Nevada Management Stock Purchase Plan

Description

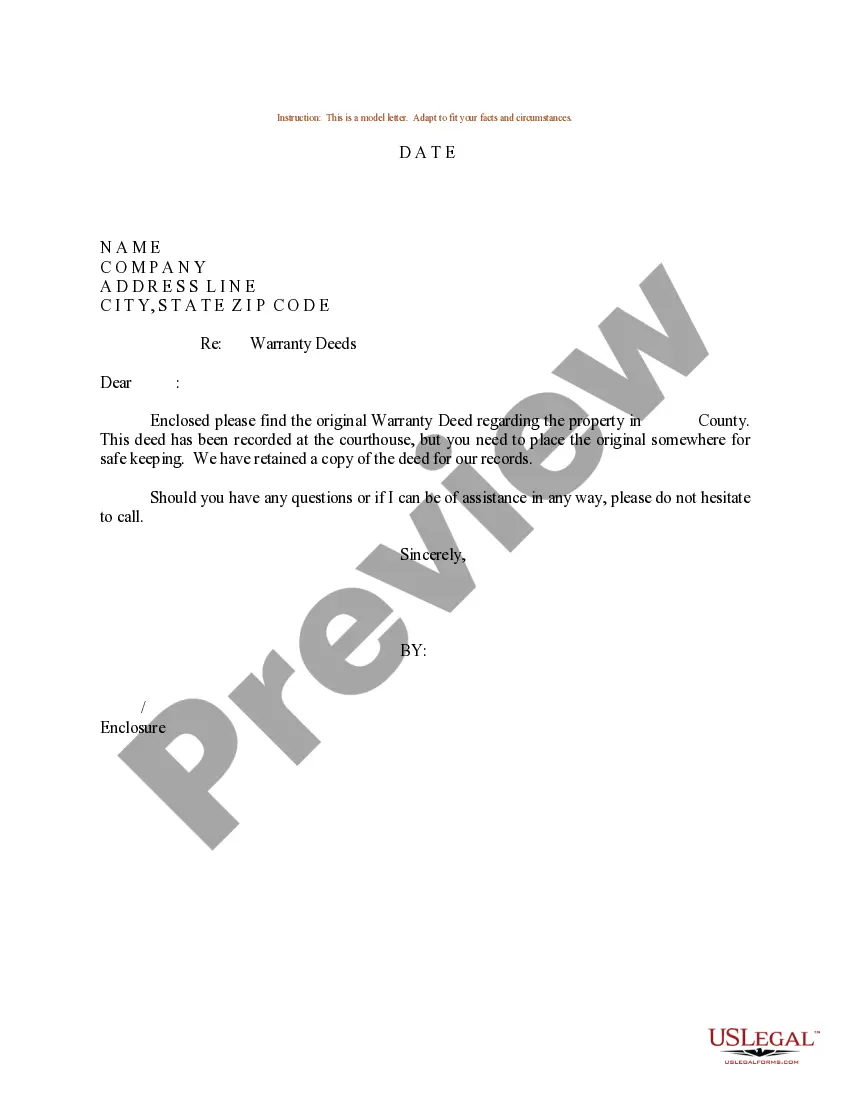

How to fill out Management Stock Purchase Plan?

Are you currently within a position that you require files for both enterprise or specific functions nearly every time? There are plenty of legitimate papers themes accessible on the Internet, but getting kinds you can rely isn`t effortless. US Legal Forms offers thousands of type themes, such as the Nevada Management Stock Purchase Plan, that are composed to meet state and federal needs.

In case you are previously informed about US Legal Forms website and have a free account, simply log in. Afterward, you may acquire the Nevada Management Stock Purchase Plan format.

Unless you have an accounts and need to start using US Legal Forms, follow these steps:

- Find the type you want and ensure it is for the appropriate town/county.

- Utilize the Preview key to review the shape.

- Browse the explanation to actually have chosen the right type.

- When the type isn`t what you are searching for, make use of the Research field to obtain the type that meets your requirements and needs.

- When you discover the appropriate type, click on Acquire now.

- Pick the rates plan you would like, submit the specified information and facts to generate your money, and pay for your order with your PayPal or bank card.

- Choose a practical document formatting and acquire your backup.

Discover all the papers themes you might have purchased in the My Forms food list. You may get a further backup of Nevada Management Stock Purchase Plan whenever, if needed. Just click on the needed type to acquire or printing the papers format.

Use US Legal Forms, one of the most extensive assortment of legitimate varieties, to save time and prevent faults. The support offers expertly produced legitimate papers themes that you can use for a range of functions. Make a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Top Companies Offering Employee stock purchase plan (1318) CreatorIQ. ... Caesars Sportsbook & . ... Kin + Carta. ... Free Agency. ... RS21. ... Astra. ... Outbrain. AdTech ? Big Data ? Digital Media ? Information Technology ? Marketing Tech. ... BillGO. Fintech ? Payments ? Software ? Financial Services.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

Disadvantages of Employee Stock Purchase Plans Ensuring the ESPP follows security and tax law guidelines can be challenging. A large amount of HR functions goes into administering the stock purchase plan. There are legal, tax, and administrative issues that go into setting up the plan.

Employees who elect to participate in a qualified ESPP are typically able to take advantage of some tax benefits, as the discount is not recognized as taxable income until the stock is sold. When you sell the stock, the discount you received when you bought it may be taxable as income.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.

How is the $25,000 limit calculated? The basic rule is that each employee cannot purchase more than $25,000 per year, valued using the fair market value on the date he/she enrolled in the current offering.

A: Yes. You may withdraw from the ESPP by notifying Fidelity and completing a withdrawal election. When you withdraw, all of the contributions accumulated in your account will be returned to you as soon as administratively possible and you will not be able to make any further contributions during that offering period.

The Bottom Line. Employee stock options can be a valuable part of your compensation package, especially if you work for a company whose stock has been soaring of late. In order to take full advantage, make sure you exercise your rights before they expire.