Nevada Material Return Record

Description

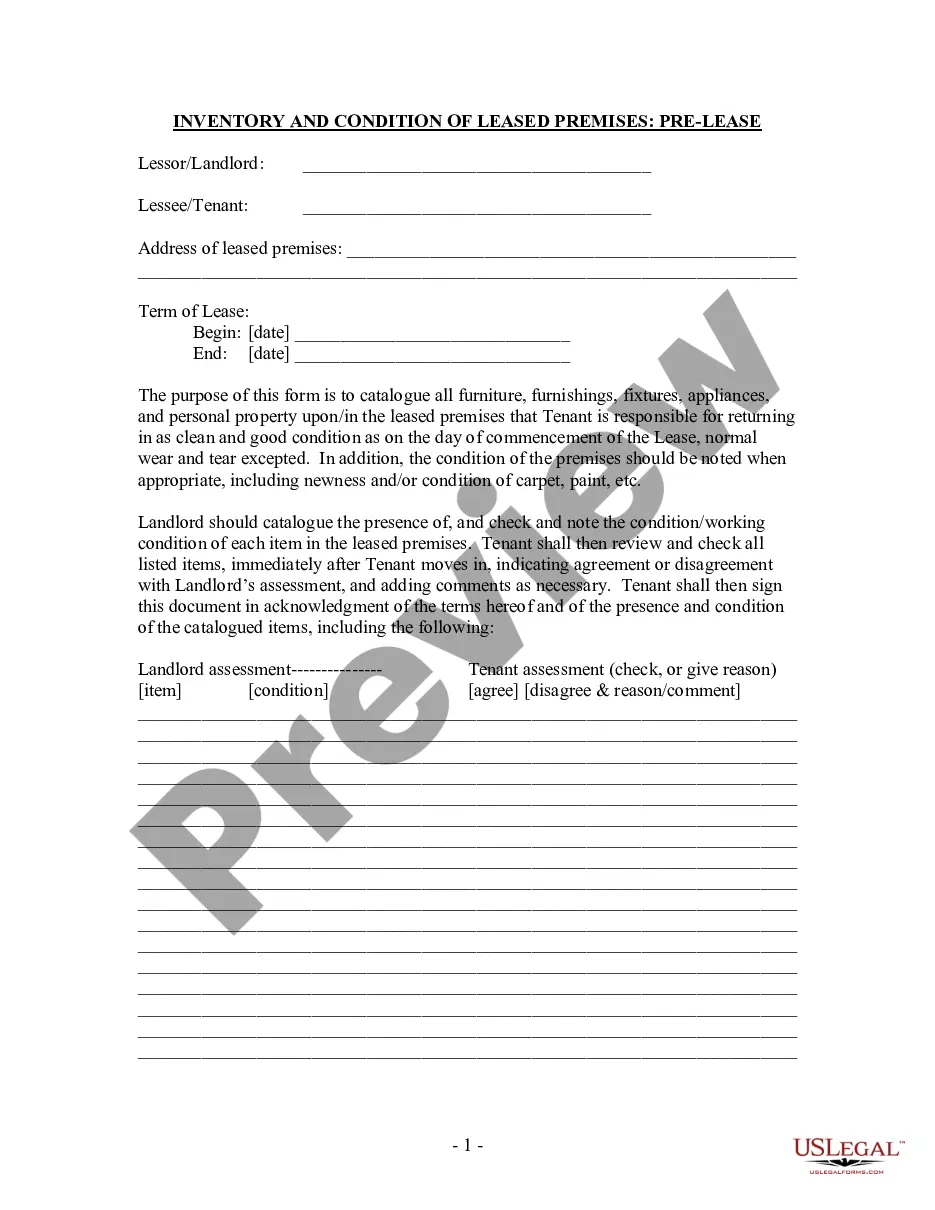

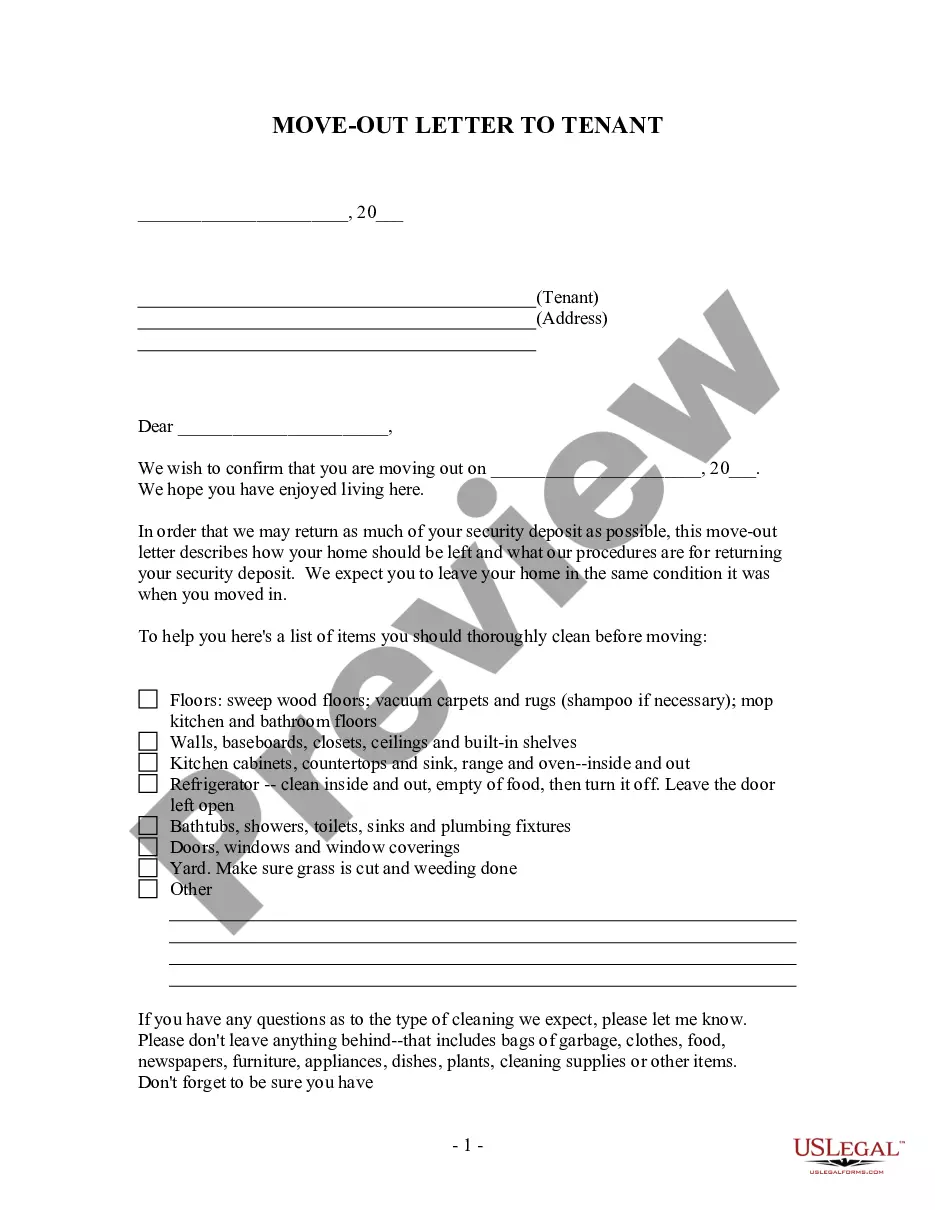

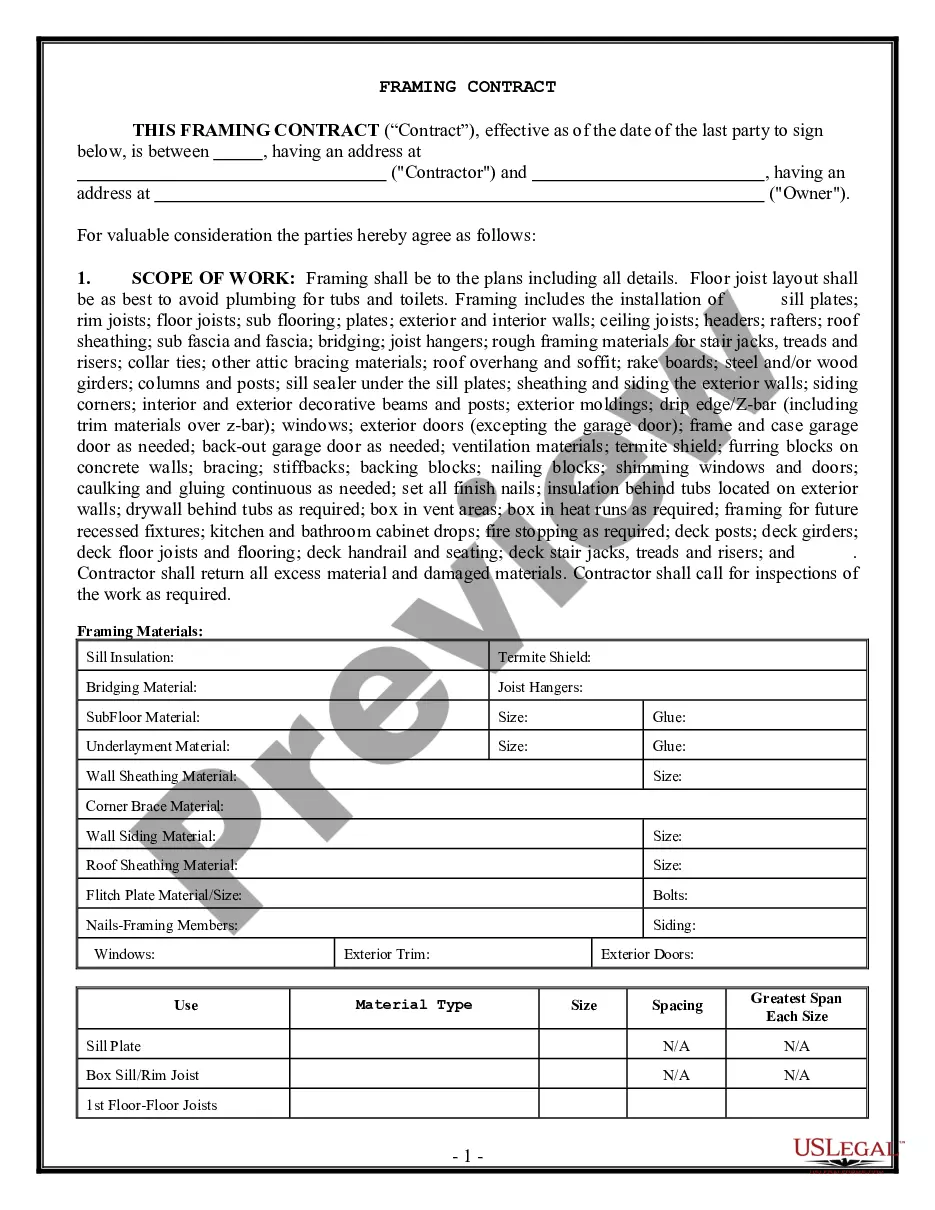

How to fill out Material Return Record?

If you need to total, obtain, or print official document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site's simple and convenient search feature to find the documents you need.

Various templates for commercial and individual purposes are categorized by type and jurisdiction, or keywords.

Every legal document template you purchase is your property indefinitely.

You have access to all the documents you downloaded in your account. Click on the My documents section to select a document to print or download again.

- Use US Legal Forms to acquire the Nevada Material Return Record in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to get the Nevada Material Return Record.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you’re using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct state/country.

