Nevada Proposed Additional Compensation Plan with copy of plan

Description

How to fill out Proposed Additional Compensation Plan With Copy Of Plan?

Are you currently in the placement in which you need files for either business or person uses just about every day? There are a variety of legitimate papers templates accessible on the Internet, but discovering kinds you can depend on isn`t easy. US Legal Forms offers 1000s of develop templates, such as the Nevada Proposed Additional Compensation Plan with copy of plan, which are published in order to meet federal and state needs.

If you are already familiar with US Legal Forms web site and also have an account, basically log in. Next, you are able to down load the Nevada Proposed Additional Compensation Plan with copy of plan format.

Should you not have an profile and want to begin using US Legal Forms, abide by these steps:

- Discover the develop you need and make sure it is for that appropriate area/county.

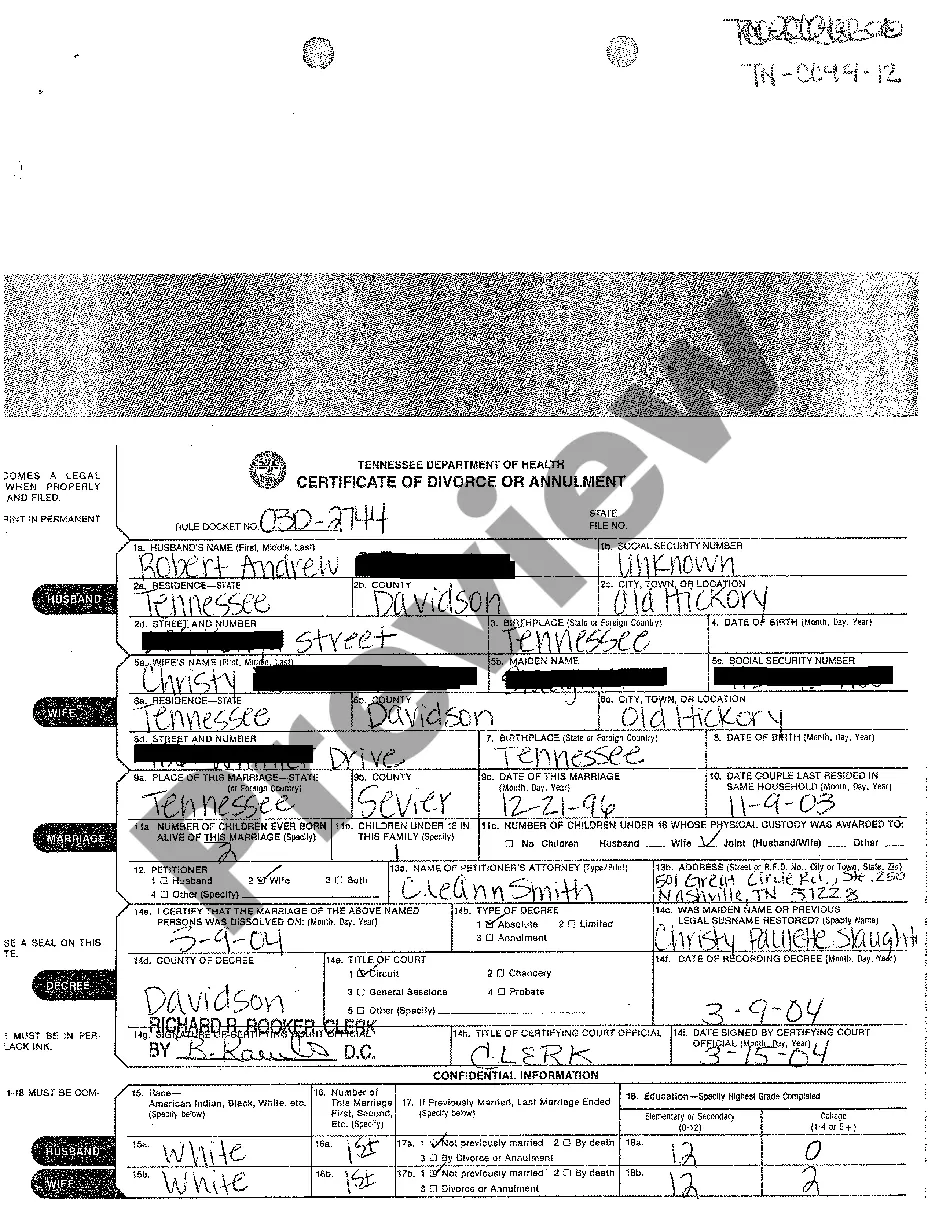

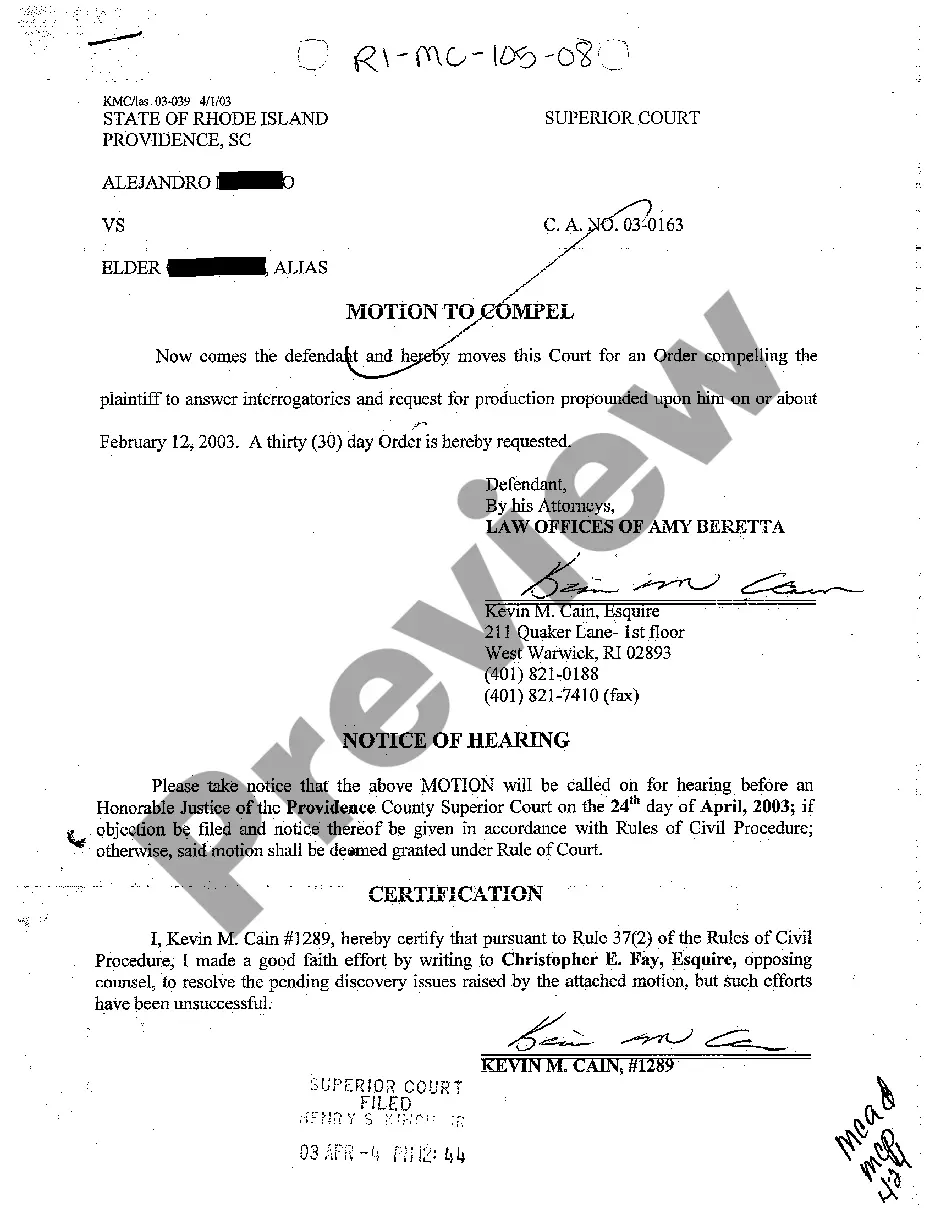

- Make use of the Review button to check the shape.

- See the description to ensure that you have selected the proper develop.

- In case the develop isn`t what you are trying to find, use the Lookup discipline to find the develop that suits you and needs.

- When you obtain the appropriate develop, simply click Purchase now.

- Pick the pricing program you need, fill in the desired information and facts to generate your account, and pay for an order making use of your PayPal or charge card.

- Pick a hassle-free paper file format and down load your copy.

Get all of the papers templates you might have bought in the My Forms food selection. You can get a extra copy of Nevada Proposed Additional Compensation Plan with copy of plan whenever, if necessary. Just select the required develop to down load or print out the papers format.

Use US Legal Forms, one of the most comprehensive collection of legitimate forms, in order to save time as well as prevent errors. The services offers professionally manufactured legitimate papers templates which can be used for a selection of uses. Produce an account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

