Nevada General Notice of Preexisting Condition Exclusion

Description

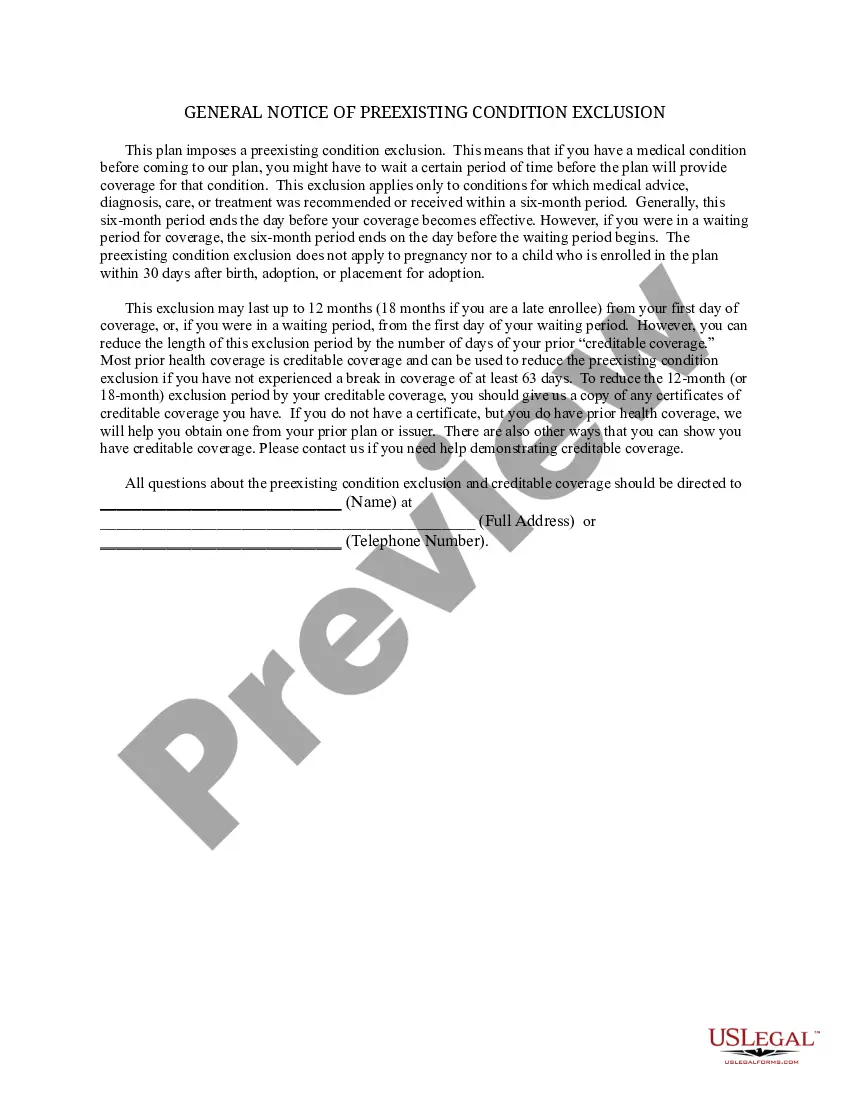

How to fill out General Notice Of Preexisting Condition Exclusion?

You could spend hours online searching for the legal document template that meets the federal and state requirements you require.

US Legal Forms offers a vast array of legal documents that have been evaluated by experts.

It is straightforward to obtain or create the Nevada General Notice of Preexisting Condition Exclusion through my services.

If available, utilize the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download option.

- Subsequently, you can complete, modify, print, or sign the Nevada General Notice of Preexisting Condition Exclusion.

- Every legal document template you obtain is yours forever.

- To get an additional copy of any purchased form, navigate to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to guarantee that you have chosen the right form.

Form popularity

FAQ

All pre-existing conditions need to be declared on your policy. This may help you to avoid large medical bills if you need treatment in another country. Failure to disclose any pre-existing medical conditions may affect the validity of your policy should you need to claim.

What is a pre-existing condition? A pre-existing condition is a medical condition that has been diagnosed prior to starting insurance coverage. While health insurance companies can no longer refuse to cover treatment or raise rates for pre-existing conditions, no such law exists for life insurance carriers.

About Nevada's Mini-COBRA Insurance Law When the federal COBRA law doesn't apply, Nevada state statutes gives workers of businesses with 19 or fewer employees the right to continue their employer-sponsored health insurance.

The time period during which a health plan won't pay for care relating to a pre-existing condition. Under a job-based plan, this cannot exceed 12 months for a regular enrollee or 18 months for a late-enrollee.

Health insurance companies cannot refuse coverage or charge you more just because you have a pre-existing condition that is, a health problem you had before the date that new health coverage starts.

Quick Answers to Common Questions If you don't disclose a health condition and it is discovered later by your insurance company, it could prevent or stop your coverage completely.

What Is the Pre-existing Condition Exclusion Period? The pre-existing condition exclusion period is a health insurance provision that limits or excludes benefits for a period of time. The determination is based on the policyholder having a medical condition prior to enrolling in a health plan.

existing condition exclusion can not be longer than 12 months from your enrollment date (18 months for a late enrollee). existing condition exclusion that is applied to you must be reduced by the prior creditable coverage you have that was not interrupted by a significant break in coverage.

Insurers have to provide a written notice indicating that a pre-existing condition is applied, and the exclusion period countdown begins immediately after any plan-required waiting period. In some states, insurers may place additional restrictions on whether they can include a pre-existing condition exclusion period.

Health insurance companies cannot refuse coverage or charge you more just because you have a pre-existing condition that is, a health problem you had before the date that new health coverage starts.