New Mexico Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool

Description

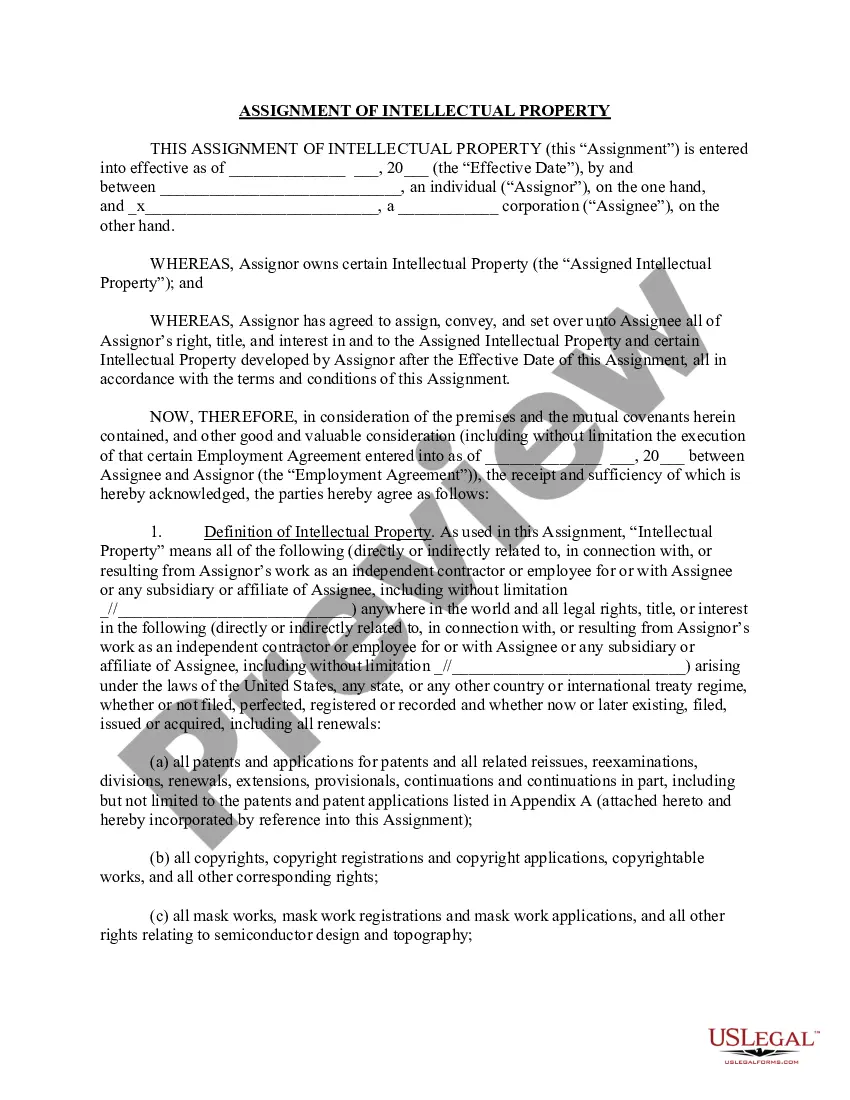

How to fill out Assignment Of Overriding Royalty Interest With Multiple Leases That Are Non Producing With Reservation Of The Right To Pool?

US Legal Forms - one of several most significant libraries of legal types in the States - gives a wide array of legal papers templates you can obtain or print. While using web site, you may get 1000s of types for organization and individual reasons, sorted by types, suggests, or key phrases.You can get the most up-to-date types of types just like the New Mexico Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool within minutes.

If you have a membership, log in and obtain New Mexico Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool from the US Legal Forms collection. The Down load key will appear on each and every kind you perspective. You have access to all in the past acquired types from the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, allow me to share straightforward guidelines to help you began:

- Ensure you have chosen the proper kind to your metropolis/region. Click on the Preview key to review the form`s content. See the kind description to actually have selected the appropriate kind.

- If the kind doesn`t satisfy your demands, take advantage of the Search discipline near the top of the screen to find the one which does.

- Should you be content with the shape, verify your selection by clicking on the Get now key. Then, opt for the costs program you favor and provide your credentials to register on an accounts.

- Procedure the deal. Use your bank card or PayPal accounts to finish the deal.

- Find the structure and obtain the shape on the product.

- Make modifications. Load, revise and print and signal the acquired New Mexico Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool.

Every single template you included with your account does not have an expiry time and is your own forever. So, if you wish to obtain or print one more duplicate, just go to the My Forms portion and click in the kind you need.

Obtain access to the New Mexico Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool with US Legal Forms, by far the most substantial collection of legal papers templates. Use 1000s of professional and state-certain templates that satisfy your business or individual requirements and demands.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well. Overriding Royalty Interest (ORRI) (US) - Westlaw Westlaw ? PracticalLaw Westlaw ? PracticalLaw

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document. Overriding Royalty Interest Explained - Landgate landgate.com ? news ? overriding-royalty-in... landgate.com ? news ? overriding-royalty-in...