New Mexico Grant Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Grant Writer Agreement - Self-Employed Independent Contractor?

You can dedicate hours online searching for the appropriate legal document template that meets the federal and state requirements you need. US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to download or print the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor from their services. If you already have a US Legal Forms account, you can Log In and click the Obtain button. After that, you can fill out, modify, print, or sign the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor.

Every legal document template you acquire is yours permanently. To get another copy of a purchased form, go to the My documents tab and click the corresponding button. If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, make sure you have selected the correct document template for the area/city of your choice. Review the form description to ensure you have chosen the right form.

Access and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

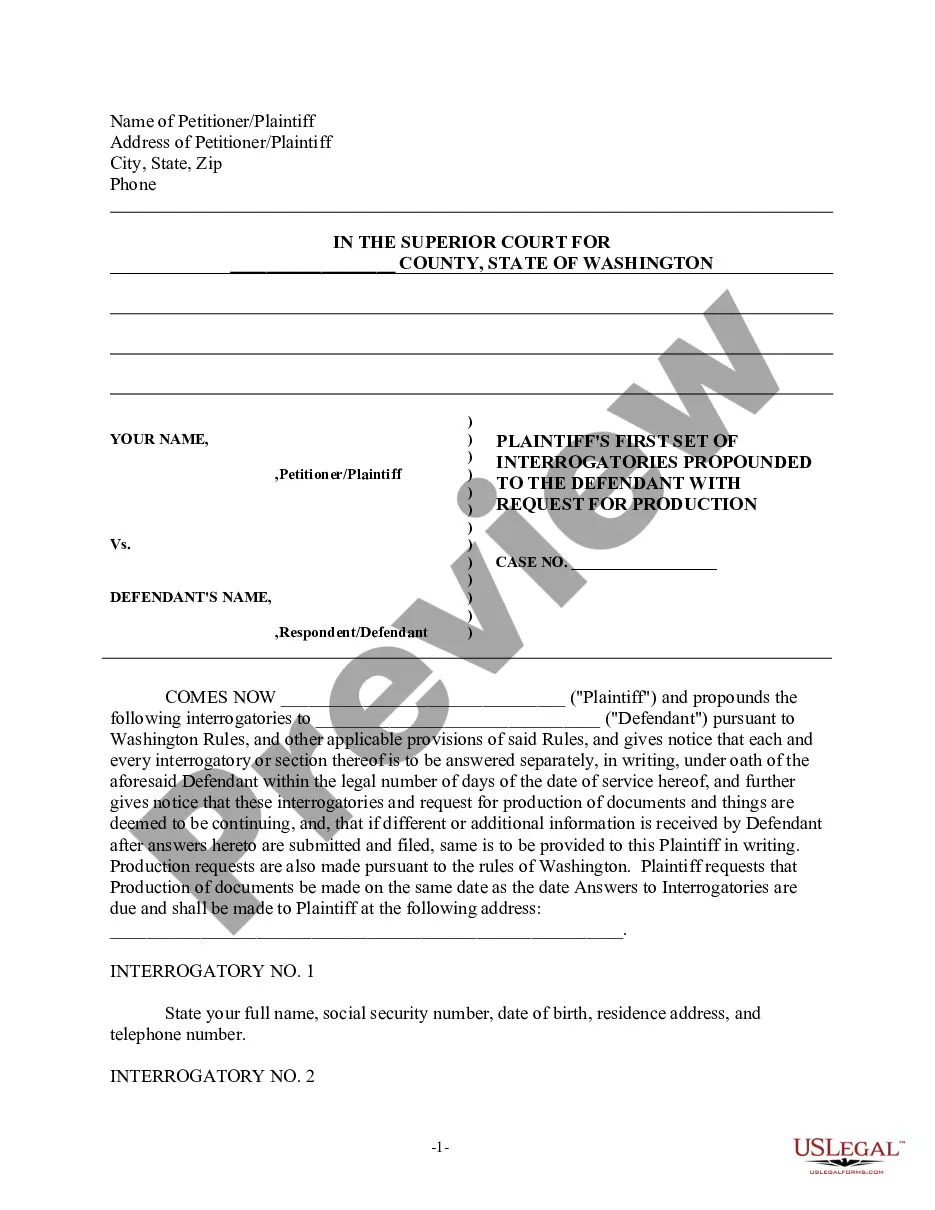

- If available, use the Review button to browse the document template as well.

- If you want to find another version of the form, use the Search box to locate the template that meets your needs and criteria.

- Once you have found the template you need, click on Purchase now to proceed.

- Choose the pricing plan you desire, enter your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Select the format of the document and download it to your device.

- Make alterations to your document if necessary. You can fill out, modify, sign, and print the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

To write an independent contractor agreement, begin by defining the scope of work and the nature of the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor. Incorporate terms regarding compensation, deadlines, and any other relevant details. It’s also important to include legal disclaimers to protect both parties. Using a platform like uslegalforms can simplify this process by providing templates and guidance tailored to your needs.

Filling out an independent contractor agreement requires attention to detail. Start by stating the parties involved and the specific services rendered under the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor. Next, include payment details, project timelines, and any additional terms that govern the work relationship. Always double-check your entries to ensure everything is clear and precise.

Writing a contract for a 1099 employee involves outlining the terms of the relationship clearly. Begin with the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor, specifying the duties, payment terms, and deadlines. Include clauses that address confidentiality and termination to protect both parties. By following this structure, you can create a comprehensive contract that meets legal standards.

To fill out an independent contractor form, start by gathering essential information such as your name, contact details, and business information. Make sure to include the specifics of the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor, including the scope of work and payment terms. Once you have all the information, carefully complete each section of the form to ensure accuracy. Finally, review the form before submission to avoid any mistakes.

Yes, having a contract is essential for independent contractors. A contract helps establish clear terms of engagement, payment schedules, and responsibilities, reducing the potential for misunderstandings. If you're in New Mexico, using the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor from uslegalforms can streamline the process and ensure that you have all the necessary legal protections in place.

Yes, a freelance writer is typically classified as an independent contractor. This means they operate as self-employed individuals who offer their writing services to clients without being tied to a single employer. To formalize this relationship, having a solid contract, such as the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor, can help clarify roles and responsibilities.

Freelance writers do not necessarily need to establish an LLC, but doing so can offer personal liability protection and potential tax benefits. An LLC can help separate personal assets from business liabilities, which is beneficial for independent contractors in New Mexico. For guidance on setting up your business structure, consider consulting resources like uslegalforms.

Freelance work and independent contracting share similarities, but they are not identical. Freelancers typically work on a project basis for multiple clients, while independent contractors may have a more formal agreement and specific terms with a single client. Regardless of the distinction, both often require a clear contract, such as the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor, to outline expectations.

To write an independent contractor agreement, start by defining the scope of work, payment terms, and deadlines. Be sure to include both parties' names and addresses, along with specific deliverables. For those in New Mexico, consider using a template like the New Mexico Grant Writer Agreement - Self-Employed Independent Contractor available at uslegalforms to ensure you cover all necessary details.

Yes, independent contractors file as self-employed individuals. When you operate under a New Mexico Grant Writer Agreement - Self-Employed Independent Contractor, you are responsible for your own taxes. This means you will report your income and expenses on your tax return, typically using Schedule C. Understanding your tax obligations is crucial for managing your finances effectively.