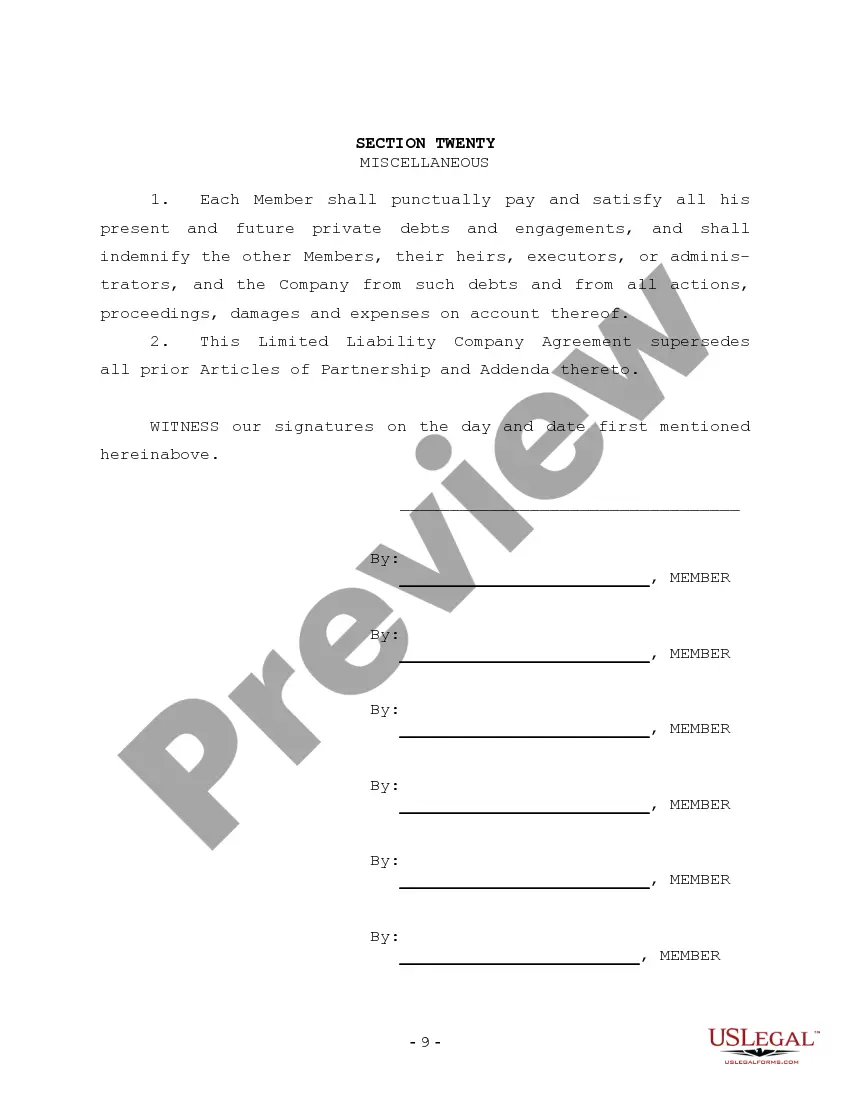

Nevada LLC Operating Agreement for Single Member

Description

How to fill out LLC Operating Agreement For Single Member?

Selecting the most suitable legal document template can be quite a challenge. Certainly, there are numerous templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Nevada LLC Operating Agreement for Single Member, which you can use for business and personal purposes.

All the forms are reviewed by experts and comply with state and federal regulations.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download properly crafted paperwork that meet state regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Nevada LLC Operating Agreement for Single Member.

- Use your account to browse the legal forms you have acquired previously.

- Go to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, make sure you have selected the correct form for your region/state.

- You can review the form using the Review button and read the form details to ensure it is the right one for you.

- If the form does not meet your expectations, use the Search field to find the correct form.

- Once you are sure that the form is suitable, click on the Get now button to obtain the form.

- Select the pricing plan you need and enter the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, edit, and print and sign the obtained Nevada LLC Operating Agreement for Single Member.

Form popularity

FAQ

In the state of Nevada, there is no legal obligation to draft/create an operating agreement. While not a requirement, an operating agreement serves as documentation outlining the relationship between the officials of the LLC and the business itself.

Are Operating Agreements Legally Required in Nevada? No, Operating Agreements are not legally required in Nevada. According to the Nevada Revised Statutes (NRS) 86.286 Operating Agreement clause, A limited-liability company may, but is not required to, adopt an operating agreement.

It can secure your liability protection. This is crucial to understand, as it's the primary main reason that your single-member LLC needs an operating agreement. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.

What To Include in a Single Member LLC Operating AgreementName of LLC.Principal Place of Business.State of Organization/Formation.Registered Office and Agent.Operating the LLC in another state (Foreign LLC)Duration of LLC.Purpose of LLC.Powers of LLC.More items...?

A Nevada single member LLC (SMLLC) is a business entity with similarities to a limited liability company (LLC), with the exception that a single-member limited liability company has only one member.

Every Nevada LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

Nevada does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

What To Include in a Single Member LLC Operating AgreementName of LLC.Principal Place of Business.State of Organization/Formation.Registered Office and Agent.Operating the LLC in another state (Foreign LLC)Duration of LLC.Purpose of LLC.Powers of LLC.More items...?24 Sept 2021

This information can generally be found on your Secretary of State website. Tip: It is unwise to operate without an operating agreement even though most states do not require a written document. Regardless of your state's law, think twice before opting out of this provision.