Iowa Checklist - Sale of a Business

Description

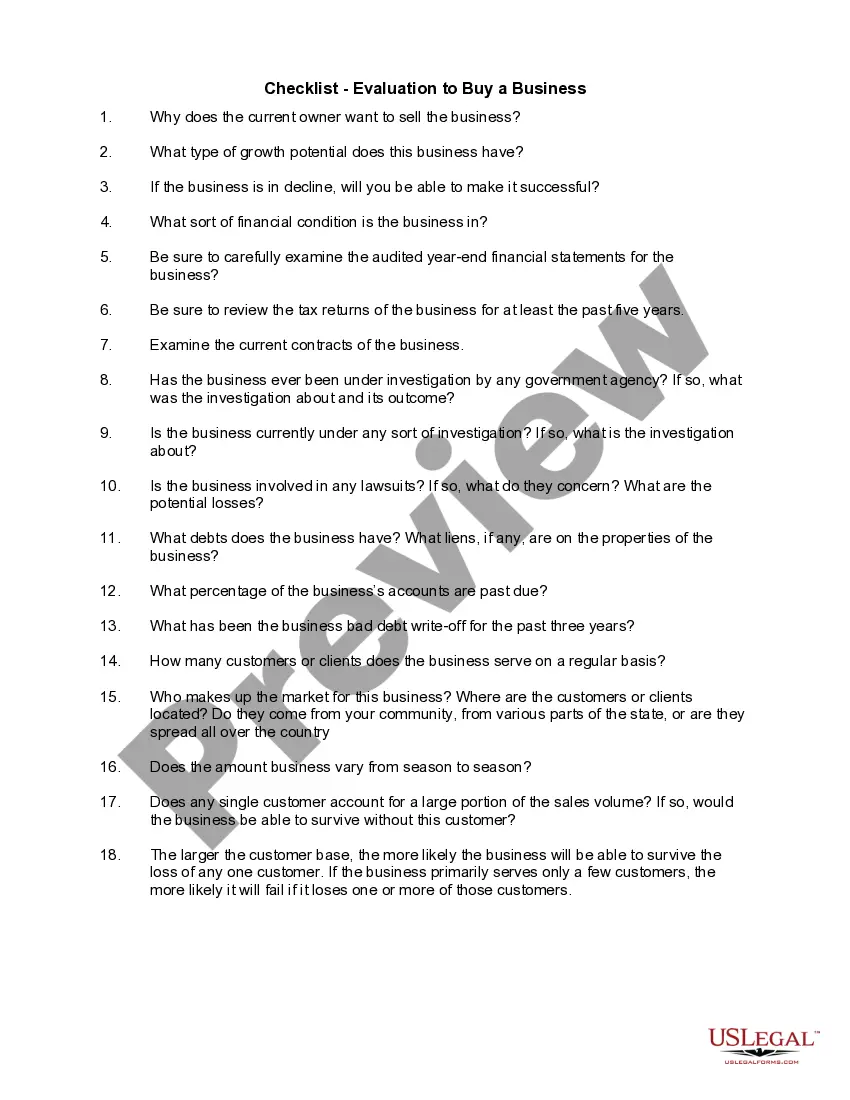

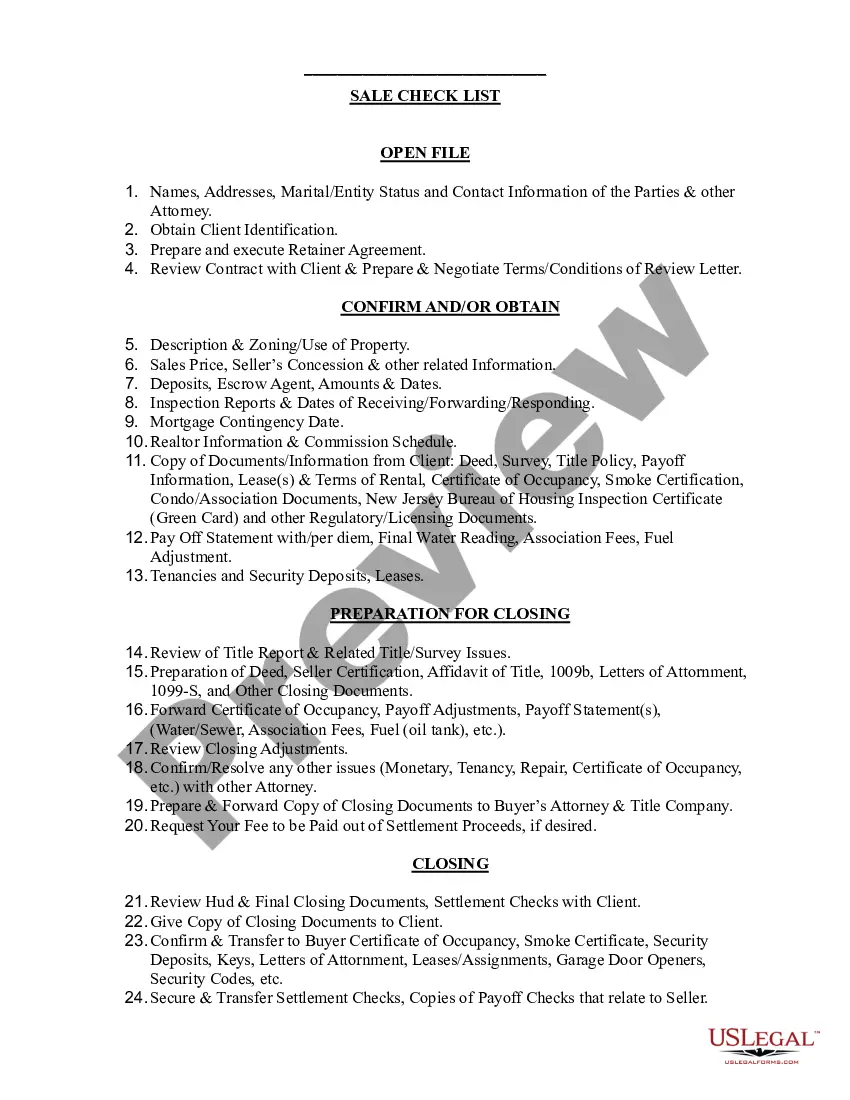

How to fill out Checklist - Sale Of A Business?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the most current versions of forms such as the Iowa Checklist - Sale of a Business within minutes.

Check the form description to ensure you have chosen the right form.

If the form does not fit your requirements, use the Search field at the top of the page to find one that does.

- If you have a subscription, Log In to download the Iowa Checklist - Sale of a Business from your US Legal Forms library.

- The Download button will appear for each form you view.

- You have access to all previously downloaded forms from the My documents section of your account.

- To utilize US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to examine the form's details.

Form popularity

FAQ

Yes, Iowa requires a seller's permit for any business engaged in taxable sales. This permit helps ensure compliance with state tax regulations. When using the Iowa Checklist - Sale of a Business, obtaining the appropriate seller's permit becomes a vital step in the process. Be sure to check the specific requirements based on your business type to stay compliant.

Most retail businesses will only need a sales tax permit. Professional services and food businesses, restaurants, grocery stores, and bars all need special permits and licenses to conduct business. Any business having employees will need an Employer Identification Number and an Iowa withholding registration.

