Nevada Agreement to Assign Lease to Incorporator in Forming Corporation

Description

How to fill out Agreement To Assign Lease To Incorporator In Forming Corporation?

Are you currently in a scenario where you require documents for either business or personal purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of document templates, such as the Nevada Agreement to Assign Lease to Incorporator in Forming Corporation, designed to meet state and federal requirements.

Once you locate the correct document, click Buy now.

Choose a payment plan that suits you, enter the required information to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nevada Agreement to Assign Lease to Incorporator in Forming Corporation template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/county.

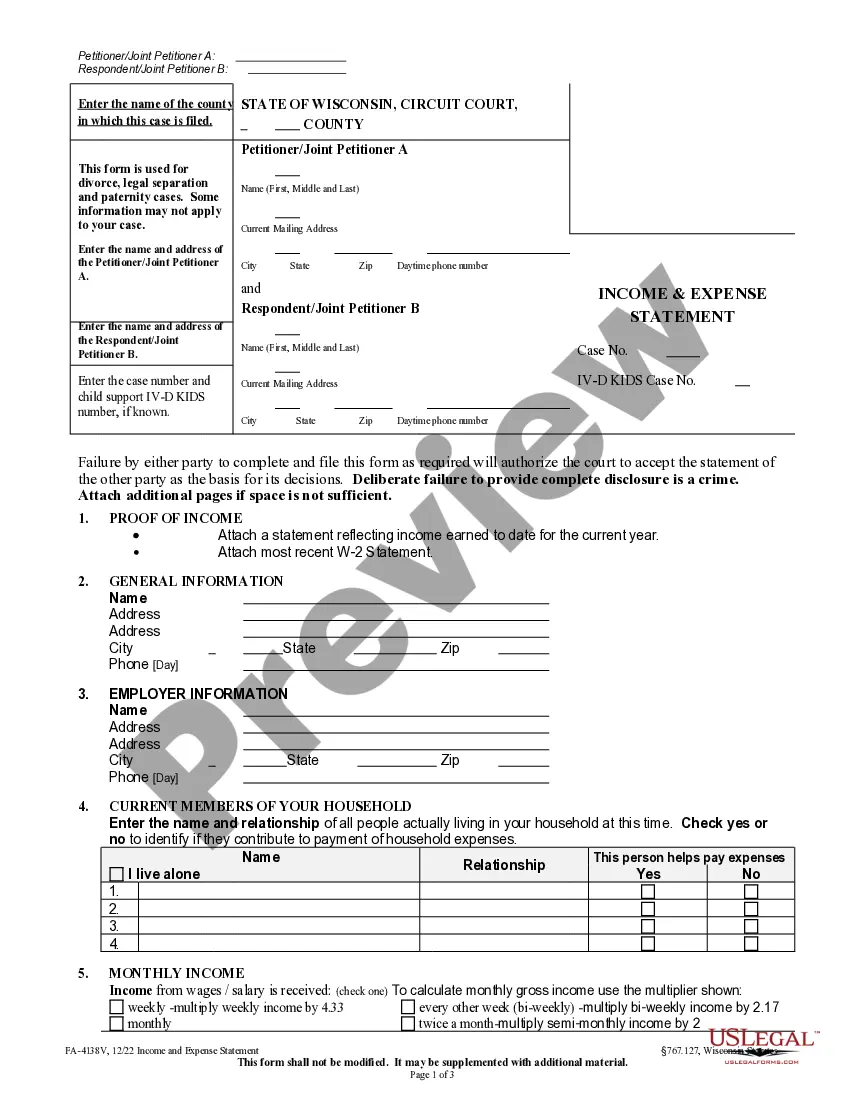

- Utilize the Preview button to review the form.

- Check the details to confirm you have selected the correct document.

- If the document isn’t what you’re looking for, use the Search field to find a form that fits your needs.

Form popularity

FAQ

To change the ownership of an LLC in Nevada, you will typically begin by updating the operating agreement to reflect the new owners. You may also need to file an Amendment to the Articles of Organization with the Secretary of State, depending on the changes made. It is beneficial to draft a Nevada Agreement to Assign Lease to Incorporator in Forming Corporation if your LLC holds real estate, ensuring a smooth transition of ownership accompanied by proper documentation.

Amending the Articles of Incorporation in Nevada requires filing a Certificate of Amendment with the Secretary of State. You should specify the changes being made, whether it involves a name change, altering the structure, or changing the purpose of the corporation. If the amendment involves property, consider creating a Nevada Agreement to Assign Lease to Incorporator in Forming Corporation to ensure legal clarity on property ownership and use.

To incorporate in Nevada, you need to choose a unique name for your corporation and file Articles of Incorporation with the Secretary of State. Additionally, you must appoint a registered agent who will receive legal documents on behalf of the corporation. It's also essential to prepare a Nevada Agreement to Assign Lease to Incorporator in Forming Corporation if you plan to use property owned by another party for your business activities.

Incorporation can lead to problems like vulnerability to lawsuits and increased administrative duties. Corporations also face potential double taxation, impacting overall profitability. To address these problems, it’s crucial to have a solid understanding of the Nevada Agreement to Assign Lease to Incorporator in Forming Corporation, which can guide you through legal complexities effectively.

Incorporating in Nevada by yourself is a straightforward process. You need to file the Articles of Incorporation with the Secretary of State and obtain necessary licenses and permits. Utilizing resources from platforms like uslegalforms can simplify this process, including guidance on the Nevada Agreement to Assign Lease to Incorporator in Forming Corporation, ensuring all steps are clear and compliant.

Nevada is often considered a favorable state for incorporation due to its business-friendly laws and absence of state income tax for corporations. Many entrepreneurs appreciate the privacy benefits offered to company owners in Nevada. However, it’s essential to fully understand the Nevada Agreement to Assign Lease to Incorporator in Forming Corporation to ensure that choosing Nevada aligns with your business goals.

While forming a Nevada LLC has many benefits, there are some disadvantages to consider. One challenge is the potential for higher taxes compared to other states, especially if you operate in another jurisdiction. Additionally, Nevada has stricter compliance requirements, which may add complexity to your operations. Understanding the Nevada Agreement to Assign Lease to Incorporator in Forming Corporation can help navigate these issues effectively.

Yes, Nevada law requires corporations to maintain minutes of meetings and other corporate actions. Corporate minutes are essential for documenting decisions and ensuring compliance with state laws. Using a Nevada Agreement to Assign Lease to Incorporator in Forming Corporation can help you establish the necessary record-keeping protocols right from the start.

In Nevada, corporate names must be distinguishable from existing entities and must include a designation such as 'Corporation,' 'Incorporated,' or an abbreviation thereof. Additionally, certain words are restricted or prohibited to prevent confusion or misrepresentation. Utilizing the Nevada Agreement to Assign Lease to Incorporator in Forming Corporation during this naming process ensures your corporation complies with state regulations.

To form a corporation in Nevada, you must select a unique business name, designate incorporators, and file Articles of Incorporation with the Secretary of State. Also, obtaining any necessary licenses and permits is crucial for compliance. Incorporating with a Nevada Agreement to Assign Lease to Incorporator in Forming Corporation simplifies this process, ensuring that all legal steps are followed correctly.