Nevada Contract for Part-Time Assistance from Independent Contractor

Description

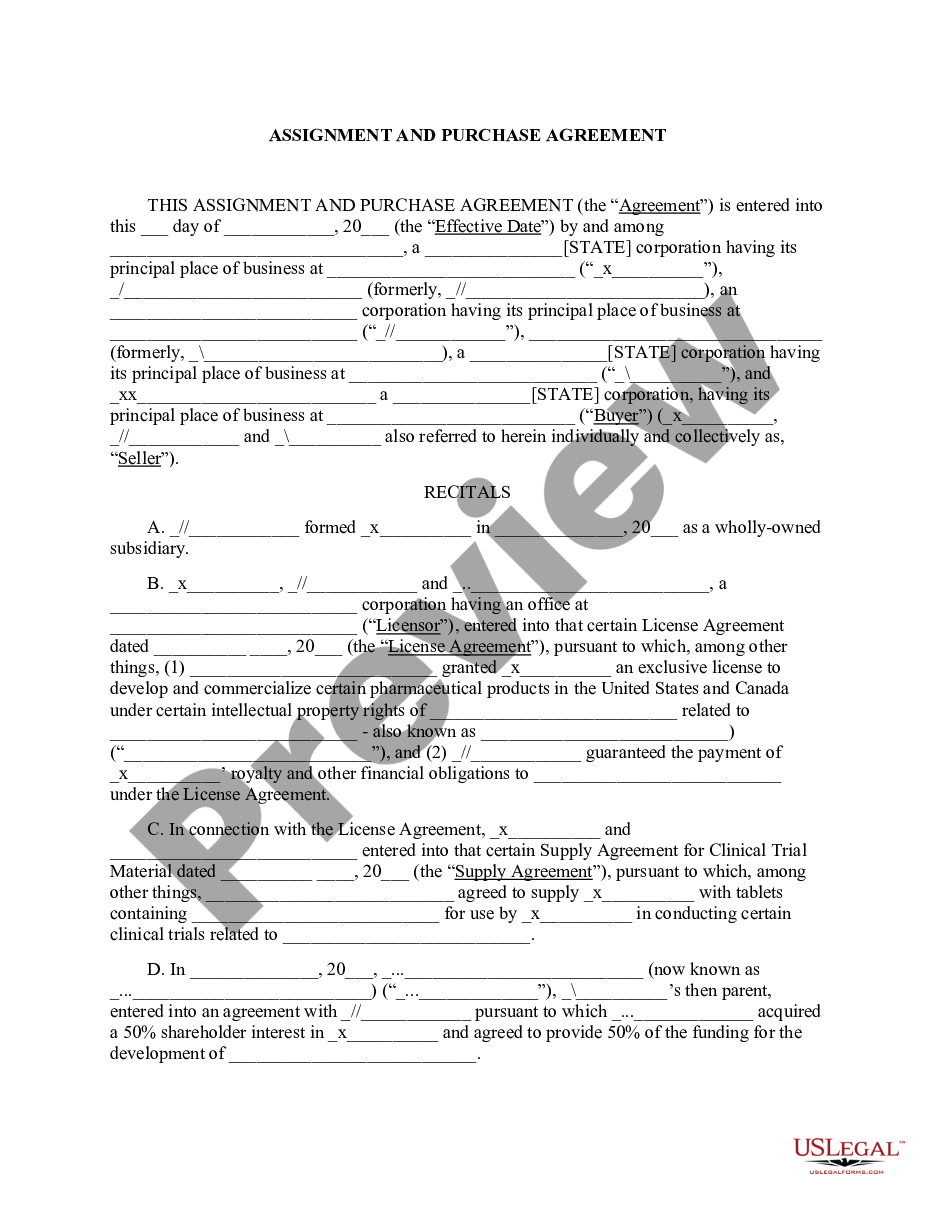

How to fill out Contract For Part-Time Assistance From Independent Contractor?

If you require to complete, retrieve, or generate sanctioned document templates, utilize US Legal Forms, the top selection of legal documents, readily available online.

Make use of the site's user-friendly and convenient search to find the paperwork you need.

A collection of templates for business and personal purposes is categorized by types and states, or keywords.

Step 4. After identifying the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to sign up for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Nevada Contract for Part-Time Assistance from Independent Contractor.

- Employ US Legal Forms to acquire the Nevada Contract for Part-Time Assistance from Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain option to get the Nevada Contract for Part-Time Assistance from Independent Contractor.

- You can also access documents you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read through the instructions.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Certainly, working part-time as a contractor is a viable option. This arrangement allows you to pursue other interests, whether personal projects or full-time employment. By using a Nevada Contract for Part-Time Assistance from Independent Contractor, you can ensure your contract defines the nature of your work and the payment you will receive. This helps protect both you and your client.

Yes, you can absolutely work as a part-time independent contractor. Many individuals choose this path to supplement their income while maintaining flexibility. A Nevada Contract for Part-Time Assistance from Independent Contractor provides a clear framework for your working relationship. It helps establish guidelines and expectations that foster a successful partnership.

As an independent contractor, you typically have the freedom to set your own hours. This flexibility allows you to manage your work schedule according to your personal needs and priorities. When drafting a Nevada Contract for Part-Time Assistance from Independent Contractor, you should specify your availability and any deadlines. This ensures clarity and keeps both parties aligned.

Yes, a part-time worker can be classified as a 1099 independent contractor. This means that instead of being an employee, they operate as a self-employed individual. When utilizing a Nevada Contract for Part-Time Assistance from Independent Contractor, you have the flexibility to define the terms and conditions of the work arrangement. Therefore, it is essential to establish clear expectations in your contract.

Most independent contractors do not receive traditional employer-sponsored benefits. When entering a Nevada Contract for Part-Time Assistance from Independent Contractor, it's crucial for both parties to discuss expectations regarding benefits. While contractors manage their own benefits, it is possible to offer bonuses or non-monetary incentives to enhance the partnership. Always clarify these terms in your contract to avoid misunderstandings.

Generally, a company does not provide benefits to 1099 employees, who are classified as independent contractors. This exemption means they are responsible for arranging their own insurance and benefits. It's vital to clarify this distinction when you create a Nevada Contract for Part-Time Assistance from Independent Contractor. However, companies can still offer bonuses or incentives separately.

Yes, a company can offer benefits selectively to certain employees. This can occur if you have a clear and justifiable reason, such as differing roles or seniority levels. However, make sure your decision aligns with your policies and complies with labor laws. For independent contractors under a Nevada Contract for Part-Time Assistance from Independent Contractor, remember that benefits are not typically provided.

Typically, independent contractors do not receive traditional employee benefits. When engaging an independent contractor under a Nevada Contract for Part-Time Assistance from Independent Contractor, it is important to understand that they are responsible for their own benefits. If you wish to provide perks, consider offering incentives like performance bonuses or flexible working conditions that do not fall under standard benefits.

Yes, you can offer a bonus to an independent contractor. When you establish a Nevada Contract for Part-Time Assistance from Independent Contractor, you may incentivize their performance through bonuses. These bonuses can be structured based on project completion or meeting certain milestones. However, make sure to document this arrangement clearly in the contract.

Yes, having a contract for an independent contractor is crucial for setting clear expectations. A well-drafted agreement protects both parties by defining the scope of work, payment terms, and responsibilities. This reduces the risk of disputes and ensures compliance with legal standards. Utilizing a Nevada Contract for Part-Time Assistance from Independent Contractor gives you a solid framework to work within.