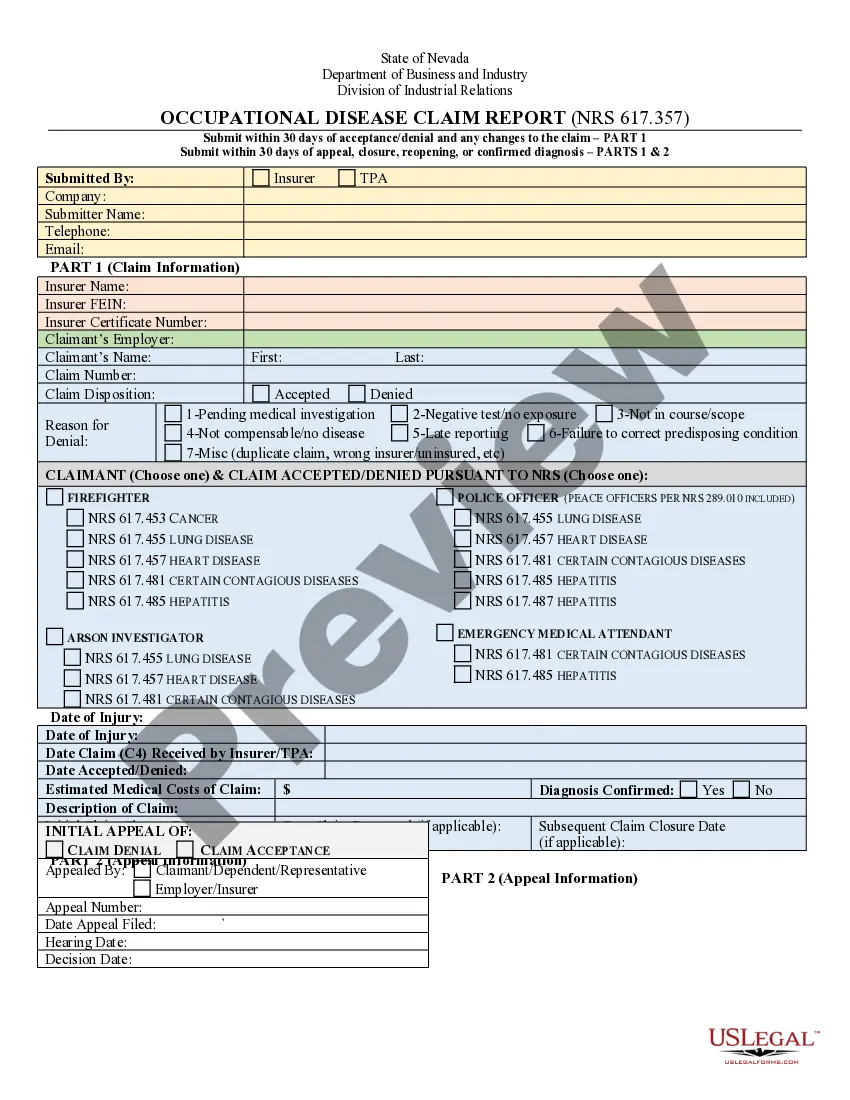

Nevada Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

Are you presently inside a situation in which you will need paperwork for sometimes enterprise or specific reasons just about every working day? There are a lot of legitimate record templates available online, but finding types you can rely on is not straightforward. US Legal Forms offers a large number of develop templates, such as the Nevada Complaint regarding Insurer's Failure to Pay Claim, that are composed to fulfill federal and state needs.

If you are already familiar with US Legal Forms website and have a free account, simply log in. Afterward, it is possible to acquire the Nevada Complaint regarding Insurer's Failure to Pay Claim design.

Unless you provide an accounts and wish to start using US Legal Forms, follow these steps:

- Get the develop you need and ensure it is to the right area/state.

- Utilize the Review key to check the shape.

- Look at the description to ensure that you have chosen the right develop.

- In case the develop is not what you are trying to find, take advantage of the Search industry to discover the develop that fits your needs and needs.

- Whenever you obtain the right develop, simply click Get now.

- Pick the prices program you would like, fill out the required information and facts to create your money, and pay money for your order with your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file formatting and acquire your version.

Get each of the record templates you have bought in the My Forms food list. You can aquire a extra version of Nevada Complaint regarding Insurer's Failure to Pay Claim any time, if possible. Just click the essential develop to acquire or print the record design.

Use US Legal Forms, the most substantial selection of legitimate varieties, to save lots of time as well as stay away from mistakes. The service offers expertly created legitimate record templates which you can use for an array of reasons. Make a free account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

If there is any indication that their policyholder isn't responsible the insurer will deny your claim. Claims may also be denied if there's evidence to show that the policyholder isn't entirely to blame for an accident. In California, anyone who contributes to an accident can be held responsible for resulting injuries.

Third-party bad faith cases typically fall under three categories: Failure to defend. Your insurance company has a duty to provide an adequate defense on your behalf in lawsuit. ... Failure to settle. Your provider has a duty to pay for any damages of which you are found liable in lawsuits. ... Negligent handling of the case.

Internal appeal: If your claim is denied or your health insurance coverage canceled, you have the right to an internal appeal. You may ask your insurance company to conduct a full and fair review of its decision. If the case is urgent, your insurance company must speed up this process.

If your claim has been refused because of a condition or exclusion, you might be able to argue: the insurer was wrong in applying the condition or exclusion. the condition or exclusion did not cause the loss (or only part of it) or the insurer wasn't disadvantaged by it (section 54, Insurance Contracts Act)

Bad Faith Claim Handling/Bad Faith Failure to Settle Within Limits. ing to the Nevada Supreme Court, bad faith is established where the insurer acts unreasonably and with knowledge that there is no reasonable basis for its conduct.

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

DIVISION OF INSURANCE Under the direction of Amy L. Parks, Nevada's Acting Commissioner of Insurance, the Division regulates and licenses insurance agents, brokers, and other professionals; sets ethical and financial standards for insurance companies; and reviews rates.

Nevada Insurance Claim Timeline In Nevada, insurers have 80 days, or about three months, to settle insurance claims they receive from claimants.