Nevada Contract Administrator Agreement - Self-Employed Independent Contractor

Description

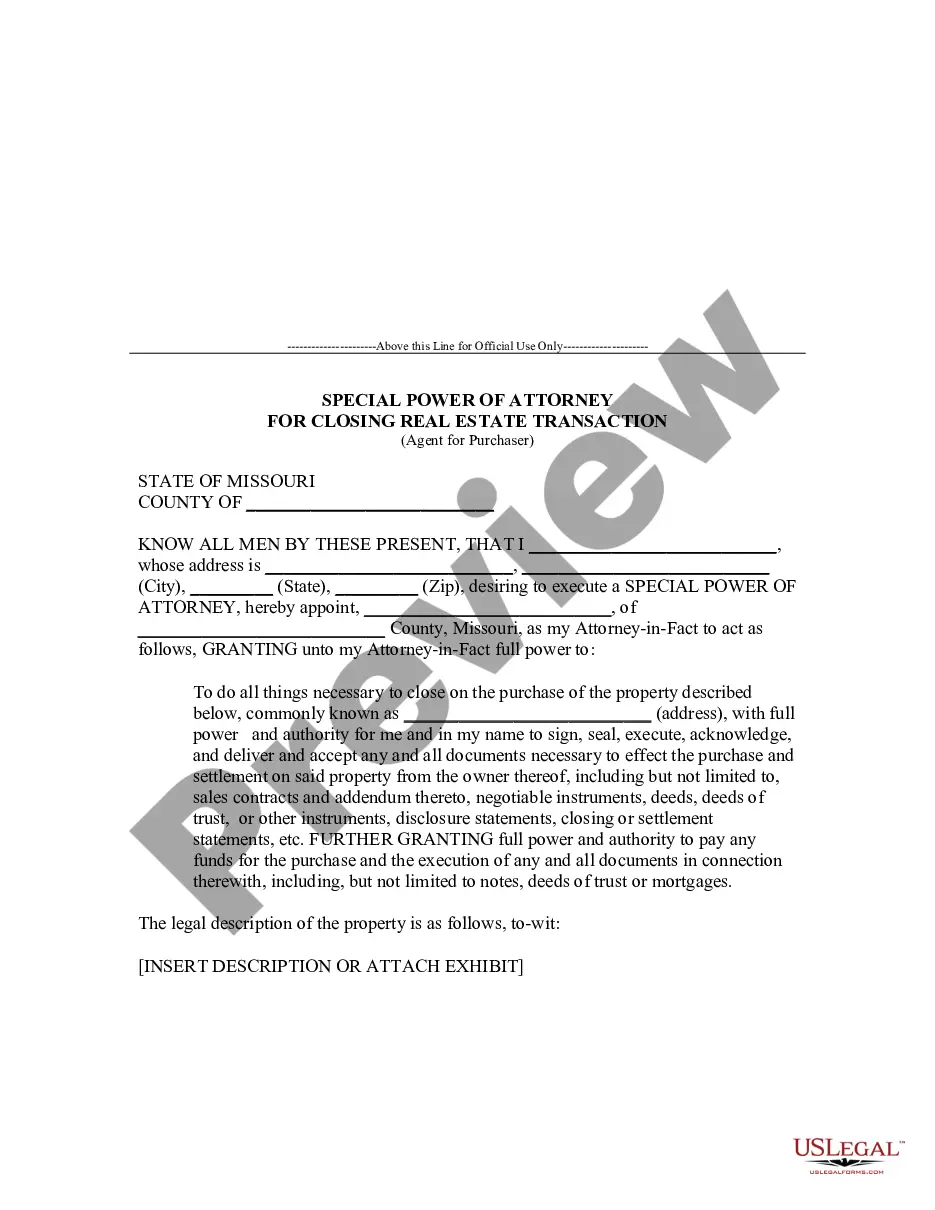

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

If you need to thorough, acquire, or create official document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the site’s straightforward and convenient search to find the documents you require.

Different templates for business and personal purposes are categorized by types and states, or keywords.

Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor. Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again. Compete and obtain, and print the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to get the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Ensure you have chosen the form for the correct region/country.

- Utilize the Review option to check the form’s content. Remember to read the details.

- If you are not satisfied with the form, use the Search field at the top of the screen to find other types in the legal form template.

Form popularity

FAQ

Independent contractors in Nevada need to complete specific forms to establish their status and comply with regulations. The Nevada Contract Administrator Agreement - Self-Employed Independent Contractor is essential for outlining the terms of your work arrangement and ensuring clarity with clients. Additionally, contractors should consider tax forms, such as the W-9, to report income correctly. Utilizing the US Legal Forms platform can guide you through the necessary paperwork and ensure you have all the forms needed for a successful independent contracting experience.

Creating an independent contractor agreement requires a few key steps. First, outline the scope of work, payment terms, and timelines. Next, incorporate specific details relating to the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor, such as confidentiality clauses and termination conditions. Using resources from USLegalForms can simplify the process, providing you with customizable templates to ensure your agreement is comprehensive and legally sound.

Yes, a self-employed person can certainly have a contract. In fact, having a written agreement is essential to clearly define the terms of the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor. This contract protects both the contractor and the client by outlining expectations, deliverables, and payment terms. To ensure clarity and avoid misunderstandings, utilizing a platform like USLegalForms can help you draft a strong contract tailored to your needs.

Absolutely, an administrative assistant can work as an independent contractor. This arrangement enables them to manage their own business while offering administrative services. Utilizing a Nevada Contract Administrator Agreement - Self-Employed Independent Contractor can streamline the client relationship and define the scope of work effectively.

Yes, you can be a self-employed administrative assistant. This role allows for a flexible schedule and the opportunity to work with multiple clients. Establishing this arrangement through a Nevada Contract Administrator Agreement - Self-Employed Independent Contractor is beneficial, as it sets clear expectations on both sides and ensures proper payment practices.

In Nevada, independent contractors typically do not need workers' compensation insurance unless they have employees. However, it’s wise to check specific regulations as they may vary based on the industry. Engaging in a Nevada Contract Administrator Agreement - Self-Employed Independent Contractor can help clarify responsibilities regarding insurance and liability.

Yes, you can issue a 1099 form to an administrative assistant if they work as an independent contractor. This classification depends on the nature of their work and the agreement in place. A Nevada Contract Administrator Agreement - Self-Employed Independent Contractor can help define this relationship clearly and ensure compliance with IRS regulations.

Yes, an independent contractor is considered self-employed. This distinction means they operate their own business and are not subject to the same regulations as traditional employees. When entering into a Nevada Contract Administrator Agreement - Self-Employed Independent Contractor, you establish your own working conditions and hours, providing greater flexibility.

When employing an independent contractor, you need to prepare several documents, including a signed independent contractor agreement and tax forms such as the W-9. Make sure to also keep any project-related documentation like invoices and work samples. Ensuring the inclusion of the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor makes your paperwork comprehensive and compliant. USLegalForms can help you organize and generate the necessary documents with ease.

To fill out an independent contractor agreement, make sure to enter all relevant details about the project and the parties involved. Clearly outline the services to be provided, payment terms, and deadlines. Including elements of the Nevada Contract Administrator Agreement - Self-Employed Independent Contractor will ensure clarity and compliance. Consider using USLegalForms for templates that guide you through the process effectively.