Nevada Employment Statement

Description

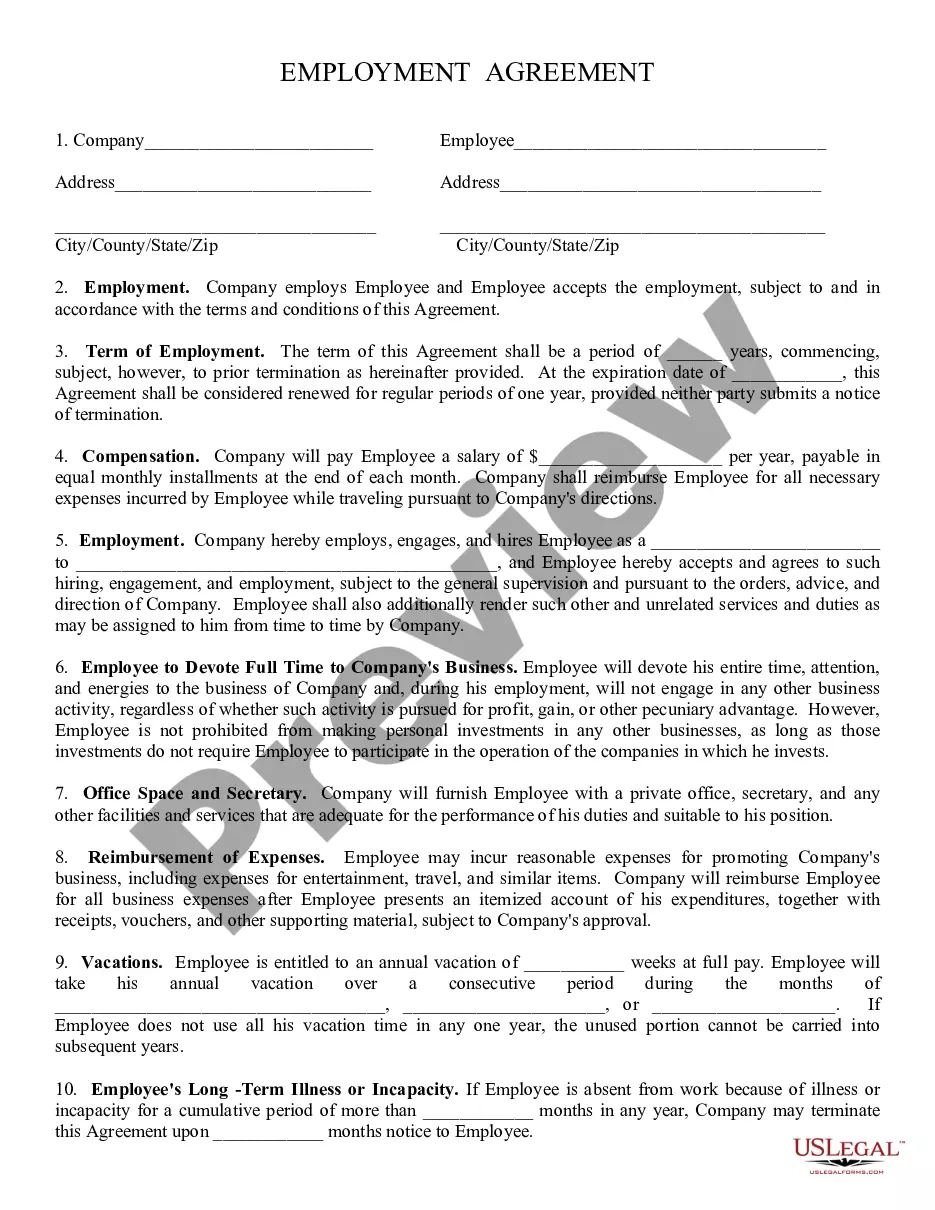

How to fill out Employment Statement?

You can spend time online trying to locate the legal document template that fulfills both state and federal requirements that you need.

US Legal Forms offers a multitude of legal forms that have been reviewed by professionals.

You can easily download or print the Nevada Employment Statement from the platform.

If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Nevada Employment Statement.

- Every legal document template you receive is yours indefinitely.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the jurisdiction of your choice.

- Review the form information to confirm you have chosen the appropriate form.

