Nevada Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

If you require to aggregate, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s straightforward and efficient search feature to find the documents you need.

A wide array of templates for business and personal uses are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your information to create an account.

- Utilize US Legal Forms to locate the Nevada Contract for Sale of Goods on Consignment with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and select the Download option to obtain the Nevada Contract for Sale of Goods on Consignment.

- You can also access forms that you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps listed below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Remember to read through the description.

Form popularity

FAQ

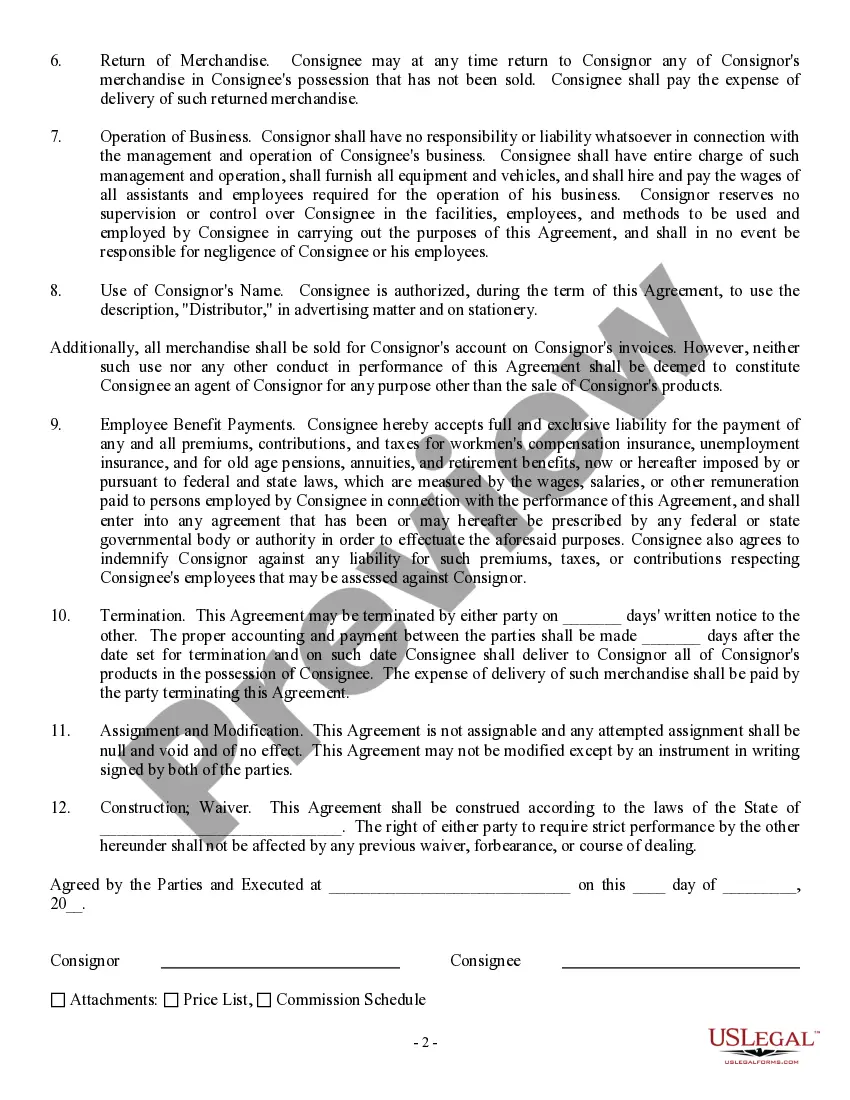

To terminate a consignment agreement, refer to the terms outlined in the Nevada Contract for Sale of Goods on Consignment. Generally, a written notice specifying the intent to terminate must be sent to the other party, adhering to any notice period set in the agreement. Ensure that all unsold items are returned and any final financial transactions are completed. Clear communication during this process helps maintain a positive relationship.

Yes, consignment sales are considered taxable income and must be reported to the IRS. Sellers should maintain accurate records of their sales transactions as stipulated in a Nevada Contract for Sale of Goods on Consignment. This ensures compliance with tax regulations and helps avoid any potential issues with tax reporting. Consulting with a tax professional can provide guidance on how to properly report these earnings.

The consignment procedure involves several steps: the seller delivers goods to the consignee, both parties agree on the sale terms, and the consignee sells the goods. The Nevada Contract for Sale of Goods on Consignment plays a vital role by outlining these processes and clarifying how payments will be disbursed upon sales. If items remain unsold after the agreed period, they are typically returned to the seller. This systematic approach helps minimize misunderstandings.

A consignment contract functions as a binding agreement that specifies the terms under which consignors provide goods to a consignee for sale. In a Nevada Contract for Sale of Goods on Consignment, this includes details about the commission structure, duration of the agreement, and what happens with unsold merchandise. This contract protects both parties by clearly outlining responsibilities and expectations, leading to a smoother transaction process.

The typical consignment split varies but often falls between 40%-60%. In the context of a Nevada Contract for Sale of Goods on Consignment, understanding local market conditions can help tailor the split. Each party's contribution to the sale process may also influence the agreed-upon percentage. Assessing these factors can lead to a successful and fair arrangement for both parties.

A consignment agreement works by allowing a seller to place their goods in the possession of a consignee who sells the items on behalf of the seller. In a Nevada Contract for Sale of Goods on Consignment, the terms specify how sales proceeds are divided, the duration of the arrangement, and how unsold items are handled. Both parties share the risk, as the seller retains ownership until the item is sold. This relationship can be advantageous for both parties involved.

A fair split for consignment sales typically hovers around 50-50, but it depends on the specific consignment arrangement. In a Nevada Contract for Sale of Goods on Consignment, both parties need to feel comfortable with the agreed-upon terms. You may adjust the percentage based on factors like market demand and the seller's contribution. Open communication helps in finding a fair deal that satisfies everyone.

The percentage of a consignment agreement can vary widely, usually ranging from 25% to 60% for the seller, depending on the items and the agreement in place. In a Nevada Contract for Sale of Goods on Consignment, terms are defined based on mutual agreement between the parties involved. It's important to negotiate a percentage that reflects the value of the goods and the effort involved in selling them. Always clarify these terms to ensure the transaction is beneficial for both sides.

To become a consignment seller, start by researching local shops that accept consignment products. Develop a compelling line of goods to offer and create a clear plan for how to manage your inventory. A Nevada Contract for Sale of Goods on Consignment will help formalize your agreements with stores. Consider using resources like US Legal Forms to streamline this process and ensure all legal aspects are addressed.

Yes, a consignment is indeed a form of contract. It establishes a legal relationship between the seller and consignor regarding the sale of goods. The Nevada Contract for Sale of Goods on Consignment clarifies this relationship, outlining rights and obligations for each party. This legal framework ensures that all parties understand their commitments and protects their interests.