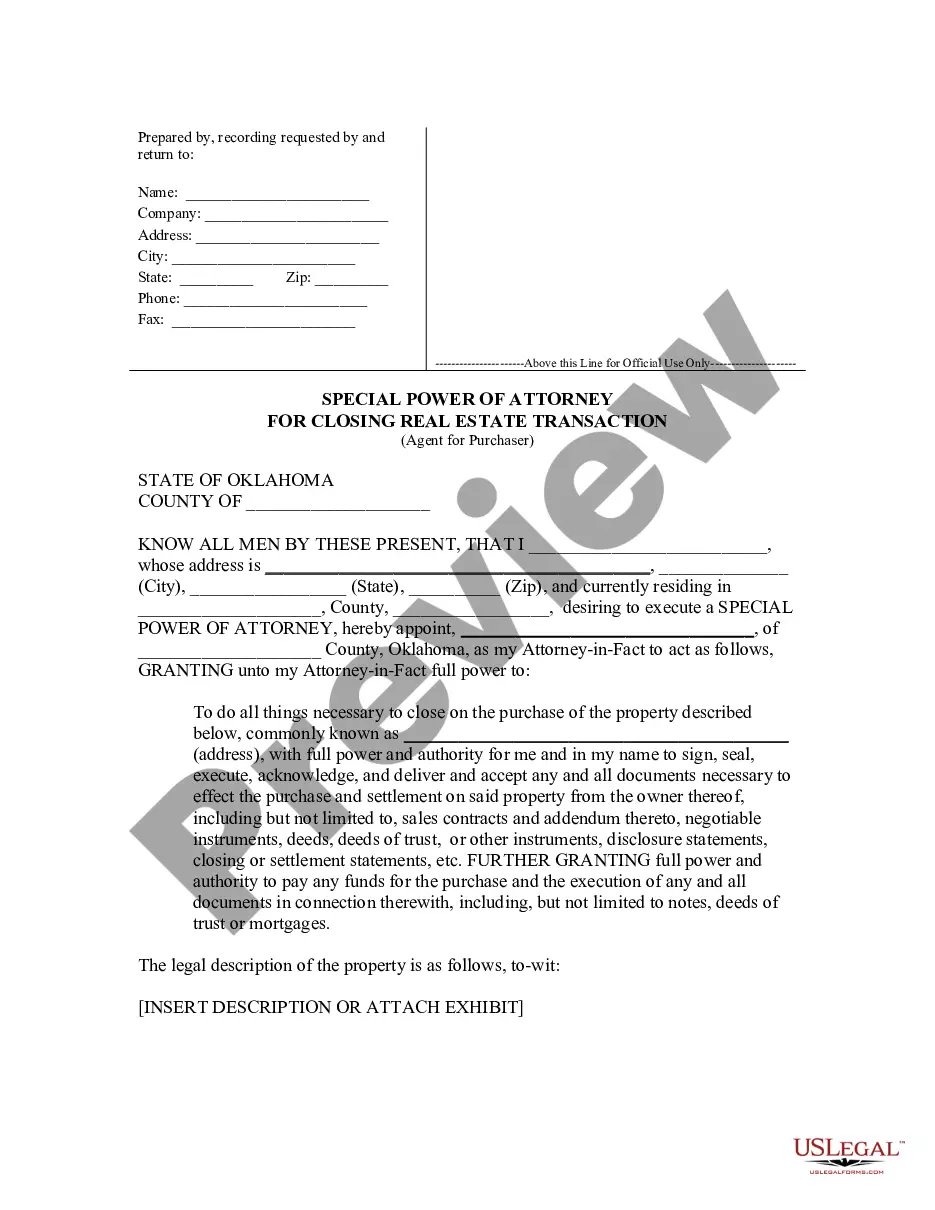

- Step 2. Utilize the Review option to examine the form's content. Be sure to read the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative templates.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, print, or sign the Nevada Material Return Record.

Form popularity

FAQ

The Commerce Tax is an annual tax passed by the Nevada Legislature during the 2015 Legislative Session. The tax is imposed on businesses with a Nevada gross revenue exceeding $4,000,000 in the taxable year. The Commerce Tax return is due 45 days following the end of the fiscal year (June 30).

Nevada has NO Inventory Tax on inventories held for sale within Nevada or for interstate transit.

How to fill out the Nevada Resale CertificateStep 1 Begin by downloading the Nevada Resale Certificate.Step 2 Enter the purchaser's seller's permit number.Step 3 Indicate the general line of business of the buyer.Step 4 Add the name of the seller.Step 5 Describe the property that will be purchased.More items...?

Any purchase, other than inventory, made by a retailer from a non-registered vendor, for use in the business, is subject to Use Tax and must be reported on the monthly or quarterly Sales and Use Tax return. Examples of this are supplies, forms, or equipment that is not re-sold.

Currently, six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming do not have a corporate income tax. However, four of those states Nevada, Ohio, Texas, and Washington do have some form of gross receipts tax on corporations.

Any purchase, other than inventory, made by a retailer from a non-registered vendor, for use in the business, is subject to Use Tax and must be reported on the monthly or quarterly Sales and Use Tax return. Examples of this are supplies, forms, or equipment that is not re-sold.

Each business entity, whose Nevada gross revenue exceeds $4,000,000 during the taxable year, unless specifically exempted by Commerce Tax law (NRS 363C), has to file a Commerce Tax return.

Each business entity, whose Nevada gross revenue exceeds $4,000,000 during the taxable year, unless specifically exempted by Commerce Tax law (NRS 363C), has to file a Commerce Tax return.

Goods that are subject to sales tax in Nevada include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

Nevada has a statewide sales tax rate of 4.6%, which has been in place since 1955. Municipal governments in Nevada are also allowed to collect a local-option sales tax that ranges from 0% to 3.775% across the state, with an average local tax of 3.357% (for a total of 7.957% when combined with the state sales tax).