A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, since the beneficiary of a trust has disclaimed any rights he has in the trust, the trustor and trustee are terminating the trust.

Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary

Description

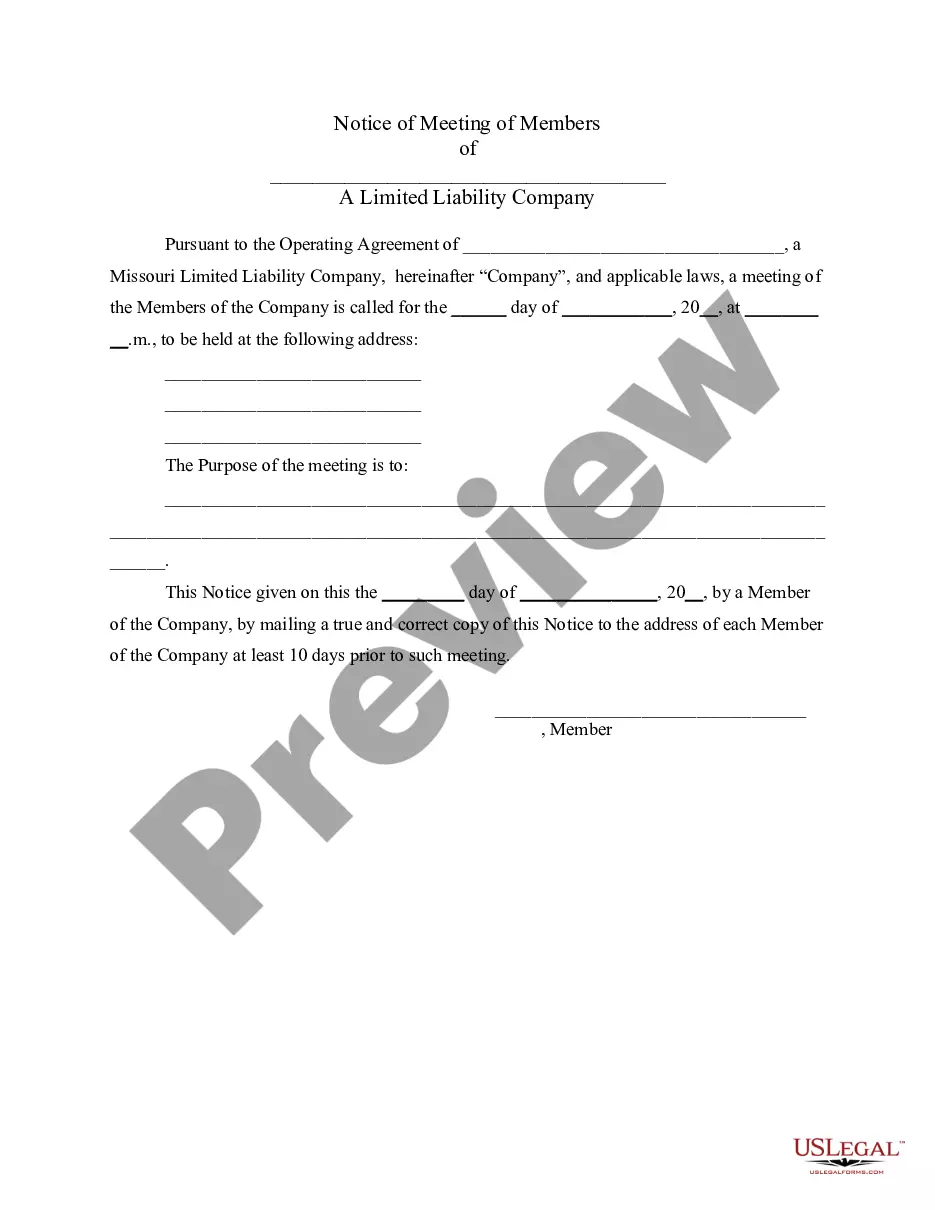

How to fill out Agreement Between Trustor And Trustee Terminating Trust After Disclaimer By Beneficiary?

You can allocate numerous hours online looking for the legal document format that satisfies the state and federal requirements you desire.

US Legal Forms offers a wide array of legal documents that are examined by professionals.

You can conveniently obtain or create the Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary from the service.

If available, take advantage of the Review button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary.

- Every legal document format you purchase is yours indefinitely.

- To get an additional copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- Firstly, make sure you have selected the appropriate document format for the state/city of your choice.

- Check the form description to ensure you have chosen the right one.

Form popularity

FAQ

Beneficiaries in Nevada generally have the right to view the trust document, which is an important aspect of their rights under the law. The Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary emphasizes the need for transparency in trust management. Access to the trust document allows beneficiaries to understand their entitlements and the intentions of the trustor. If you are a beneficiary seeking access to a trust, consider consulting with a legal professional to navigate this process effectively.

Yes, a trustee must maintain communication with beneficiaries under the Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. This communication ensures that beneficiaries stay informed about the status of the trust and any changes that may occur. Regular updates foster transparency and trust in the relationship between the trustee and the beneficiaries. Beneficiaries should feel empowered to ask questions and seek clarity about their interests.

The 5 year rule for trusts applies primarily to the distribution of assets to beneficiaries. In Nevada, if a trust is established and then terminated, the assets may be distributed according to the Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. This rule can affect how beneficiaries receive their share and when they are eligible to access it. Understanding this rule is crucial for both trustees and beneficiaries to avoid potential complications.

One downside of placing assets in a trust is the potential costs involved, including legal fees and ongoing administrative expenses. Moreover, if a trust is not updated regularly to reflect changes in family circumstances, it could lead to unintended consequences. Therefore, leveraging a robust Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can reduce complications and ensure clarity.

A trust can sometimes create an illusion of control that may lead to dependency among beneficiaries. Additionally, maintaining a trust requires ongoing management and oversight, which can become burdensome. However, with a well-structured Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, these challenges can be effectively managed.

One of the most common mistakes parents make is failing to communicate their intentions clearly. Without clear guidelines, beneficiaries may face confusion or disputes regarding the trust's terms. Establishing a comprehensive Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can help clarify these expectations.

While trusts offer many benefits, there are potential risks to assess. Mismanagement by the trustee can lead to financial losses, and poorly drafted terms can create conflicts. It's crucial to have clear and precise agreements in place, like a Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, to mitigate these risks.

It's often beneficial for parents to consider placing their assets in a trust. A trust can provide protection from probate, ensuring that assets are distributed according to their wishes. Additionally, using a trust can simplify matters during estate management. This approach aligns well with a Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary.

Yes, if all beneficiaries agree to terminate the trust, it can be dissolved. This aligns with the principles laid out in the Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. Mutual consent simplifies the termination process, allowing involved parties to reach a satisfactory conclusion. It is advisable to document this agreement formally to avoid any future disputes.

In Nevada, a trustee is required to notify beneficiaries within a reasonable timeframe, which is often stipulated in the trust document or state law. Generally, this timeframe can be as little as 60 days after the trust becomes irrevocable. The Nevada Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary emphasizes the importance of timely communication. Proper notification ensures beneficiaries are informed and can act in accordance with their rights.