Nevada Agreement to Form Partnership in the Future in Order to Carry Out a Contract to be Obtained

Description

How to fill out Agreement To Form Partnership In The Future In Order To Carry Out A Contract To Be Obtained?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal paperwork templates that you can purchase or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms such as the Nevada Agreement to Form Partnership in the Future to Execute a Contract available within minutes.

If you already have an account, Log In to obtain the Nevada Agreement to Form Partnership in the Future to Execute a Contract from the US Legal Forms catalog. The Download button will be visible on every form you view. You can access all previously acquired forms from the My documents tab of your profile.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

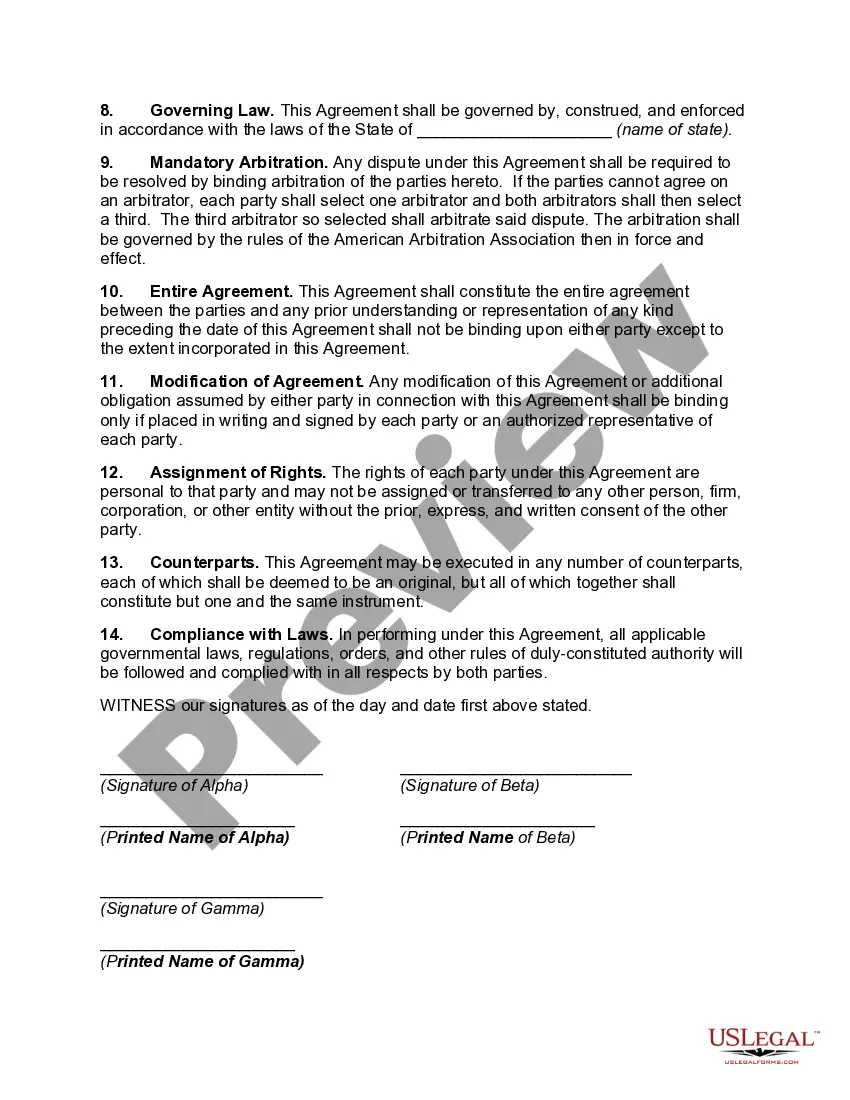

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Nevada Agreement to Form Partnership in the Future to Execute a Contract. Each template added to your account has no expiration date and is yours permanently. If you wish to download or print an additional copy, simply visit the My documents section and click on the form you need. Access the Nevada Agreement to Form Partnership in the Future to Execute a Contract with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to assist you.

- Ensure you have chosen the correct form for your area/state.

- Click the Preview button to review the form's details.

- Read the form description to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Get now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The four main types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has distinct characteristics that may suit different business needs. Understanding these differences will guide you in establishing a Nevada Agreement to Form Partnership in the Future in Order to Carry Out a Contract to be Obtained that aligns with your business goals. This knowledge also helps you evaluate the level of liability and control each partner has.

A limited partnership includes general partners who manage the business and limited partners who contribute capital but have limited control. A limited liability limited partnership (LLLP) provides the same structure as a limited partnership, but it adds liability protection for general partners. This distinction is important for those considering a Nevada Agreement to Form Partnership in the Future in Order to Carry Out a Contract to be Obtained.

In this way, a partnership agreement is similar to corporate bylaws or a limited liability company's (LLC) operating agreement. There's no state that requires a partnership agreement, and it's possible to start a business without one.

NRS 88.400 Certificate of authorization to transact business; identification of defaulting partnerships; reinstatement of partnership which is unit-owners' association; forfeiture and penalty.

Before creating a partnership, it is important to draft a well-thought-out operating agreement that will cover the following: Name of the partners and the process of adding new partners or removing them. Outline of the company. Each partner's percentage of investment and profit.

written partnership agreement will reduce the risk of misunderstandings and disputes between the owners. Without a written agreement, owners in a company will be stuck with the state's default rules.

A partnership agreement must contain the name and address of each partner and his contribution to the business. Contributions may consist of cash, property and services. The agreement must detail how the partners intend to allocate the company's profits and losses.

It's ultimately up to you and the partners to decide how to create the partnership agreement. It's a legal contract, so it should be worded as such, and signed by all parties. You can choose an online template, create one yourself or speak to an attorney to draw up the contract.

Unlike some states, any business can become an LLP in Nevada. However, you must have at least two partners (a sole proprietor cannot form an LLP). If your partnership operates under an assumed name (something other than the partners' surnames), you must register the business' name with the state.

Another difference between the two Chapters would be that Chapter 88 requires a dissolution date for your LP, while 87A allows for your limited partnership to exist forever. Regardless of the type of limited partnership, the partnership must register as such with the Nevada Secretary of State.