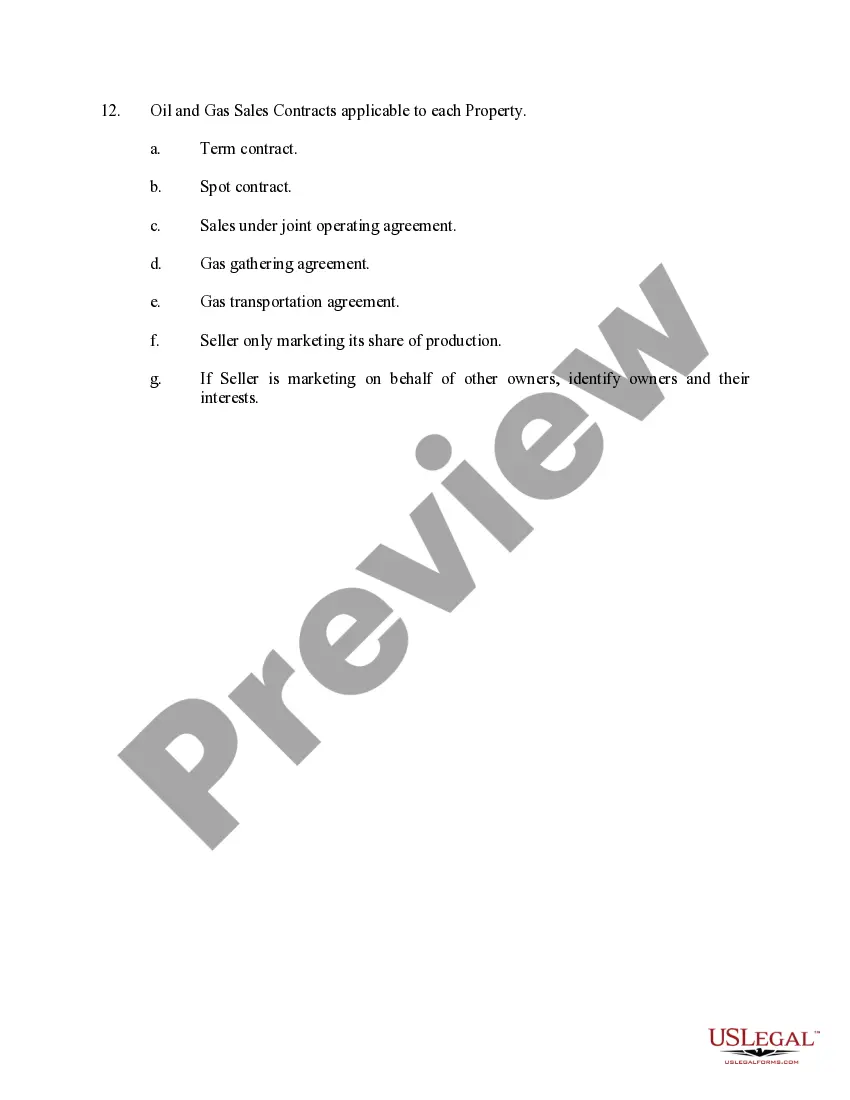

New Mexico Checklist of Information to Obtain For Producing Properties Evaluation

Description

How to fill out Checklist Of Information To Obtain For Producing Properties Evaluation?

US Legal Forms - one of many greatest libraries of lawful types in the United States - delivers a wide range of lawful record themes you are able to down load or produce. Using the site, you may get 1000s of types for organization and personal uses, categorized by types, suggests, or key phrases.You will find the most up-to-date models of types like the New Mexico Checklist of Information to Obtain For Producing Properties Evaluation in seconds.

If you currently have a monthly subscription, log in and down load New Mexico Checklist of Information to Obtain For Producing Properties Evaluation from your US Legal Forms catalogue. The Acquire key will show up on each and every develop you perspective. You have access to all in the past saved types within the My Forms tab of your bank account.

If you want to use US Legal Forms initially, here are simple recommendations to help you get began:

- Be sure to have picked the right develop for your city/county. Select the Preview key to examine the form`s content. Browse the develop explanation to ensure that you have selected the right develop.

- When the develop does not suit your specifications, take advantage of the Look for area towards the top of the display screen to discover the one that does.

- When you are satisfied with the shape, verify your option by clicking on the Acquire now key. Then, choose the rates strategy you like and supply your references to register to have an bank account.

- Process the deal. Use your charge card or PayPal bank account to finish the deal.

- Choose the file format and down load the shape on your system.

- Make alterations. Load, modify and produce and sign the saved New Mexico Checklist of Information to Obtain For Producing Properties Evaluation.

Every single web template you included with your account does not have an expiration time which is yours for a long time. So, if you want to down load or produce another version, just visit the My Forms area and click about the develop you want.

Obtain access to the New Mexico Checklist of Information to Obtain For Producing Properties Evaluation with US Legal Forms, probably the most substantial catalogue of lawful record themes. Use 1000s of expert and status-distinct themes that satisfy your business or personal demands and specifications.

Form popularity

FAQ

All New Mexico seniors at least 65 years old may claim a special exemption. See the instructions for PIT-ADJ.

To record a document such as a deed, mortgage, water rights, lien or other you must: Bring the document in person to the Clerks Office or send by mail: Documents must be original (all required seals and signatures) Notary Information must be complete signature, date, seal, and expiration date is required.

New Mexico Property Tax Rates Tax rates in New Mexico are expressed in terms of mills, which are equal to $1 of tax for $1,000 of taxable value. For example, if your taxable value after exemptions is $40,000 and your mill rate is 20 mills (i.e. $0.020), your taxes owed will be $800.

Property taxes in Mexico vary throughout the country and are calculated yearly depending on the real estate value established by the officials. Residential property tax is typically around 6,5 pesos per 1000 pesos of assessed value. For commercial and rental estates used only seasonally, the rate can be twice as much.

Each person shall have exempt a homestead in a dwelling house and land occupied by the person or in a dwelling house occupied by the person although the dwelling is on land owned by another, provided that the dwelling is owned, leased or being purchased by the person claiming the exemption.

New Mexico retirement taxes Taxpayers age 65 and older can deduct up to $8,000 from their taxable income, and income for residents 100 years and older is completely tax-exempt in New Mexico.