Nevada Financial Statement Form - Universal Use

Description

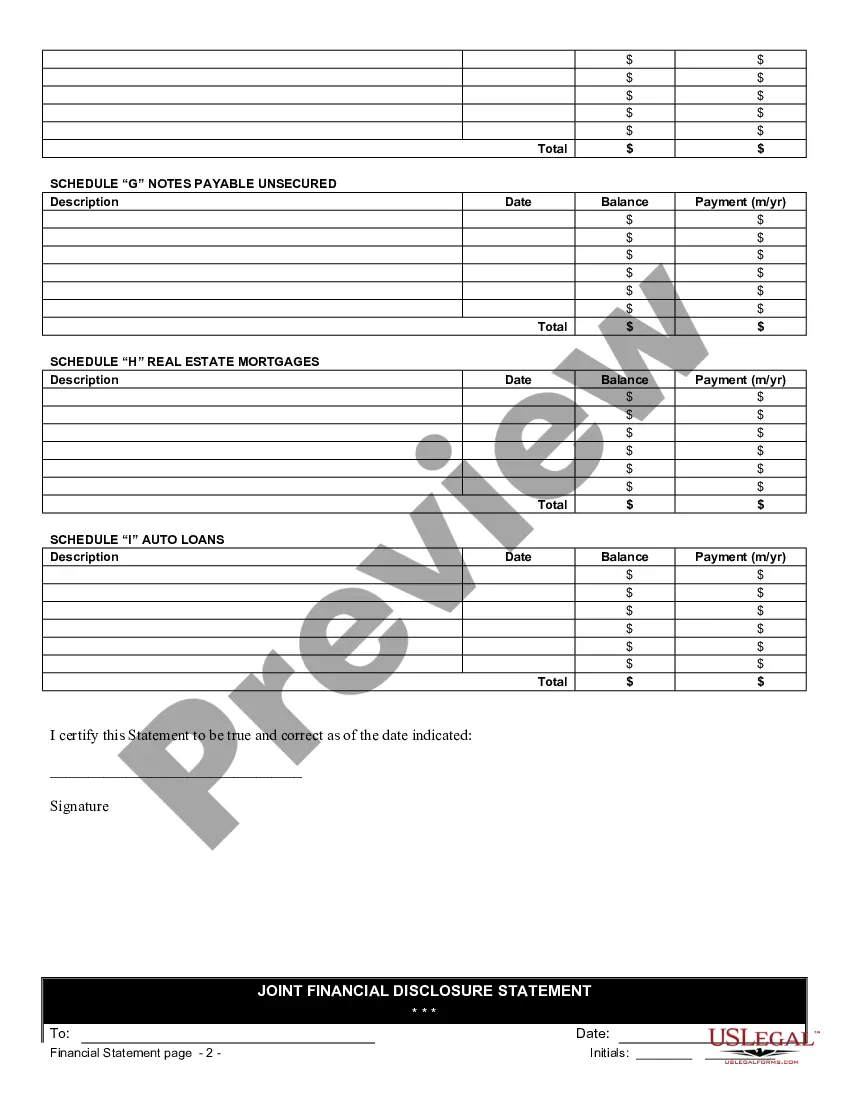

How to fill out Financial Statement Form - Universal Use?

Finding the appropriate legal document template can be a challenge.

Clearly, there are numerous templates accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple tips to follow: First, ensure you have selected the correct form for your region/county. You can review the form using the Preview button and check the form description to confirm it is suitable for you.

- This service provides thousands of templates, including the Nevada Financial Statement Form - Universal Use, which can be utilized for business and personal purposes.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Nevada Financial Statement Form - Universal Use.

- Use your account to search for the legal forms you may have previously ordered.

- Visit the My documents tab of your account and download another copy of the document you need.

Form popularity

FAQ

Filling out a UCC-1 form involves several steps, starting with entering your information as the secured party, followed by details of the debtor. You should clearly describe the collateral being secured to protect your interests. The Nevada Financial Statement Form - Universal Use simplifies this process, guiding you through each step ensuring that your filings are accurate and meet state requirements.

In Nevada, the consumer use tax applies to purchases made outside the state that will be used or consumed in Nevada. The tax rate is generally aligned with the state's sales tax rate, and it is essential for residents to be aware of this when budgeting for personal purchases. Utilizing the Nevada Financial Statement Form - Universal Use can help you keep track of any applicable use tax liabilities.

The Uniform Commercial Code financing statement form is a legal document utilized to secure interests in personal property. It plays a crucial role in establishing a creditor’s claim against a debtor's assets. By completing the Nevada Financial Statement Form - Universal Use, you can easily file and record your financing statements with state authorities, ensuring your security interests are protected.

A Nevada sales tax permit allows businesses to collect sales tax on taxable goods and services sold in the state. It is essential for compliance and to avoid penalties for non-collection. Using the Nevada Financial Statement Form - Universal Use can aid businesses in organizing their sales transactions, helping to ensure that all responsibilities regarding sales tax are fulfilled.

You can file the Nevada modified business tax online through the Nevada Department of Taxation’s website. Alternatively, you can submit paper forms by mail to the designated tax office. The Nevada Financial Statement Form - Universal Use can simplify your filing process by giving you a clear structure for your financial data, improving your accuracy and compliance.

To close your modified business tax (MBT) account in Nevada, you must first ensure that all filings and payments are up to date. You can then submit a written request to the Nevada Department of Taxation for account closure. Employing the Nevada Financial Statement Form - Universal Use can facilitate accurate reporting, making the closure process smoother and more efficient.

The transient tax in Nevada is a tax imposed on businesses that provide accommodations, such as hotels and motels, to visitors. It is designed to generate revenue for local governments and services. Utilizing the Nevada Financial Statement Form - Universal Use will help businesses detail their earnings properly, ensuring timely compliance with transient tax regulations.

The Nevada modified business tax is used to fund various state programs, including education and public safety. It applies to businesses based on their gross payroll. By understanding and maintaining accurate financial records with tools like the Nevada Financial Statement Form - Universal Use, businesses can better manage tax obligations and reporting requirements.

Filing a Nevada state tax return depends on your income and business activities. Generally, Nevada does not have a personal income tax, but if you earn income from a corporation, you may need to submit a tax return. Additionally, using the Nevada Financial Statement Form - Universal Use can help streamline your reporting process and ensure compliance with state regulations.

No, sales and use tax differs significantly from property tax. Sales and use tax are transaction-based taxes applied during purchases, whereas property tax is assessed on real estate ownership. To manage both types of taxes effectively, you can rely on the Nevada Financial Statement Form - Universal Use for clear documentation.