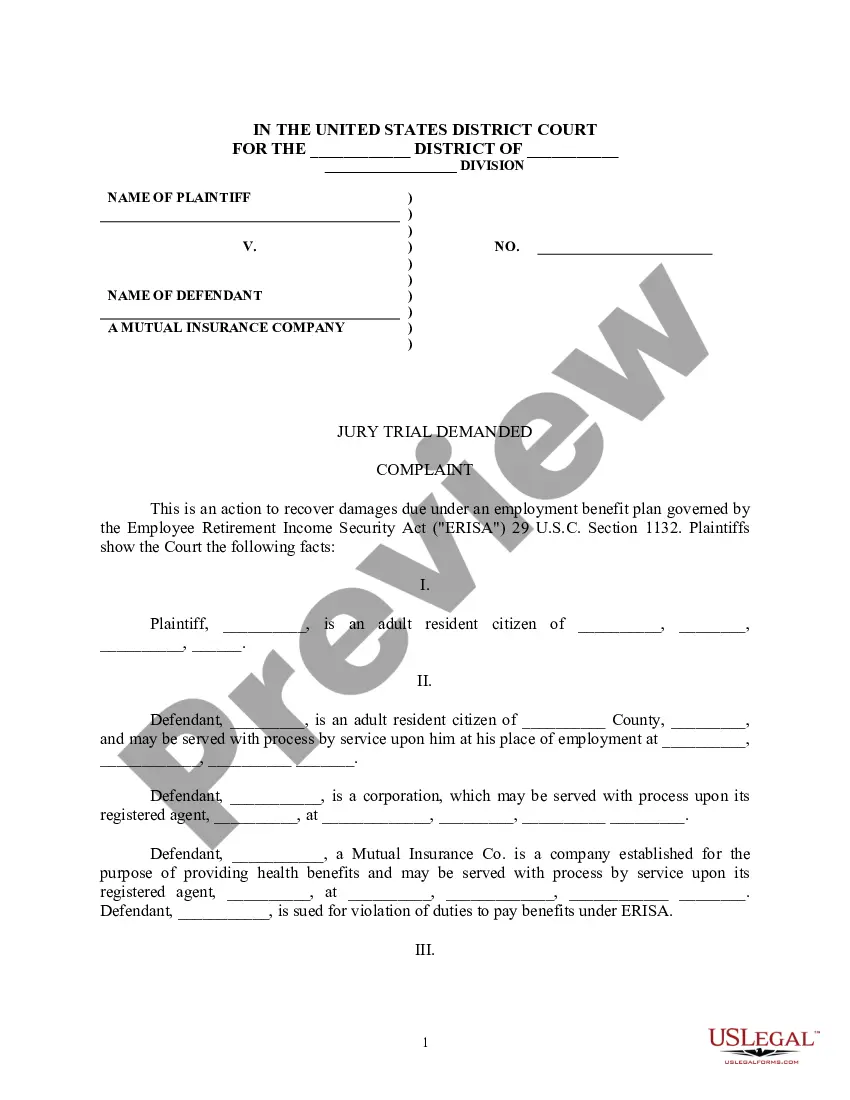

This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Nevada Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

US Legal Forms - one of several largest libraries of lawful forms in the USA - delivers a variety of lawful document layouts you are able to acquire or printing. While using site, you may get 1000s of forms for company and individual reasons, sorted by groups, suggests, or key phrases.You can get the newest versions of forms just like the Nevada Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand in seconds.

If you currently have a registration, log in and acquire Nevada Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand in the US Legal Forms collection. The Obtain option can look on every develop you see. You have accessibility to all in the past acquired forms from the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, here are easy guidelines to help you began:

- Be sure to have selected the right develop for the area/area. Select the Review option to examine the form`s information. Look at the develop explanation to actually have selected the correct develop.

- In case the develop does not match your requirements, utilize the Look for industry towards the top of the display to get the the one that does.

- In case you are pleased with the shape, validate your option by visiting the Buy now option. Then, select the prices plan you prefer and provide your accreditations to register for the bank account.

- Approach the transaction. Use your credit card or PayPal bank account to finish the transaction.

- Pick the format and acquire the shape in your gadget.

- Make modifications. Load, change and printing and indication the acquired Nevada Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

Each and every template you added to your account lacks an expiry time and is also your own property eternally. So, if you want to acquire or printing yet another copy, just check out the My Forms section and then click on the develop you will need.

Obtain access to the Nevada Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand with US Legal Forms, the most comprehensive collection of lawful document layouts. Use 1000s of professional and express-distinct layouts that fulfill your business or individual needs and requirements.

Form popularity

FAQ

Law 41.141 in Nevada pertains to the obligations of insurers regarding the payment of benefits and the conduct expected from them. This law reinforces the need for insurers to act in good faith and handle claims fairly. If you find yourself facing issues with your insurer, a Nevada Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand may provide a pathway to address grievances and seek appropriate compensation.

An insurer can refuse to pay a claim if the insured fails to abide by the policy provisions because these provisions are legally binding. When policyholders do not comply with the terms they agreed to, insurers have grounds to deny claims. Understanding these provisions is essential, and if you believe your claim was wrongfully denied, consider filing a Nevada Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand to assert your rights.

If an insurer fails to investigate a claim properly, it may result in an unjust denial or delay in benefits. Insurers are legally obligated to conduct thorough investigations, and neglecting this duty can lead to legal repercussions. In such cases, you may want to explore options like a Nevada Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand to address the insurer's shortcomings and protect your rights.

When an insurance company refuses to pay a claim, it is often referred to as a claim denial. This situation can lead to significant frustration, as policyholders expect their claims to be honored. If you encounter this issue, you may consider filing a Nevada Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. This legal action can help you seek justice and recover the benefits you deserve.

If a bad faith claim is filed in Nevada, it must be proven in court. The claimant must show as much proof as they can that the insurer in fact denied coverage without just cause or that they acted recklessly or negligently when conducting the claim process.

A bad faith lawsuit is a civil suit for damages brought by the plaintiff against the defendant because the defendant has breached a legal or contractual duty to act in good faith towards the plaintiff, occasioning their loss.

You need to prove that you have a covered loss under the policy. Finally, you must prove bad faith. To prove bad faith, you document the insurance company's actions in investigating your case. You can use Nevada's rules of civil procedure to conduct formal discovery and gather records from the insurance company.

Insurance bad faith in Nevada is when an insurance company refuses to defend or indemnify a policy holder without a reasonable basis. An insurance policy is a legal contract between you and your liability insurance company. Your insurer has a ?duty to defend? and indemnify you against third party claimants.

Common Law Bad faith is established when an insurer acts unreasonably or negligently and with the knowledge that there is no reasonable basis for its conduct. ing to Nevada law, a bad faith tort claim must be commenced within four years of the adverse action by the insurance company.

Nevada Insurance Claim Timeline In Nevada, insurers have 80 days, or about three months, to settle insurance claims they receive from claimants.