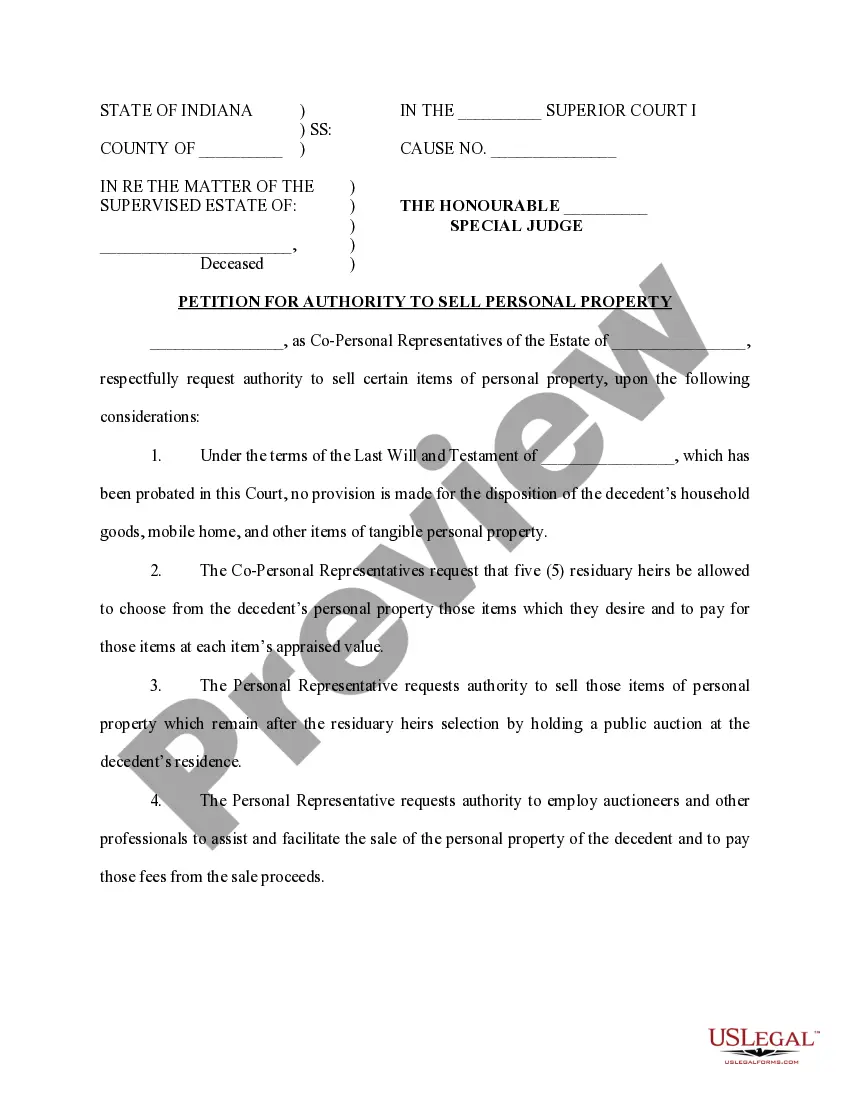

In this form, the beneficiary consents to the revocation of the trust of which he/she is a beneficiary and consents to the delivery to the trustor by the trustee of any and all monies or property of every kind, whether principal or income, in trustee's possession by virtue of the Trust Agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Consent to Revocation of Trust by Beneficiary

Description

How to fill out Consent To Revocation Of Trust By Beneficiary?

Selecting the appropriate official document template can be a challenge.

It goes without saying that numerous templates are accessible online, but how can you find the official format you need.

Make use of the US Legal Forms website. The platform offers thousands of templates, including the Nevada Consent to Revocation of Trust by Beneficiary, that you can utilize for business and personal purposes.

You can preview the form using the Preview option and review the form description to ensure it is the correct one for you.

- All of the documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to retrieve the Nevada Consent to Revocation of Trust by Beneficiary.

- Use your account to navigate through the legal documents you have previously purchased.

- Access the My documents section of your account to obtain another copy of the file you require.

- If you are a new user of US Legal Forms, here are straightforward instructions to follow.

- First, confirm that you have selected the correct document for your city/region.

Form popularity

FAQ

Revoking an irrevocable beneficiary is a complex process that often requires official court procedures. In some situations, the Nevada Consent to Revocation of Trust by Beneficiary can provide a path to amend or alter the beneficiary designation. It's crucial to obtain legal counsel to ensure compliance with state laws and the trust's terms. Proper guidance can facilitate a smoother transition in managing your trust.

The 5-year rule typically refers to the period during which assets transferred to an irrevocable trust are protected from creditors and may affect Medicaid eligibility. In many cases, assets need to be in the trust for at least five years to qualify for certain benefits. Evaluating the implications of the Nevada Consent to Revocation of Trust by Beneficiary can help you plan effectively. Professional legal assistance can provide clarity on navigating these regulations.

Beneficiaries can usually withdraw from an irrevocable trust only when specific conditions set by the trust document are met. This often includes reaching a certain age or fulfilling specific terms outlined by the trust. The Nevada Consent to Revocation of Trust by Beneficiary may offer alternative options for beneficiaries seeking access to their interests. Always review the trust provisions carefully and consult an attorney for guidance.

Yes, a beneficiary of an irrevocable trust can be removed, but this typically requires a court process. Reasons for removal may include misconduct or incapacity. The Nevada Consent to Revocation of Trust by Beneficiary can be a relevant factor in such cases. Seeking guidance from legal professionals can help you navigate this complex process smoothly.

In most cases, a beneficiary cannot revoke an irrevocable trust. However, under specific circumstances, such as the Nevada Consent to Revocation of Trust by Beneficiary, a beneficiary may have some options. It's essential to consult legal experts who can help you understand your rights and the process involved. Understanding these nuances can be crucial for managing your estate effectively.

Revoking a trust can be straightforward, especially when all beneficiaries agree. In Nevada, the Consent to Revocation of Trust by Beneficiary provides a clear path for this action. However, complexities may arise depending on the trust's terms and the beneficiary's relationship with other parties. Using resources like US Legal Forms can simplify the revocation process, offering you the guidance needed.

A beneficiary can terminate a trust by obtaining the consent of all parties involved, including the trustee and other beneficiaries. In Nevada, the process may involve formal documentation that states the intent to revoke the trust. Utilizing tools like the Nevada Consent to Revocation of Trust by Beneficiary ensures clarity and adherence to legal standards. Platforms such as US Legal Forms can assist in drafting the necessary paperwork for this process.

Setting up a trust can come with various pitfalls, including the complexity of legal requirements and potential costs. Misunderstanding the rules governing the trust can lead to incorrect distributions and beneficiary disputes. Additionally, failing to properly fund the trust will render it ineffective. Utilizing resources like the Nevada Consent to Revocation of Trust by Beneficiary can help prevent these common missteps.

Parents in the UK often overlook the importance of flexibility in their trust fund setup. A rigid approach can hinder their ability to adapt to changing family situations or financial needs. They may also neglect to consider tax implications, which can cause unexpected costs. Understanding how the Nevada Consent to Revocation of Trust by Beneficiary applies can highlight critical lessons in flexibility that parents can learn from across borders.

Terminating a trust in Nevada requires specific actions including notifying all beneficiaries. A written document outlining the termination, signed by the trustee, is necessary to finalize this process. Once the trust is terminated, assets can be distributed according to the trust's terms. Familiarizing yourself with the Nevada Consent to Revocation of Trust by Beneficiary can simplify this termination process.