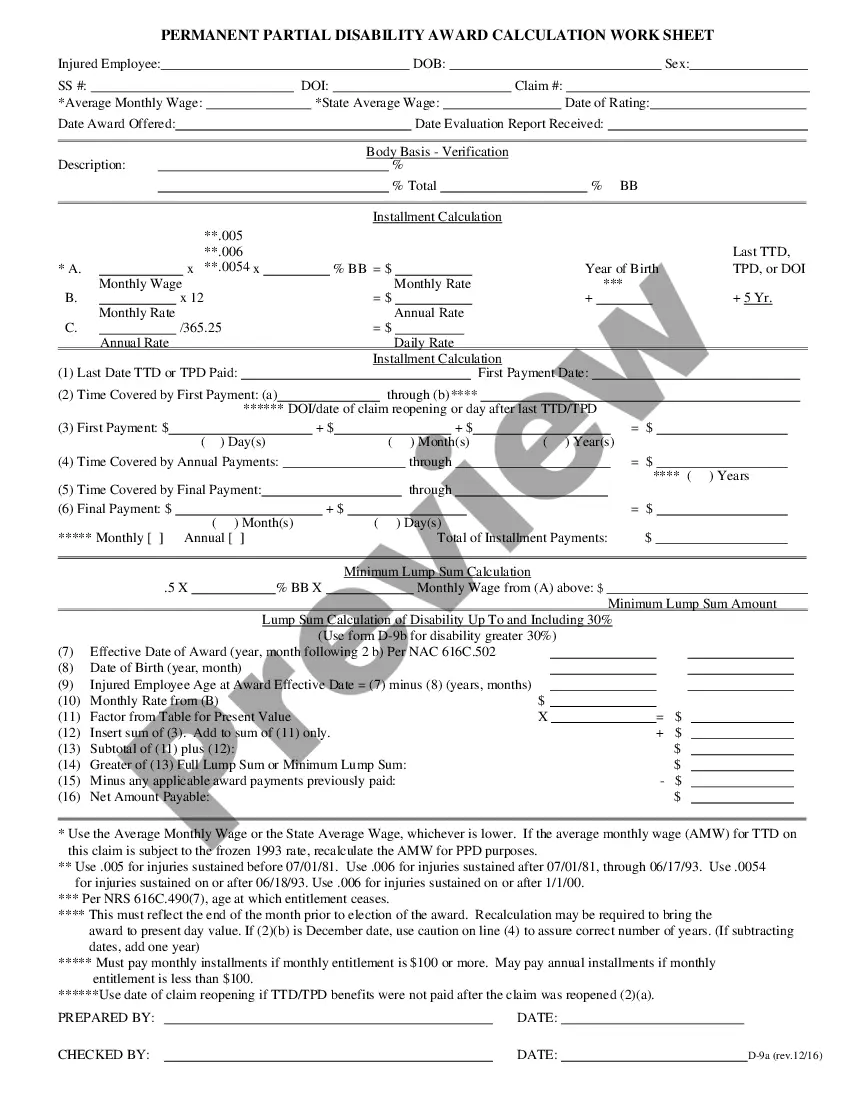

The Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheet 25 Percent is a document used to calculate the amount of permanent partial disability benefits an injured worker is entitled to receive based on the degree of disability. This worksheet is used to calculate an award for a 25% permanent partial disability. It takes into consideration the wages the employee was earning before the injury, the estimated value of the employee's future wages, and the cost of medical care associated with the disability. There are three types of Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheets: 25 Percent, 50 Percent, and 100 Percent. Each worksheet is tailored to the individual circumstances of the employee and the amount of disability.

Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheet 25 Percent

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheet 25 Percent?

How much time and resources do you often spend on drafting official paperwork? There’s a greater option to get such forms than hiring legal experts or spending hours browsing the web for an appropriate template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, like the Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheet 25 Percent.

To acquire and prepare a suitable Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheet 25 Percent template, follow these easy steps:

- Look through the form content to ensure it meets your state laws. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheet 25 Percent. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your Nevada D-9(a) Permanent Partial Disability Award Calculation Worksheet 25 Percent on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

Under Nevada law, lump-sum permanent partial disability (PPD) awards are based off the total installment payments that would have been paid on the award. The lump-sum award is reduced to present value, which is the worth of all installment payments after they are discounted at a specified rate.

What Is Total Permanent Disability? Total permanent disability (TPD) is a condition in which an individual is no longer able to work due to injuries. Total permanent disability, also called permanent total disability, applies to cases in which the individual may never be able to work again.

When your disability check isn't enough to live on, you may have additional options at your disposal. For example, you may qualify for extra help in specific areas such as health care costs, food, and housing. Different federal, state, and local programs may be available.

Method of estimation: DALYs for a specific cause are calculated as the sum of the years of life lost due to premature mortality (YLLs) from that cause and the years of years of healthy life lost due to disability (YLDs) for people living in states of less than good health resulting from the specific cause.

When you reach the level of maximum medical improvement after a workplace injury and nothing more can be done to improve your condition, if you are still partially disabled, a doctor will reevaluate you and assign you a permanent impairment rating (PIR) that ranges from one percent to one hundred percent.

The injured worker's monthly wage as of the date of the injury. 150% of the Nevada state average weekly wage times 4.33.

Most long-term disability insurance policies provide for a benefit of 60 percent of gross wages, so the annual and monthly Gross LTD Benefit figures are simply 60 percent of the Gross Annual Wage and Gross Monthly Wage figures.

The current maximum amount for SSDI payments is $3,345 per month. For SSI payments, by contrast, the maximum monthly amount a disabled individual can receive in 2023 is $914 for an eligible individual, and $1371 for an eligible individual with an eligible spouse.