Nevada Bill of Sale of Mobile Home with or without Existing Lien

Description

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

Have you ever found yourself in a situation where you need documents for either business or personal purposes almost daily.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms provides a vast array of form templates, including the Nevada Bill of Sale for Mobile Home with or without Existing Lien, designed to comply with state and federal regulations.

Once you find the correct form, click on Get now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nevada Bill of Sale for Mobile Home with or without Existing Lien template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/region.

- Use the Review button to view the document.

- Check the details to confirm you've selected the correct form.

- If the form isn't what you need, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

A mobile home can be classified as real property in Nevada if it is permanently affixed to land and meets certain conditions set by local laws. This classification ensures that the mobile home enjoys the same protections and rights as traditional homes. When selling, having a Nevada Bill of Sale of Mobile Home with or without Existing Lien is crucial for a smooth transaction. By understanding this classification, buyers and sellers can make informed decisions about ownership.

A mobile home is typically categorized as a manufactured home, which is built in a factory and transported to its location. Depending on its permanent setup, it can either be classified as personal property or real property in Nevada. If you want to sell or transfer ownership, the proper documentation, like the Nevada Bill of Sale of Mobile Home with or without Existing Lien, is essential. This classification can affect taxes, financing, and your rights as an owner.

To convert a mobile home to real property in Nevada, you must follow a series of steps, including affixing the home to a permanent foundation. Additionally, you should obtain a certificate from the local authority confirming the conversion. Once this is completed, you may then execute a Nevada Bill of Sale of Mobile Home with or without Existing Lien, which provides legal documentation for the transaction. This process can simplify matters when selling or financing the property.

In Nevada, real property typically includes land and anything permanently attached to it, such as buildings or fixtures. A mobile home may be classified as real property if it meets specific requirements, such as being permanently affixed to the land. This classification is important for transactions, especially when using a Nevada Bill of Sale of Mobile Home with or without Existing Lien. Understanding these distinctions can help you navigate property laws more effectively.

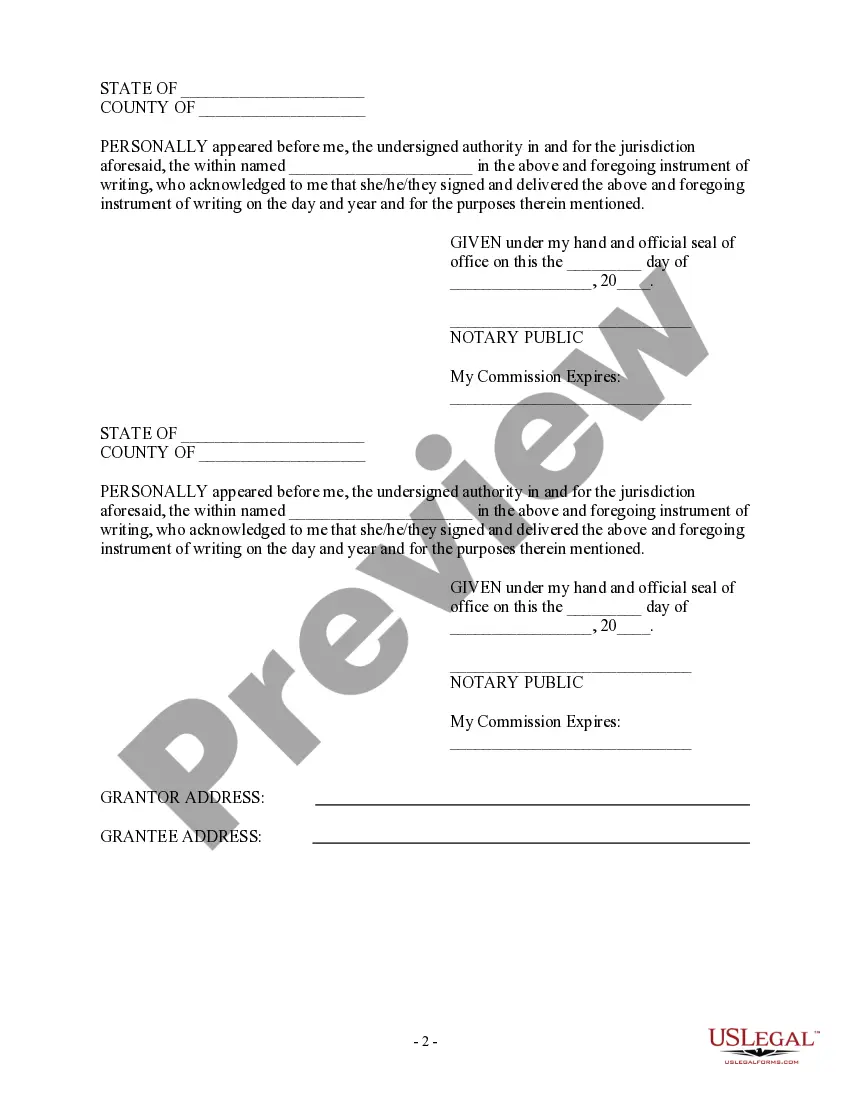

When writing a Nevada bill of sale, use a clear format to avoid confusion. Start with the date, then list both parties’ names and addresses. Next, describe the mobile home including the VIN and any existing liens. A sample document can further clarify how to fill out all sections accurately, making it a practical choice for those creating a Nevada Bill of Sale of Mobile Home with or without Existing Lien.

To write out a bill of sale for a mobile home in Nevada, start with the date of the transaction. Include the names and addresses of both the buyer and seller, and provide a detailed description of the mobile home including make, model, and VIN. Ensure you clearly state any existing lien and include spaces for signatures to validate the agreement. This will create a comprehensive Nevada Bill of Sale of Mobile Home with or without Existing Lien.

Transferring your mobile home to real property involves a few crucial steps. First, you need to attach the mobile home to land with the appropriate foundation. Then, file the Nevada Bill of Sale of Mobile Home with or without Existing Lien to begin the legal process of conversion. This ensures that your mobile home is legally recognized as real property.

To convert your mobile home into real property in Nevada, start by consulting with local authorities about permit requirements. Next, have your mobile home permanently affixed to a foundation. After you complete these steps, file the Nevada Bill of Sale of Mobile Home with or without Existing Lien to ensure that your property is properly classified.

Yes, you can convert a mobile home into a real house in Nevada. This conversion involves permanently attaching the mobile home to a foundation and obtaining the necessary permits. Once you complete the process, you will need to submit the Nevada Bill of Sale of Mobile Home with or without Existing Lien to finalize the transition to real property.

In Nevada, a mobile home can be classified as real property if it is permanently affixed to land. When this occurs, you must file the Nevada Bill of Sale of Mobile Home with or without Existing Lien to officially convert the title. It's essential to understand this distinction, as it affects property taxes and legal rights.