Nevada Line of Credit Promissory Note

Description

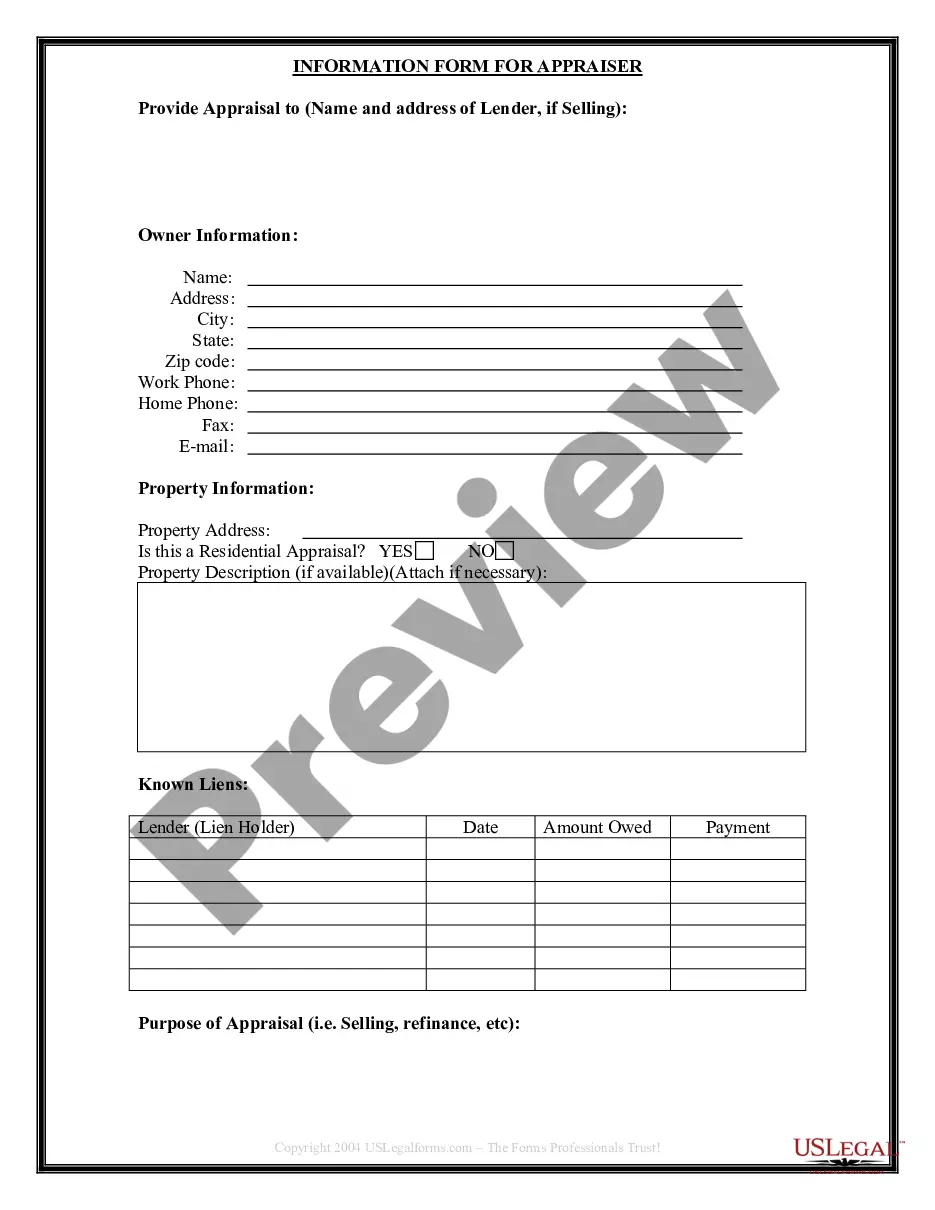

How to fill out Line Of Credit Promissory Note?

Choosing the best legitimate papers web template could be a struggle. Obviously, there are a variety of themes available on the Internet, but how do you get the legitimate type you require? Take advantage of the US Legal Forms website. The support gives a huge number of themes, such as the Nevada Line of Credit Promissory Note, that you can use for organization and private needs. All the forms are examined by specialists and meet state and federal demands.

In case you are previously signed up, log in for your account and click the Download switch to have the Nevada Line of Credit Promissory Note. Utilize your account to search from the legitimate forms you possess bought earlier. Proceed to the My Forms tab of your own account and acquire one more backup from the papers you require.

In case you are a whole new end user of US Legal Forms, listed here are easy guidelines for you to follow:

- Initial, make certain you have selected the correct type for your personal area/county. It is possible to look through the form while using Preview switch and read the form information to make sure it is the best for you.

- In case the type does not meet your expectations, use the Seach industry to find the right type.

- When you are positive that the form would work, click the Buy now switch to have the type.

- Pick the costs plan you need and enter the needed information and facts. Make your account and pay money for the order using your PayPal account or Visa or Mastercard.

- Pick the document format and download the legitimate papers web template for your device.

- Total, modify and printing and indication the received Nevada Line of Credit Promissory Note.

US Legal Forms will be the most significant collection of legitimate forms where you will find various papers themes. Take advantage of the service to download professionally-made paperwork that follow status demands.

Form popularity

FAQ

Promissory Notes and Your Credit Reports However, only traditional lenders and investment firms typically report such information to credit reporting agencies. Therefore, information about a promissory note may never appear on your credit reports.

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

Reporting to a Credit Bureau Is an Involved Process A promissory note default can affect a borrower's credit rating if the promissory note holder has the ability to report the deficiency to the various credit reporting agencies.

A promissory note is a legally binding promise to repay a debt. These agreements could be used for personal loans, student loans, mortgages and more. Promissory note laws vary by state, but they typically include the loan amount, loan terms and signatures from both the lending and borrowing party.

It is a written agreement signed by drawer with a promise to pay the money on a specific date or whenever demanded. This note is a short-term credit tool which is not related to any currency note or banknote.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.