An irrevocable trust established to qualify contributions for the annual federal gift tax exclusion for gifts of a present interest. The trust is named Crummey because of a case involving a family named Crummey. The trust contains Crummey Powers, enabling a beneficiary to withdraw assets contributed to the trust for a limited period of time.

Nevada Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement

Description

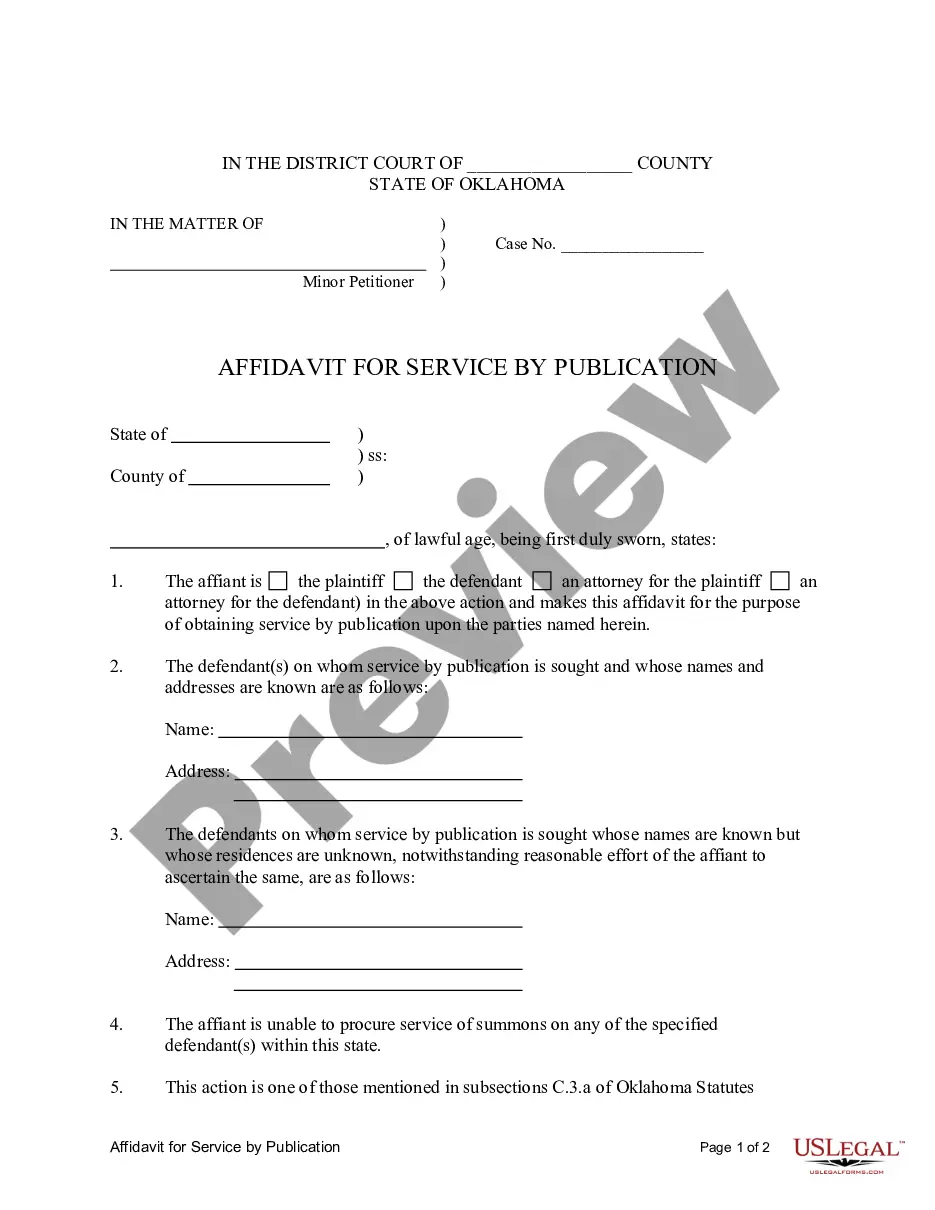

How to fill out Sprinkling Trust For Children During Grantor's Life, And For Surviving Spouse And Children After Grantor's Death - Crummey Trust Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you will obtain thousands of forms for business and personal applications, organized by categories, states, or keywords.