Form popularity

FAQ

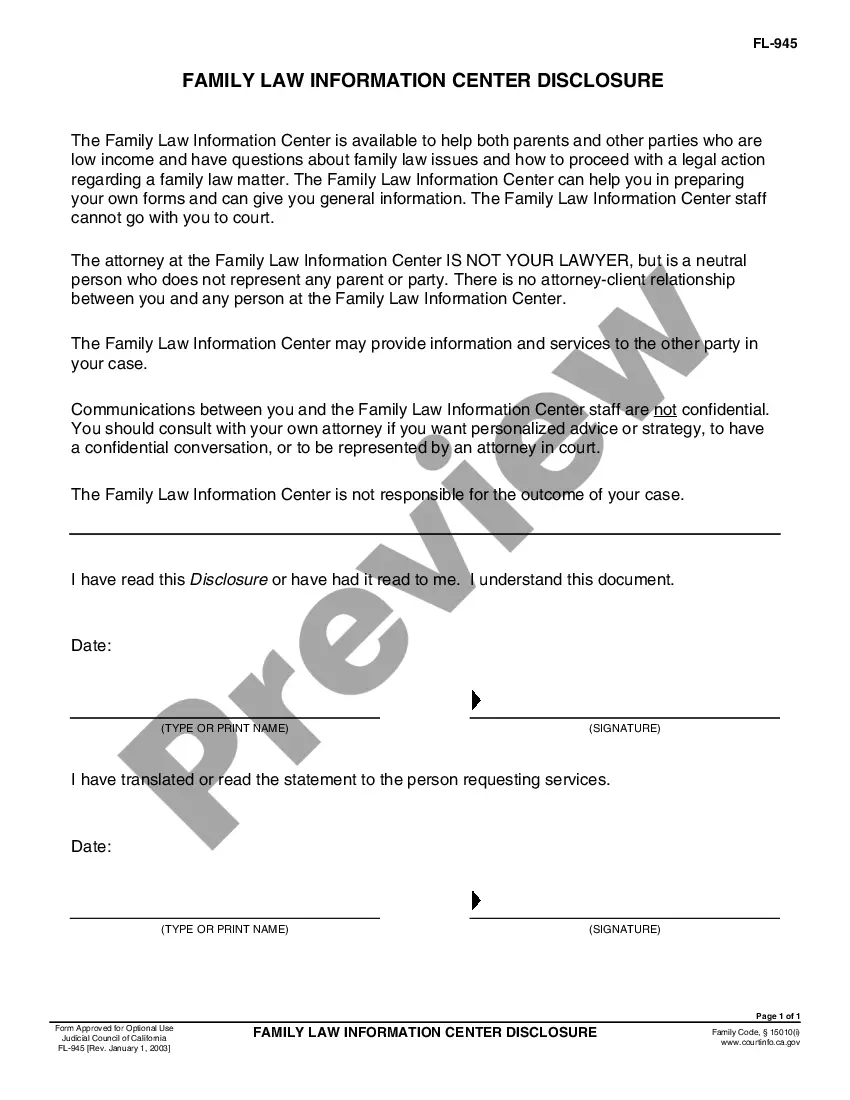

A person can work part time and collect UI or PUA benefits. The claimant must certify weekly and report how much they earned each week. In order to collect UI or PUA, the person must earn less than their weekly benefit amount per week.

Mission: We exist to empower a vibrant labor market in Nevada by creating business and worker connections with high-quality demand-driven services. The Employment Security Division (ESD) is a combination of Unemployment Insurance, Workforce Development, and the Commission on Postsecondary Education.

Your weekly benefit entitlement is calculated by taking a percentage of your earnings in the quarter in which you earned the most during your base period. There is no minimum weekly payment, but the maximum you can receive in unemployment benefits in Nevada per week is $469.

You MUST complete a weekly work search activity record for each week you file for unemployment benefits. Work search activity records may be reviewed at any time by both the Telephone Claim Centers and the JobConnect Offices, and you may be required to provide supporting documentation.

Monetary Eligibility Criteria Successful claimants must have earned 1.5 times their earnings in their highest-paid quarter over the entire base period or have been paid in at least 3 quarters. You cannot claim unemployment benefits if you earned less than $400 in your highest-paid quarter.

Nevada law prohibits individuals from receiving unemployment benefits if they refuse to accept offers of suitable work, or quit work, without good cause.

To qualify for unemployment insurance in Nevada, your total base period earnings must be at least 1.5 times your HQW. Your HQW must be a minimum of $400, making the minimum total amount of base period earnings to be $600. Finally, you must have worked during at least two quarters of the base period.

The Employment Security Division (ESD), part of the Nevada Department of Employment, Training and Rehabilitation, handles Nevada's unemployment benefits and eligibility. It administers employer taxes and uses them to provide temporary financial aid for workers who are unemployed through no fault of their own.

DEPARTMENT OF EMPLOYMENT, TRAINING AND REHABILITATION IS A PROACTIVE WORKFORCE AND REHABILITATION AGENCY. 1 bC NEVADA.

Collecting Unemployment After Being Fired If, for example, you deliberately disregarded your employer's reasonable rules or policies, or you were so careless on the job as to demonstrate a substantial disregard of your employer's interests or your job duties, you will be disqualified.