Nevada Sample Letter for Exemption of Ad Valorem Taxes

Description

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

Discovering the right authorized document template can be a struggle. Obviously, there are tons of layouts available on the net, but how do you get the authorized develop you need? Use the US Legal Forms web site. The assistance provides a large number of layouts, like the Nevada Sample Letter for Exemption of Ad Valorem Taxes, that you can use for organization and private requirements. All of the types are checked out by professionals and satisfy state and federal needs.

In case you are presently registered, log in to your accounts and click the Down load button to get the Nevada Sample Letter for Exemption of Ad Valorem Taxes. Use your accounts to search with the authorized types you have bought earlier. Check out the My Forms tab of your respective accounts and have yet another backup in the document you need.

In case you are a whole new customer of US Legal Forms, here are easy directions that you can adhere to:

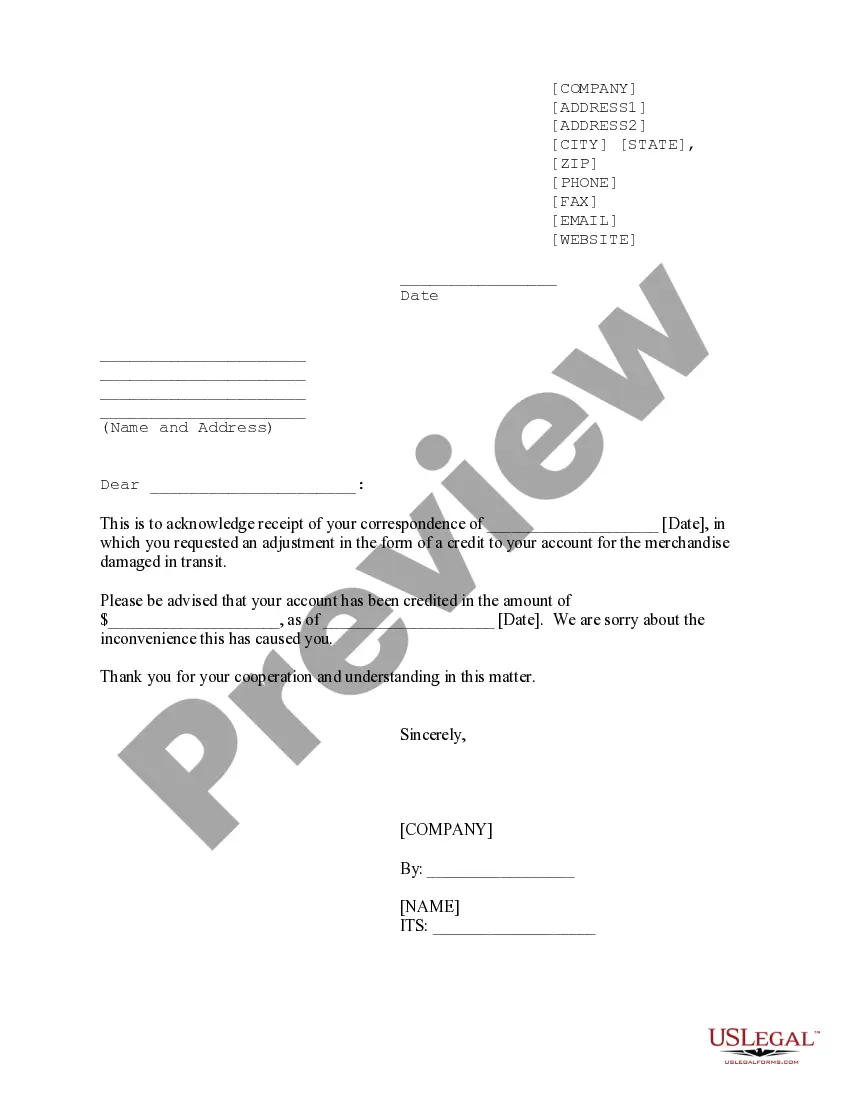

- Initially, ensure you have chosen the appropriate develop for your town/region. You are able to look over the shape using the Review button and study the shape outline to make certain this is the best for you.

- In the event the develop fails to satisfy your needs, take advantage of the Seach field to obtain the correct develop.

- When you are certain the shape is proper, go through the Acquire now button to get the develop.

- Opt for the rates program you want and type in the required details. Create your accounts and pay for the order utilizing your PayPal accounts or charge card.

- Select the submit file format and obtain the authorized document template to your device.

- Complete, modify and produce and indicator the received Nevada Sample Letter for Exemption of Ad Valorem Taxes.

US Legal Forms may be the largest catalogue of authorized types that you can find numerous document layouts. Use the company to obtain expertly-manufactured paperwork that adhere to state needs.

Form popularity

FAQ

How do I write a tax-exempt letter? A tax exempt letter needs to include the name and contact information of the organization. Then establish the reason for the tax exempt status such as listing what the organization does that will profit the public.

This statewide program refunds up to a maximum of $500 on the property tax paid by eligible senior citizens on their primary residence.

Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption.

Yes, Nevada offers tax exemptions to persons meeting certain requirements such as: Surviving Spouse, Veterans, Disabled Veterans, and Blind Persons. These exemptions can be applied to real property, personal property (mobile homes, etc.) or used to exempt all or part of your vehicle privilege tax.

Exemptions Exemption TypeAssessed Value80%-99% Disabled Veteran25,800100% Disabled Veteran34,400Surviving Spouse1,720Surviving Spouse & Blind6,8805 more rows

Does Nevada have any property tax exemptions for seniors? While there is no general property tax exemption for seniors, there are a number of specific programs from which some retirees may benefit.

All property tax exemptions in Nevada are stated in "assessed value" amounts. The term "assessed value" approximates 35% of the taxable value of an item. The exemption amount will vary each year depending on the Consumer Price Index and the tax rates throughout the County.

File the completed Application for Sales/Use Tax Exemption for Religious/Charitable/Educational Organizations with a copy of your IRS determination letter to the Nevada Department of Taxation. Also include your bylaws, articles of incorporation, a financial statement and an outline of your charitable activities.