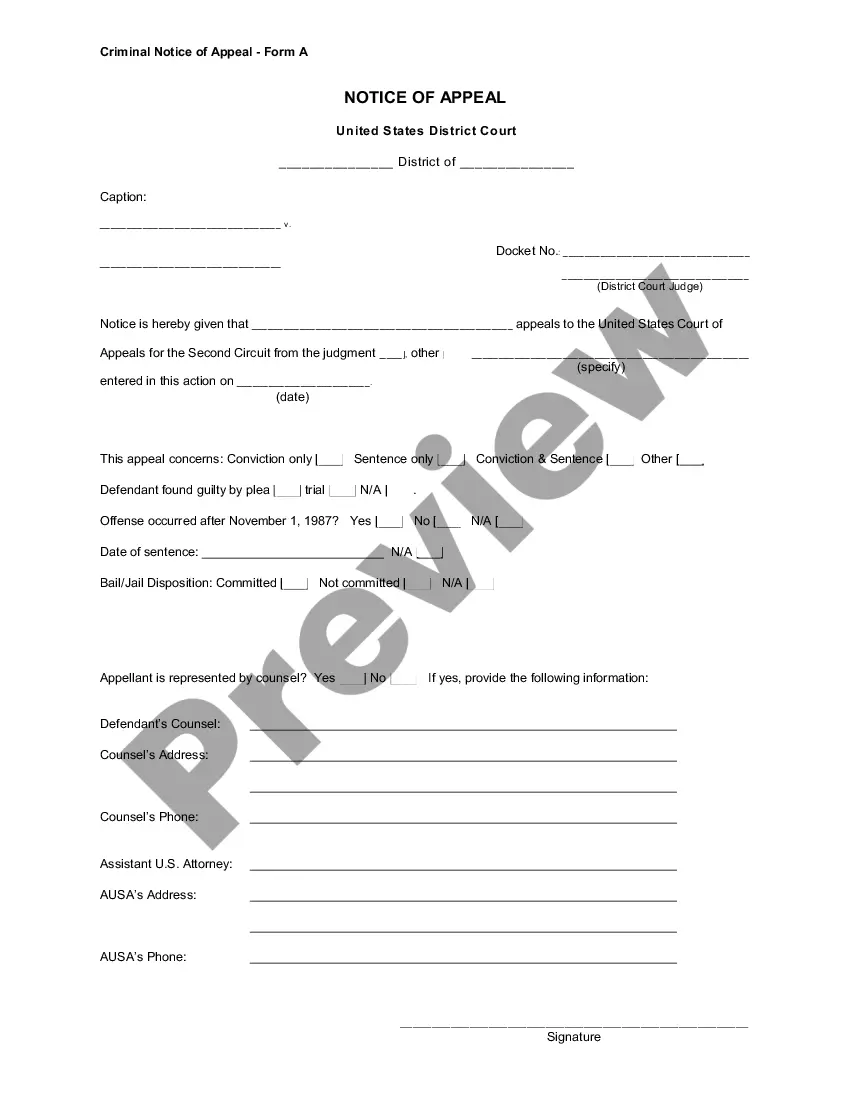

Yes, you can write your own legally binding contract, provided it meets specific legal requirements such as mutual consent and consideration. Make sure to cover all essential terms to avoid misunderstandings. A Nevada Design Agreement - Self-Employed Independent Contractor template may serve as a helpful guide to ensure your contract fulfills all legal criteria.

When writing a contract as an independent contractor, focus on clarity and mutual understanding. Define project goals, services provided, timelines, and payment methods. A well-structured Nevada Design Agreement - Self-Employed Independent Contractor can ensure you cover all necessary aspects while also establishing professional boundaries.

An effective independent contractor agreement should clearly state the nature of the work, payment details, and delivery timelines. You should also cover confidentiality and termination clauses to avoid potential disputes. Remember, using a Nevada Design Agreement - Self-Employed Independent Contractor template can help you draft a professional agreement efficiently.