Nevada Agreement to Form Partnership in Future to Conduct Business

Description

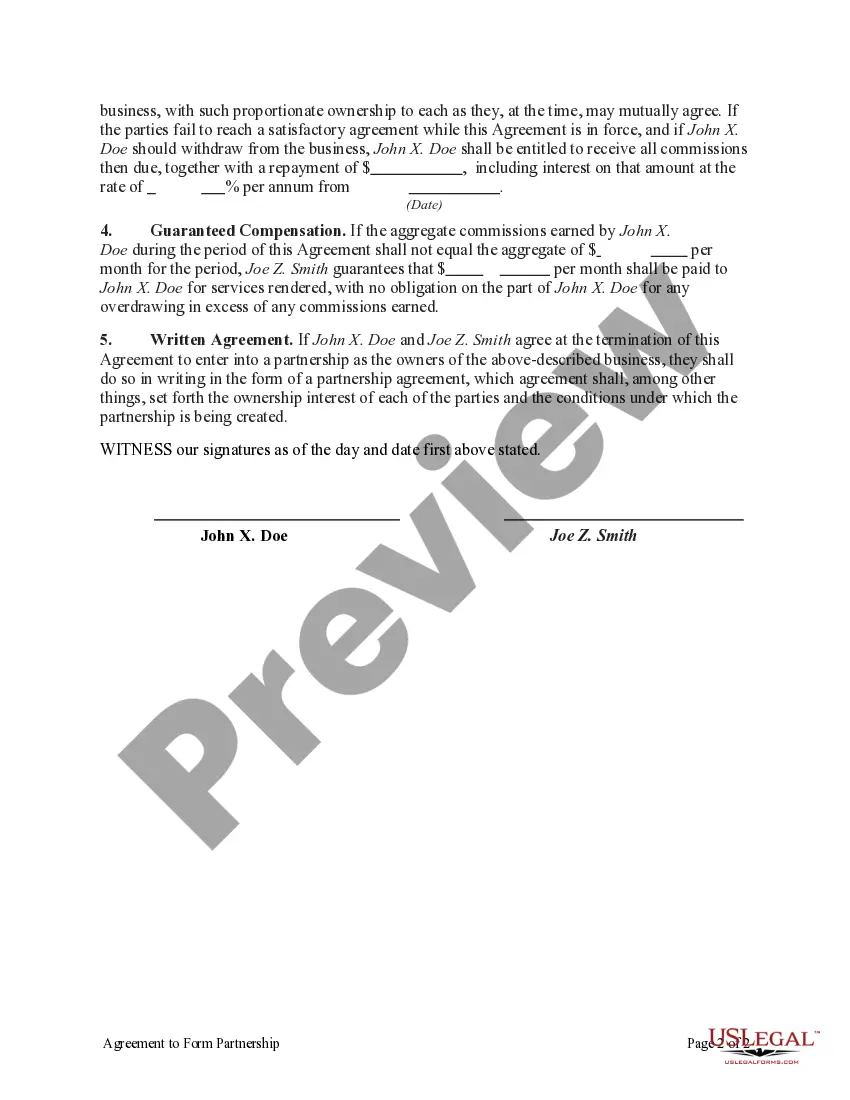

How to fill out Agreement To Form Partnership In Future To Conduct Business?

It is feasible to spend hours on the Internet attempting to locate the valid documents template that aligns with the state and federal criteria you require.

US Legal Forms offers a vast selection of valid forms that are reviewed by professionals.

You can conveniently download or print the Nevada Agreement to Form Partnership in Future to Conduct Business from our platform.

If available, use the Review button to examine the documents template as well.

- If you possess a US Legal Forms account, you can Log In and select the Obtain button.

- Subsequently, you can complete, amend, print, or sign the Nevada Agreement to Form Partnership in Future to Conduct Business.

- Every valid documents template you obtain is yours permanently.

- To obtain another copy of any acquired form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct documents template for the state/town of your choice.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Transforming your LLC into a partnership involves drafting a Nevada Agreement to Form Partnership in Future to Conduct Business. This agreement specifies the roles and responsibilities of each partner within your LLC. It’s crucial to officially update your business structure and inform state authorities. Platforms like US Legal Forms offer valuable tools and templates to help you navigate this transition smoothly.

To form a single member LLC partnership, you should create a Nevada Agreement to Form Partnership in Future to Conduct Business. This document will outline the terms and conditions of your partnership agreement with potential partners. It's essential to consult legal resources or professionals to ensure compliance with Nevada laws. Additionally, using platforms like US Legal Forms can simplify the process by providing templates and guidance.

Yes, Nevada recognizes domestic partnerships that offer the same benefits as marriage for individuals who prefer this legal structure. A domestic partnership is a viable alternative for couples wishing to formalize their commitment without entering into a marriage. The Nevada Agreement to Form Partnership in Future to Conduct Business can be applied here to establish clear terms and conditions for your partnership.

Yes, partnerships have specific filing requirements in Nevada. They must submit annual information returns to report the income and expenses of the business. By using the Nevada Agreement to Form Partnership in Future to Conduct Business as a guide, partners can ensure they meet all necessary filing requirements and maintain good standing with state regulations.

Yes, Nevada does require partnerships to file a tax return, even though the state does not impose a personal income tax. The partnership must file Form 1065 to report the income, deductions, gains, and losses of the partnership. It's wise to note that, under the Nevada Agreement to Form Partnership in Future to Conduct Business, understanding these tax obligations is crucial for compliance.

To form a partnership LLC in Nevada, you first need to choose your partnership name that includes 'LLC.' Next, you must file the Articles of Organization with the Nevada Secretary of State. It is also important to draft an operating agreement outlining the roles of each partner. Additionally, the Nevada Agreement to Form Partnership in Future to Conduct Business is a helpful document that can streamline this process.

Writing a simple partnership agreement begins with stating the partnership's name and the names of the partners. Next, outline each partner's responsibilities and how profits and losses will be shared. For further assistance, consider templates from uslegalforms that align with the Nevada Agreement to Form Partnership in Future to Conduct Business, ensuring a straightforward and effective process.

To fill a partnership form, start by providing basic information about the partnership and its partners. Clearly define the business purpose, partner roles, and each member's contributions. Refer to the Nevada Agreement to Form Partnership in Future to Conduct Business to ensure that your application meets legal requirements and is comprehensive.

The four types of partnerships in business are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type varies in terms of liability and management structure. Understanding these distinctions is vital for creating a Nevada Agreement to Form Partnership in Future to Conduct Business that fits your needs and protects all partners involved.

The structure of a partnership agreement typically includes an introduction, definitions, roles and responsibilities, financial contributions, and profit distribution details. Additionally, it should address dispute resolution mechanisms and the process for modifying the agreement. Following the Nevada Agreement to Form Partnership in Future to Conduct Business can help ensure a comprehensive structure that meets legal standards.