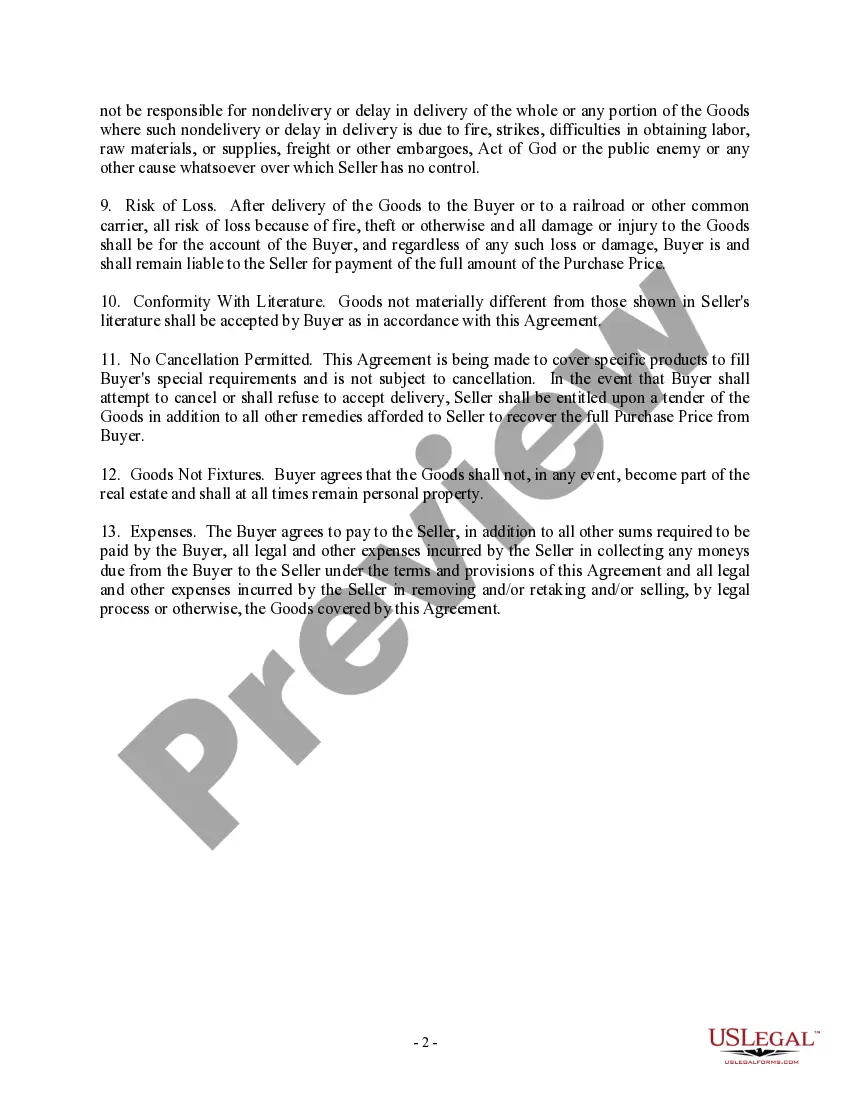

Nevada Conditional Sales Contract

Description

How to fill out Conditional Sales Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print. By using the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Nevada Conditional Sales Contract in just a few minutes.

If you already have an account, sign in and download the Nevada Conditional Sales Contract from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are planning to use US Legal Forms for the first time, here are some easy steps to get started: Make sure you have selected the right form for your city/state. Click the Preview button to review the form's content. Read the form description to confirm that you have chosen the correct form. If the form does not meet your needs, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, affirm your decision by clicking the Get now button. Then, select the pricing plan you prefer and provide your details to register for an account. Complete the payment. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Nevada Conditional Sales Contract. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you need.

Gain access to the Nevada Conditional Sales Contract through US Legal Forms, which boasts one of the largest collections of legal document templates.

Take advantage of thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Access the Nevada Conditional Sales Contract with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Easily navigate through categories or use the search function to find specific forms.

- Ensure you have chosen the correct document by previewing and reading descriptions.

- Once you have confirmed your choice, proceed to purchase and download the form.

- Modify the downloaded document as needed to fit your requirements.

Form popularity

FAQ

The key difference between a CS and HP agreement is that you will become the legal owner of the vehicle, once all repayments have been made to the lender, where as on HP there will be an option to purchase fee at the end of the contract before you legally own the vehicle.

Also known as a sale on satisfaction or sale on trial, a sale on approval contract regulates the conditional sale of goods made on a trial basis. Sellers use this contract to induce sales that buyers may not be enthusiastic about, while buyers use it to examine and inspect goods they may not otherwise buy.

A conditional contract, also called a hypothetical contract, is a contract agreement that only requires performance once the delineated conditions are met. This legal agreement requires prior performance of another agreement or clause in order to be enforceable.

DISTINGUISHING A LEASE FROM A CONDITIONAL SALES AGREEMENT A conditional sales agreement (and not a lease) exists if any of the following are found: The agreement applies part of each payment toward an equity interest. The agreement provides for the transfer of title after payment of a stated amount.

What Is a Conditional Sales Agreement? A conditional sales agreement is a financing arrangement where a buyer takes possession of an asset, but its title and right of repossession remain with the seller until the purchase price is paid in full.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

The Conditional Sale Agreement If you buy equipment on an installment plan, for example, it's yours only if you meet the condition of making all the payments. The buyer gets the equipment sooner than if they paid full price; the seller has security because they can repossess the equipment.

Conditional sales contract (also known as financing leases) In which the title does not pass to the buyer until the last installment payment has been paid. Thus, property can be repossessed as soon as any payment is missed.