You can find the latest document templates such as the Nevada Sprinkling Trust for Minors During the Grantor's Lifetime, and for Surviving Spouse and Minors after the Grantor's Passing - Crummey Trust Agreement within moments.

Review the Review button to verify the content of the form. Check the description to confirm you have chosen the correct one.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you currently hold a monthly subscription, Log In to access and download the Nevada Sprinkling Trust for Minors During the Grantor's Lifetime, and for Surviving Spouse and Minors after the Grantor's Passing - Crummey Trust Agreement from the US Legal Forms library.

- The Obtain button appears on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to assist you in getting started.

- Ensure you have selected the appropriate form for your locality/county.

Form popularity

FAQ

One significant disadvantage of a Crummey Trust is the potential for miscommunication regarding beneficiaries' rights. If beneficiaries do not understand their withdrawal options, this could create tension between family members. Moreover, because withdrawal powers can lead to liquidity issues, careful planning and management are essential.

If Crummey letters are not sent, the contributions to the trust may fail to qualify for annual gift tax exclusions. This oversight can lead to unwanted tax liabilities for the grantor, diminishing the advantages of establishing the trust. Ensuring that Crummey letters are dispatched is a critical step for maintaining the intended tax benefits of a Nevada Sprinkling Trust for Children.

Crummey letters should ideally be sent promptly following each contribution to the trust. The IRS expects beneficiaries to have a reasonable time to exercise their withdrawal right, typically within 30 to 45 days. Adhering to this timeframe safeguards the tax benefits associated with a Nevada Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement.

Failure to send a Crummey letter can result in substantial tax consequences for the grantor. Without this notification, contributions may not qualify for the annual gift tax exclusion, potentially leading to taxable gifts. Therefore, it is crucial to send timely Crummey letters whenever establishing a Nevada Sprinkling Trust for Children During Grantor's Life or for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement.

Crummey letters are essential for establishing the gift tax exclusion when creating a Nevada Sprinkling Trust for Children During Grantor's Life and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement. They notify beneficiaries about their right to withdraw contributions made to the trust. This notification helps ensure that the trust's assets qualify for the annual gift tax exclusion, thus maximizing tax benefits for the grantor.

One downside of a Crummey trust is the potential for misunderstanding among beneficiaries regarding their withdrawal rights. This confusion can lead to disputes and dissatisfaction. Additionally, if the contributions exceed the annual gift tax exclusion, tax liabilities may arise. However, when structured correctly, a Nevada Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement can minimize these issues and provide significant advantages.

A sprinkling trust allows the trustee to allocate distributions among beneficiaries based on their individual needs. This flexibility ensures that funds can be directed towards education, health care, and other essential expenses. Such a structure is particularly beneficial in a Nevada Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, as it helps to manage assets effectively according to the circumstances.

Trust funds can sometimes create a dependency on inheriting wealth rather than promoting independence. Beneficiaries may lack life skills if they rely solely on fund distributions. Furthermore, the costs associated with establishing and maintaining a trust can be significant. Considering a Nevada Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement may alleviate some of these concerns while providing applicable benefits.

A bypass trust can complicate the estate planning process. It may lead to higher administration costs and could limit access to funds for beneficiaries. Additionally, without careful planning, the benefits intended for children during the grantor's life and for surviving spouses after the grantor's death might not be fully realized. Utilizing a Nevada Sprinkling Trust can mitigate some of these drawbacks while offering greater flexibility.

Bloodline trusts can limit flexibility in managing assets. Beneficiaries often find that they have little say in how the trust is operated, which may lead to dissatisfaction. Additionally, if the bloodline trust is not well-structured, it might not provide the benefits intended for children during the grantor's life or for surviving spouses after the grantor's death. You may want to consider a Nevada Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement for more comprehensive benefits.