Nevada Letter to Other Entities Notifying Them of Death

Description

How to fill out Letter To Other Entities Notifying Them Of Death?

US Legal Forms - one of the greatest libraries of lawful varieties in the United States - delivers a variety of lawful document layouts you can download or printing. Making use of the website, you can find thousands of varieties for company and personal reasons, categorized by types, states, or keywords.You can get the latest models of varieties like the Nevada Letter to Other Entities Notifying Them of Death within minutes.

If you already have a monthly subscription, log in and download Nevada Letter to Other Entities Notifying Them of Death from the US Legal Forms collection. The Download key will appear on every single develop you see. You gain access to all earlier downloaded varieties within the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed here are basic recommendations to help you started:

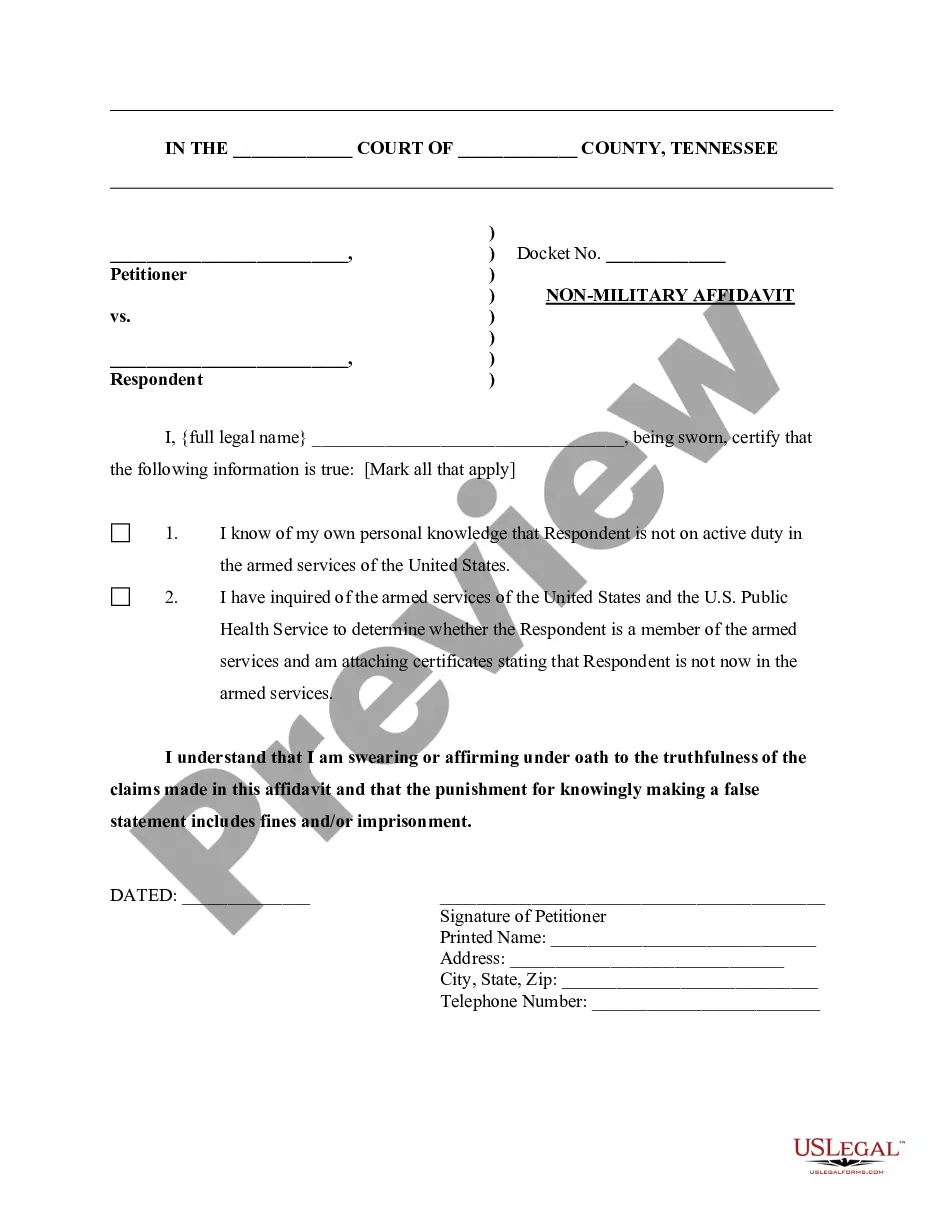

- Ensure you have picked the best develop for your area/region. Click on the Review key to examine the form`s information. See the develop explanation to ensure that you have selected the right develop.

- When the develop does not match your demands, use the Lookup discipline at the top of the screen to find the one which does.

- Should you be satisfied with the shape, validate your selection by clicking on the Acquire now key. Then, choose the pricing program you favor and give your accreditations to register for an profile.

- Approach the deal. Make use of your bank card or PayPal profile to accomplish the deal.

- Find the formatting and download the shape in your product.

- Make adjustments. Fill up, revise and printing and signal the downloaded Nevada Letter to Other Entities Notifying Them of Death.

Each and every web template you added to your account does not have an expiry date which is the one you have eternally. So, if you would like download or printing one more backup, just visit the My Forms segment and then click about the develop you will need.

Gain access to the Nevada Letter to Other Entities Notifying Them of Death with US Legal Forms, one of the most substantial collection of lawful document layouts. Use thousands of specialist and state-particular layouts that meet up with your small business or personal requirements and demands.

Form popularity

FAQ

The basic information usually included in a death notice is: Date and location of death. Cause of death (optional) Names of surviving family members (optional) Details of the funeral service (public or private); if public, date, time, and location of service.

Example Letter #2 Our family is deeply saddened to inform you that Grandmother passed away in her sleep Wednesday night. As many of you know, she has been suffering from kidney failure for some time now. We are relieved that her passing was peaceful and painless.

A death notification or, in military contexts, a casualty notification is the delivery of the news of a death to another person. Death notification telegram, 1944. There are many roles that contribute to the death notification process. The notifier is the person who delivers the death notice.

The Death Notification Service is a free, online service that allows you to notify member organisations of the death of a family member, friend or other acquaintance.

A death notice is a brief statement announcing someone's death. In just a few sentences, the notice explains need-to-know details about the death, along with information regarding memorial or funeral services to be held.