Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you need to fill out, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Leverage the site's straightforward and efficient search function to locate the documents you seek. Various templates for business and personal applications are categorized by type and recommendations, or keywords.

Use US Legal Forms to obtain the Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate in just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to every form you've obtained in your account. Check the My documents section to select a form to print or download again.

Complete and download, and print the Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with US Legal Forms. There are numerous professional and state-specific forms available for your personal or business needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Buy button to acquire the Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you've selected the form for your appropriate city/state.

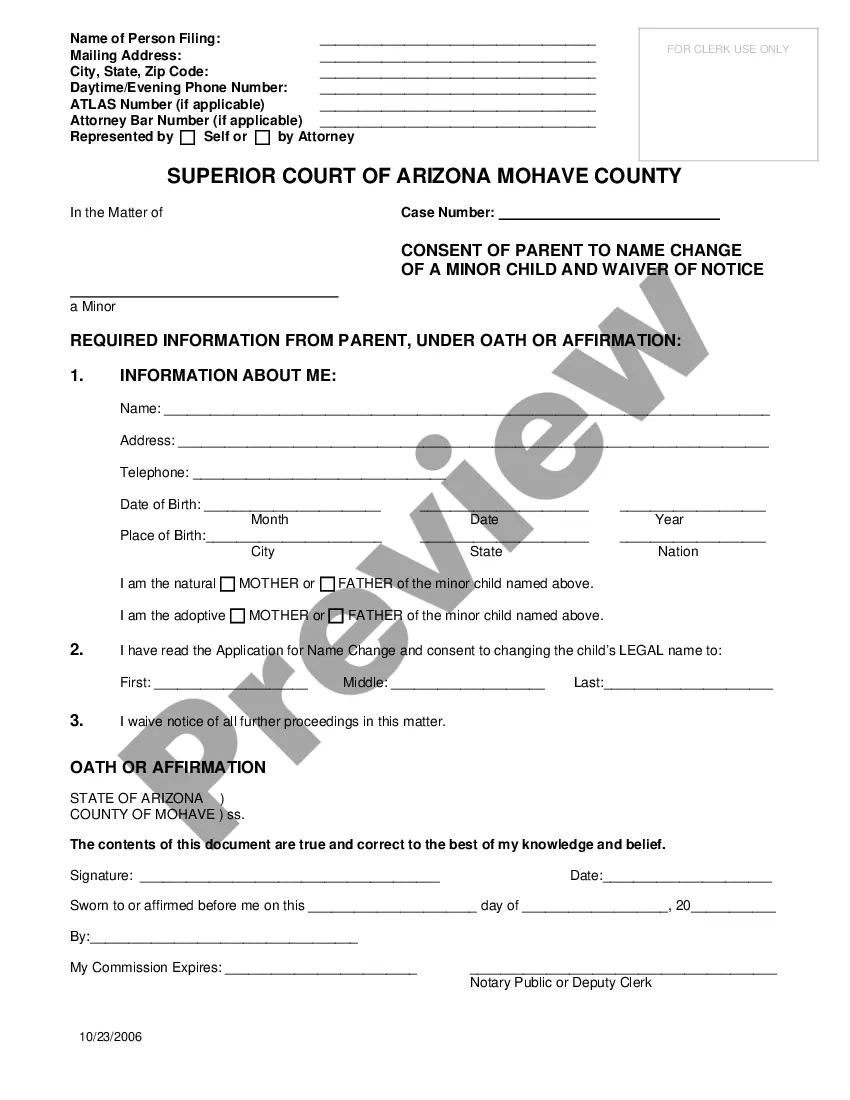

- Step 2. Use the Preview option to review the contents of the form. Don't forget to check the summary.

- Step 3. If you're not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Form popularity

FAQ

Nexus requirements refer to the criteria that establish a business's tax presence in a state. For those with a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it is critical to meet both physical and economic nexus guidelines to avoid unexpected tax liabilities. Consulting a tax advisor ensures you understand and meet all Nexus requirements specific to your operations.

The Nevada gross receipts tax rate varies by industry but generally ranges from 0.051% to 0.331%. Businesses engaging in a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate should promptly check industry classifications to determine applicable rates accurately. Keeping up to date on these rates is important for budgeting and compliance.

In Nevada, Nexus rules can be established through physical presence, such as employees or inventory in the state. Additionally, economic nexus may apply if your business exceeds certain sales thresholds. Understanding the specific Nexus rules related to a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate is crucial for your business strategy.

Nexus rules determine whether a business has a sufficient connection to a state to be subject to its tax laws. In the context of a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, establishing nexus can affect tax obligations and reporting requirements. It's vital to understand these rules to ensure compliance and avoid potential fines.

Several items are considered non-taxable in Nevada, including certain food items, prescription drugs, and medical devices. Identifying these non-taxable items is important for businesses involved in leasing retail space, especially if operating under a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, as it may influence your overall tax strategy.

The threshold for triggering a commerce tax return in Nevada is an annual gross revenue of $4 million. Businesses exceeding this amount must file a commerce tax return, which may affect your Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Understanding this threshold is essential for financial planning and maintaining compliance.

Yes, in general, rentals are subject to sales tax in Nevada. This includes rentals of tangible personal property and certain services. If your leasing arrangements involve a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it's wise to consult with a tax professional to ensure compliance with sales tax regulations.

The percentage breakpoint is the sales figure at which the additional rent starts being applied in a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. It is calculated by dividing the base rent by the agreed-upon percentage. This breakpoint motivates tenants to increase sales, as they will only owe additional rent after surpassing this threshold. Understanding this concept can lead to more informed financial decisions for both landlords and tenants.

Calculating the lease percentage involves a few straightforward steps in a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. First, determine your total sales amount at the end of the agreed period. Next, divide the additional rent amount by your total sales, and then multiply by 100 to get the percentage. This calculation not only clarifies the financial relationship but also empowers tenants to track their performance against the lease terms.

To calculate the break-even point for percentage rent in a Nevada Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you need to know the fixed base rent and the percentage rent. Divide the base rent by the rent percentage to find the sales figure at which total rent equals the base amount. This calculation helps both landlords and tenants understand when additional rent applies and plan their finances accordingly.