Nevada Sworn Statement regarding Proof of Loss for Automobile Claim

Description

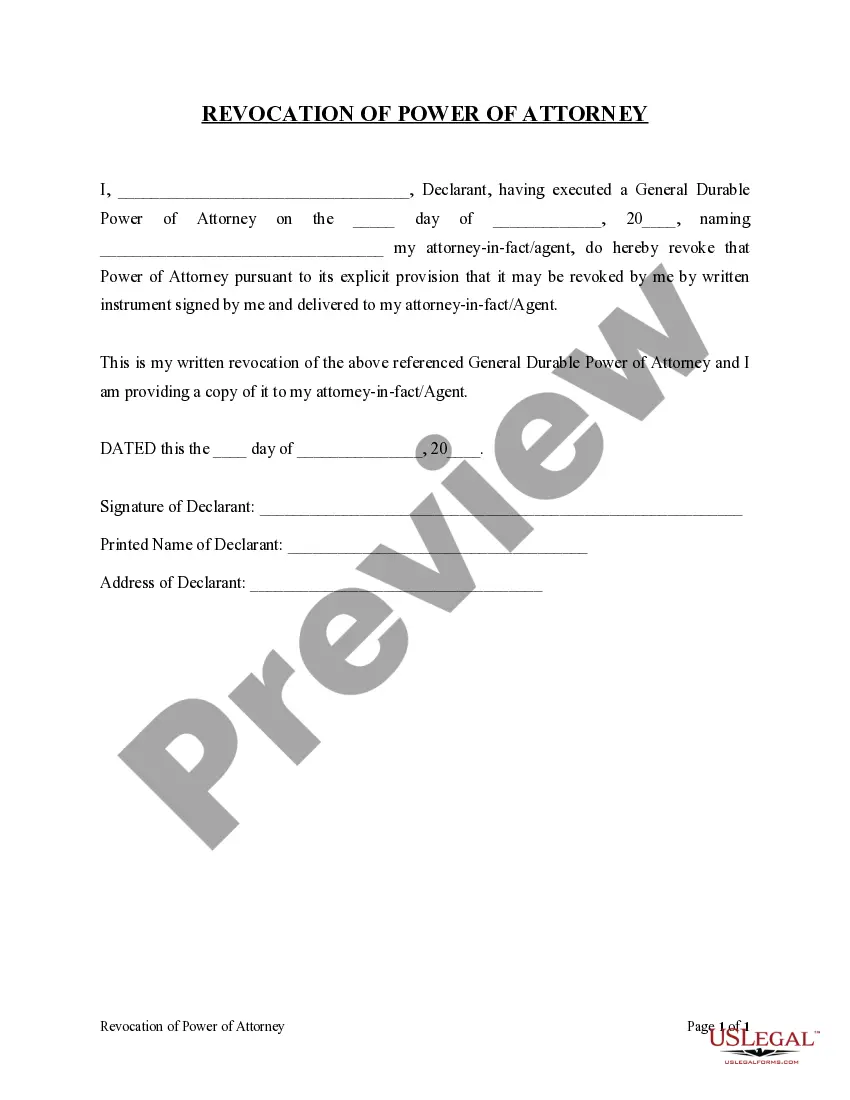

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

US Legal Forms - one of the most significant libraries of lawful forms in the States - offers a variety of lawful document layouts it is possible to obtain or print. While using web site, you will get thousands of forms for company and specific reasons, categorized by types, says, or search phrases.You can get the latest variations of forms such as the Nevada Sworn Statement regarding Proof of Loss for Automobile Claim in seconds.

If you have a registration, log in and obtain Nevada Sworn Statement regarding Proof of Loss for Automobile Claim from your US Legal Forms library. The Download button will show up on every kind you see. You have access to all in the past saved forms in the My Forms tab of the accounts.

If you would like use US Legal Forms the first time, here are simple guidelines to get you started off:

- Ensure you have picked out the right kind to your city/region. Click the Review button to examine the form`s content material. See the kind explanation to ensure that you have chosen the appropriate kind.

- When the kind doesn`t match your specifications, utilize the Search discipline on top of the display to obtain the the one that does.

- In case you are content with the form, validate your selection by clicking on the Get now button. Then, choose the prices prepare you like and give your credentials to sign up on an accounts.

- Approach the financial transaction. Utilize your charge card or PayPal accounts to perform the financial transaction.

- Select the structure and obtain the form on your gadget.

- Make modifications. Complete, revise and print and sign the saved Nevada Sworn Statement regarding Proof of Loss for Automobile Claim.

Every single design you put into your bank account does not have an expiration time and it is your own permanently. So, in order to obtain or print one more version, just visit the My Forms section and click on in the kind you want.

Gain access to the Nevada Sworn Statement regarding Proof of Loss for Automobile Claim with US Legal Forms, probably the most comprehensive library of lawful document layouts. Use thousands of professional and condition-particular layouts that fulfill your business or specific requirements and specifications.

Form popularity

FAQ

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.

Satisfactory proof of loss, as required for an insured to obtain penalties from an insurer, is that which is sufficient to fully apprise the insurer of the claim and extent of the damage. Louisiana Bag Co., 2008-0453, p. 16, 999 So.

A Proof of Loss form helps to substantiate any damages that you suffered due to an insurance-covered event. The insurance policy itself and this document are used together to determine whether or not the insurance company has liability.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.

The Proof of Loss form is an official, notarized, sworn statement from the insured to the insurer concerning the scope of damage to their property. The insurance company uses this information as a basis for determining their liabilities for the property loss.

Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

Information You'll Need For a Proof of Loss Form It will usually include the following: Policy number. Date and cause of the damage. Parties with a financial interest in the claim such as your mortgage holder.

What is a Proof of Loss? A Sworn Statement in Proof of Loss outlines the basic details of your property damage claim and serves as a cover document for your supporting claim materials and documentation.