New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor

Description

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

Selecting the optimal legal document design can be challenging.

Clearly, there is a multitude of templates available online, but how can you locate the legal template you require.

Utilize the US Legal Forms site. The platform offers thousands of templates, including the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor, which can serve both business and personal purposes.

You can preview the form using the Preview option and review the form description to confirm this is the right one for you. If the template does not meet your needs, utilize the Search section to find the suitable document. Once you are confident that the form is correct, click on the Get now button to obtain the document. Select the pricing plan you prefer and enter the required information. Create your account and complete your order using your PayPal account or credit card. Choose the file format and download the legal document design to your device. Complete, edit, print, and sign the acquired New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest collection of legal templates where you can discover various document designs. Take advantage of the service to obtain professionally crafted paperwork that meets state requirements.

- All templates are vetted by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire option to find the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor.

- Use your account to search through the legal documents you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have chosen the correct template for your state/region.

Form popularity

FAQ

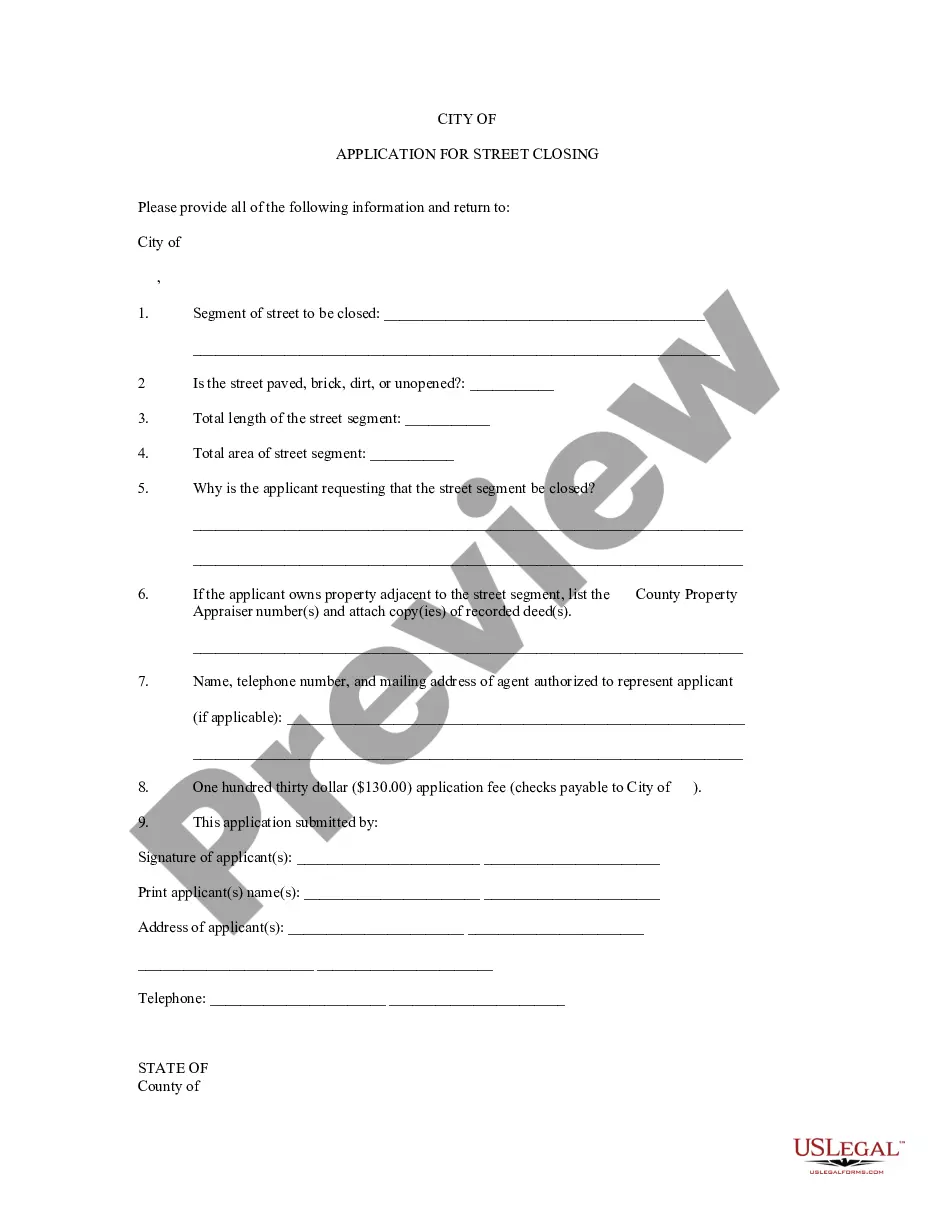

To write an independent contractor agreement, start by stating both parties' names and contact information. Outline the specific work to be performed, payment details, and deadlines. Don't forget to include termination clauses and references to the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor for clarity. For efficient drafting, consider leveraging resources like US Legal Forms, which offer templates designed to meet your specific needs.

An independent contractor typically fills out several key documents including the contractor agreement, tax forms like the W-9, and any specific permits required for their service. Referencing the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor will guide you on what is necessary for compliance. Additionally, you may need to track invoices and payment confirmations. US Legal Forms can help simplify this process by providing the right paperwork templates.

Filling out an independent contractor agreement requires you to outline the services to be provided, payment structures, and timelines. It’s crucial to align this with the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor for legal validity. Don't forget to include the agreement's start and end dates, and signature lines. For a streamlined experience, consider using US Legal Forms, which offers ready-made templates tailored for your needs.

Writing a contract for a 1099 employee involves clearly defining the scope of work, payment terms, and timeline for completion. Make sure to reference the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor to ensure compliance with state regulations. Designate sections for confidentiality and dispute resolution to protect both parties. Utilizing services like US Legal Forms can provide you with a solid foundation and ensure all necessary elements are included.

To fill out an independent contractor form effectively, begin by providing your personal information, such as your name, address, and Social Security number. Next, specify the services you will provide as outlined in the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor. Ensure you include the payment details and signature line for both parties. You may want to use platforms like US Legal Forms for templates to guide you through the process.

Yes, having a contract as an independent contractor is highly important. A well-crafted contract, such as the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor, provides legal protection and clarifies expectations. It helps both parties understand their responsibilities and avoid potential disputes. Ultimately, a solid agreement fosters a smoother working relationship.

To create an independent contractor agreement, start by outlining the scope of work and payment terms. Next, include important details like timelines, confidentiality clauses, and termination conditions. You can use resources like the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor to guide you through this process efficiently. Having a clear agreement helps protect your rights and establishes a professional relationship.

Typically, the business that hires the independent contractor writes the independent contractor agreement. However, both parties can collaborate to ensure clarity and fairness. Leveraging templates can be valuable, especially the New Mexico Contract Administrator Agreement - Self-Employed Independent Contractor, which simplifies the process. It's essential to have a well-drafted agreement to outline the terms and avoid misunderstandings.