Nevada Location Worksheet

Description

How to fill out Location Worksheet?

If you wish to obtain, retrieve, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you have found the form you require, select the Buy now option. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Nevada Location Worksheet in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Download option to access the Nevada Location Worksheet.

- You can also find forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct region/state.

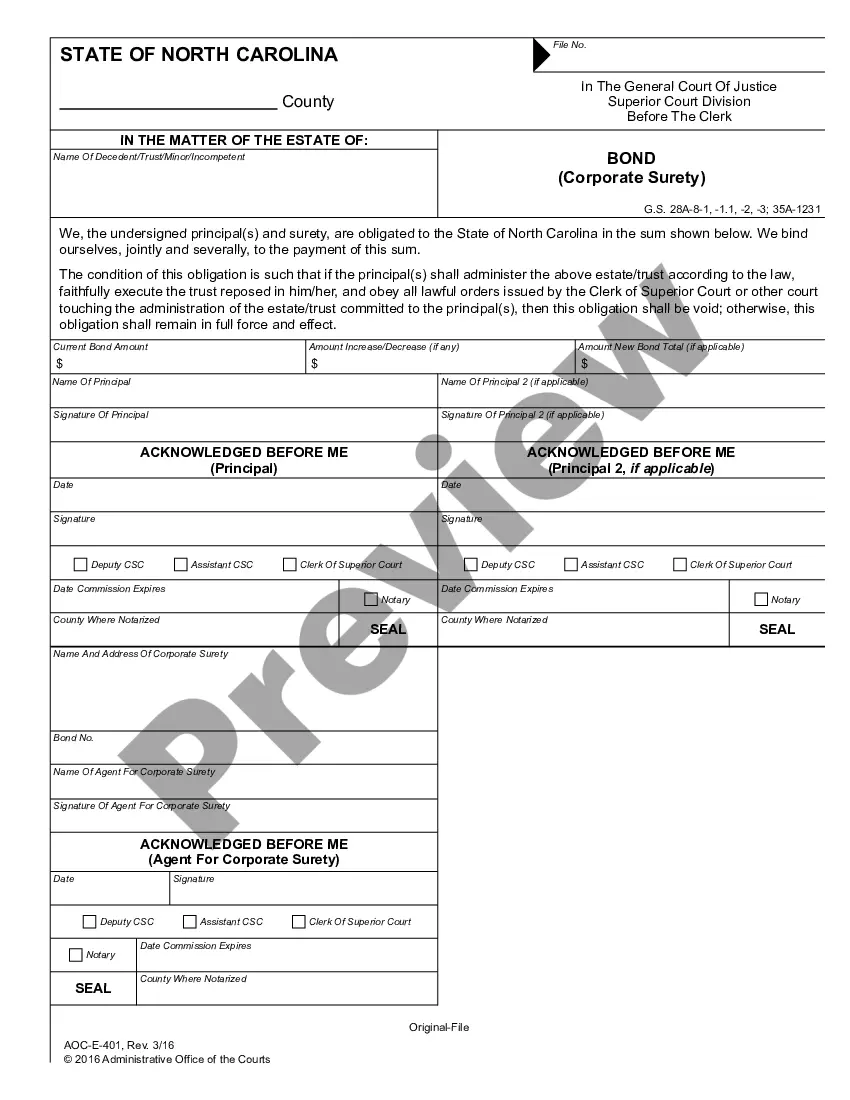

- Step 2. Use the Preview option to review the details of the form. Be sure to examine the particulars.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Filling out a Nevada resale certificate form involves detailing your business name, address, and the seller's permit number. You should also include a clear description of the items being purchased for resale. Using the Nevada Location Worksheet can simplify this process, providing a structured format to ensure you include all critical information.

To obtain a Nevada MBT number, you must complete the registration process with the Nevada Department of Taxation. This process includes providing essential business details and may require the submission of the Nevada Location Worksheet. This worksheet aids you in gathering the necessary information to ensure a smooth application experience.

In Nevada, a TID, or Tax Identification Number, is essential for businesses to comply with state taxation requirements. This number is necessary for filing taxes, applying for permits, and conducting financial transactions. Ensuring you have the correct TID is vital, and the Nevada Location Worksheet can assist you in managing your tax identification needs effectively.

The Modified Business Tax (MBT) rate in Nevada varies based on the type of business. Generally, the MBT rate for most businesses is set at 1.475% on gross wages after deductions. For a clear understanding of MBT implications on your business, refer to the Nevada Location Worksheet to assess your tax obligations efficiently.

Filling out a sales tax exemption certificate in Nevada requires specific information such as your business name, address, and the reason for the exemption. You should accurately provide your NV seller's permit number and make sure to sign the certificate. Utilizing the Nevada Location Worksheet can help streamline this process and ensure you complete all necessary details correctly.