For example, the employer may offer health insurance, dental insurance, life insurance, short- and long-term disability insurance and vision insurance. Employee retirement plans, like 401(k) plans, are another common form of indirect compensation. Equity-based programs are another compensation offering.

Willis Towers Watson's Catherine Hartmann, rewards practice leader for North America, typically outlines five key considerations for her clients: competitive positioning, segmentation, performance orientation, affordability and governance.

Ultimately, salary survey data should be gathered and reviewed every two to three years so that appropriate adjustments can be made to the organization's salary ranges.

Once a compensation structure has been established, the structure should be reviewed and updated every one to two years to reflect changes in the organization, jobs, market conditions, wages, compression, and pay equity laws.

The Nevada Deferred Compensation Program (NDC) is a voluntary 457(b) retirement savings program for employees of the State of Nevada and other local government employers. The program is designed to supplement your PERS pension and/or other retirement savings and pensions.

Most private companies review their plans annually, but reviewing every few years or during rounds of funding are also common. The reality is that each option has its pros and cons, and the frequency of the review largely hinges on your company's goals, upcoming plans, and where you are in your growth phase.

You should revise your pay structure annually to ensure it's on par with the job market and accepted among your employees. Some companies revise their compensation plans every 3-5 years, but I find that too much changes in that time.

How to create a compensation plan Determine your compensation philosophy. Outline job architecture by defining roles and levels. Create guidelines for performance evaluations. Define direct compensation (salary, bonus, and equity) Add in benefits. Implement a pay equity process. Conduct post-hoc reviews.