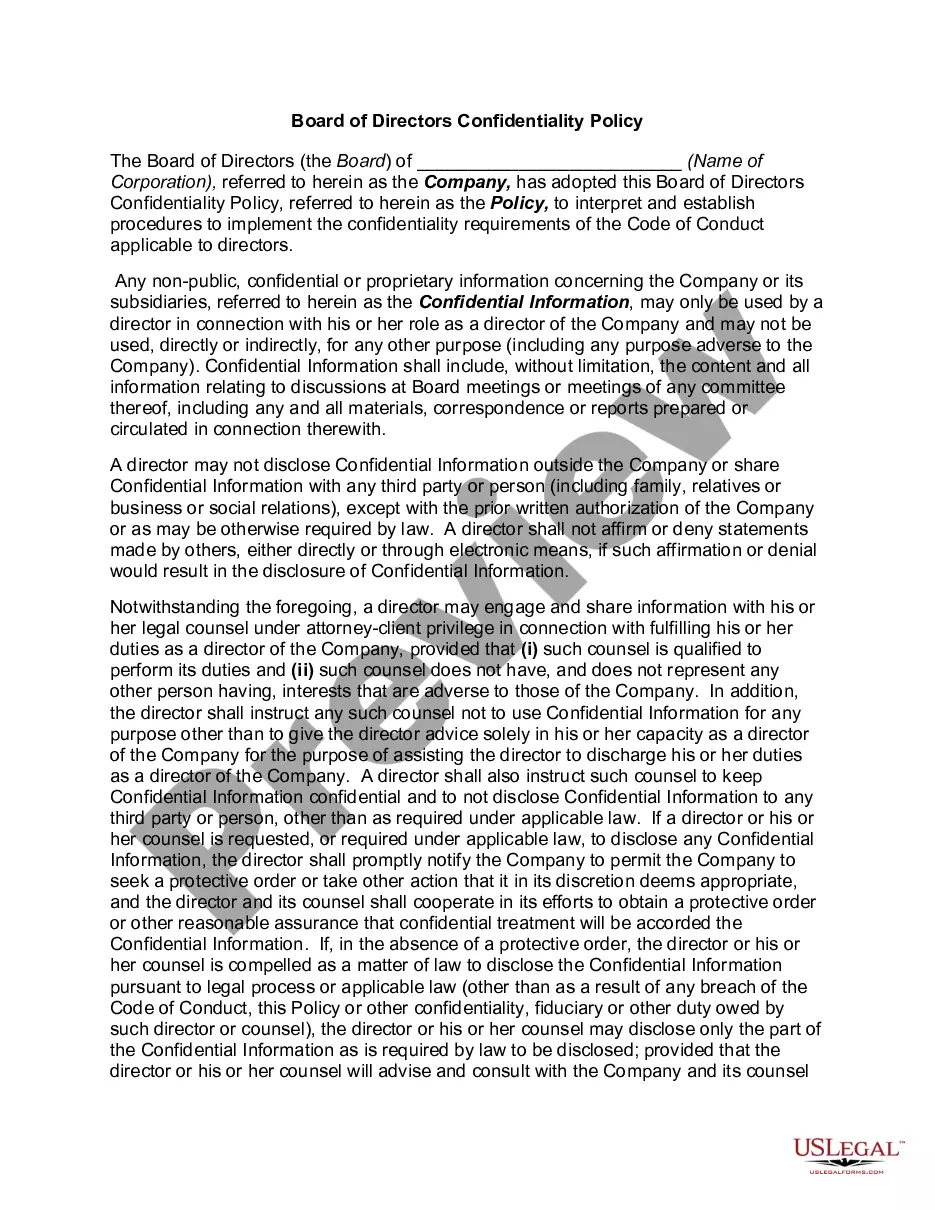

Legal documentsClient contracts and trading agreements evidence of your business agreements with clients and other parties.Employee contracts and agreements evidence of contracts between you and your staff.Franchise agreement (where applicable) evidence of your franchise agreement.More items...?

Most business organizations that transact business in the state of Iowa are also required to maintain a registered office.

How to Sell a Small Business in 7 StepsDetermine the value of your company.Clean up your small business financials.Prepare your exit strategy in advance.Boost your sales.Find a business broker.Pre-qualify your buyers.Get business contracts in order.

Selling your business: major documents to have on-handFederal tax returns for the past three years (corporate or Schedule C)Income statements for YTD and the past three years.Balance sheets for the past three years.Statement of seller's discretionary earnings for most recently completed year.More items...?

Cost to Form an LLC in Iowa. The cost to start an Iowa limited liability company (LLC) is $50. This fee is paid to the Iowa Secretary of State when filing the LLC's Certificate of Organization.

To do so in Iowa, you must register your fictitious name with the Iowa Secretary of State. You may register online, or by postal mail by filing a Fictitious Name Resolution. The filing fee is $5.

The cost to start an LLC in Iowa is $50 to file the Certificate of Organization with the Iowa Secretary of State.

How to Form a Corporation in IowaChoose a Corporate Name.Prepare and File Articles of Incorporation.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Initial Directors and Hold a Board Meeting.Comply With Iowa Biennial Report Requirements.Comply With Other Tax and Regulatory Requirements.More items...