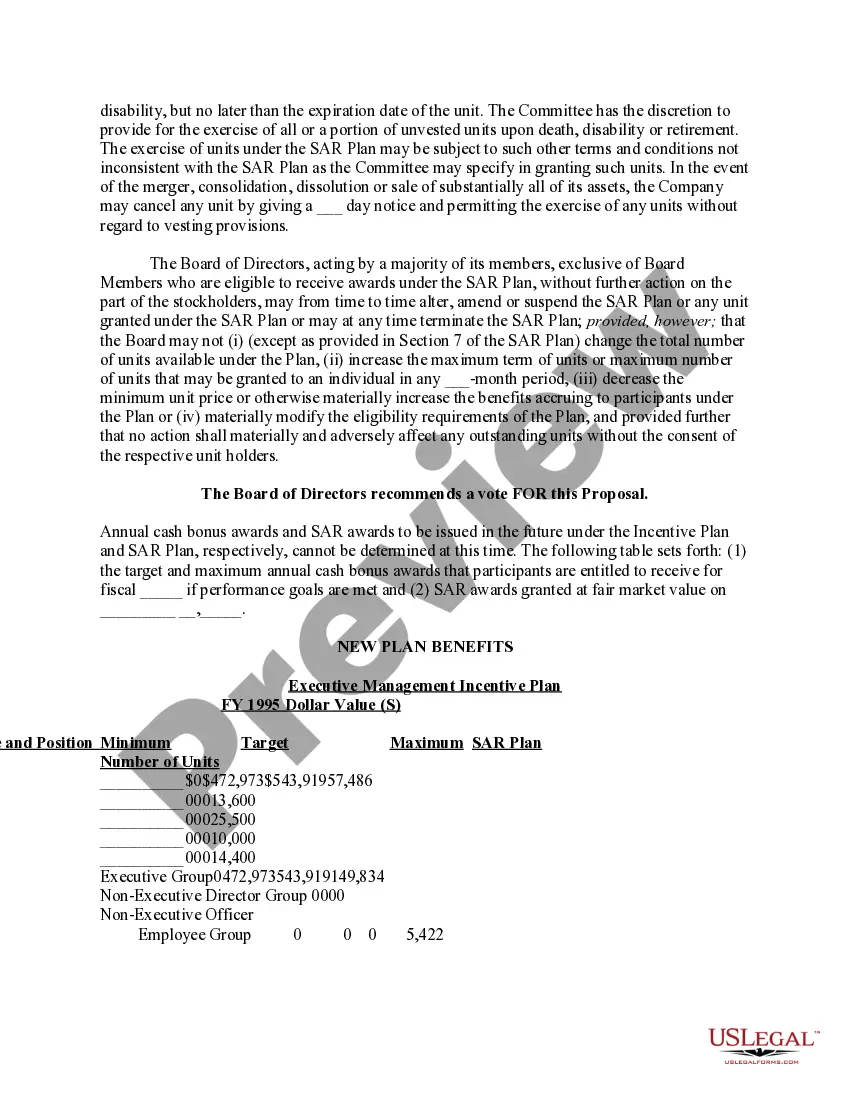

Nevada Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Are you presently in the place where you will need documents for possibly enterprise or specific functions just about every working day? There are a lot of legitimate papers layouts available on the Internet, but getting kinds you can depend on isn`t easy. US Legal Forms delivers a large number of type layouts, much like the Nevada Proposal to approve material terms of stock appreciation right plan, that happen to be published in order to meet federal and state requirements.

If you are currently acquainted with US Legal Forms site and have an account, simply log in. Afterward, you can download the Nevada Proposal to approve material terms of stock appreciation right plan template.

If you do not come with an account and would like to start using US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is to the correct town/area.

- Use the Review switch to examine the form.

- Browse the description to actually have selected the right type.

- If the type isn`t what you`re trying to find, utilize the Lookup industry to obtain the type that meets your needs and requirements.

- Whenever you obtain the correct type, click Buy now.

- Opt for the rates prepare you would like, complete the required information to make your money, and pay for the transaction with your PayPal or bank card.

- Pick a hassle-free paper formatting and download your version.

Locate every one of the papers layouts you possess purchased in the My Forms food selection. You can aquire a additional version of Nevada Proposal to approve material terms of stock appreciation right plan at any time, if needed. Just click on the essential type to download or print out the papers template.

Use US Legal Forms, one of the most comprehensive assortment of legitimate varieties, in order to save efforts and prevent blunders. The service delivers professionally produced legitimate papers layouts that can be used for a range of functions. Create an account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Employees can only exercise the stock appreciation rights after the shares have vested. The vesting period is the minimum period employees must hold the stocks before they can exercise the stock appreciation rights. Generally, employers offer stock appreciation rights along with stock options.

Stock appreciation rights do expire. The expiration period varies from plan to plan. Once your rights expire, they are worthless. There are often special rules for terminated, retired, and deceased employees.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

How Do Stock Appreciation Rights Work? Stock Appreciation Rights are similar to Stock Options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a SAR vests, an employee can exercise it at any time prior to its expiration.

Employee stock ownership plans (ESOPs), which can be stock bonus plans or stock bonus/money purchase plans, are qualified defined contribution plans under IRC section 401(a). Similar to stock options, stock appreciation rights are given at a predetermined price and often have a vesting period and expiration date.

?SARs? means stock appreciation rights entitling the holder thereof to receive a cash payment in an amount equal to the appreciation in the Common Shares over a specified period, as set forth in this Plan and in the applicable Grant Agreement.

There are no U.S. federal income tax consequences when an employee is granted SARs. However, at exercise an employee will recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.