New Mexico Woodworking Services Contract - Self-Employed

Description

How to fill out Woodworking Services Contract - Self-Employed?

Are you in a situation where you will require documents for either business or personal purposes almost every day.

There are numerous authentic document templates available online, but locating reliable ones isn't straightforward.

US Legal Forms offers a vast array of form templates, such as the New Mexico Woodworking Services Contract - Self-Employed, designed to comply with state and federal regulations.

Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Mexico Woodworking Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

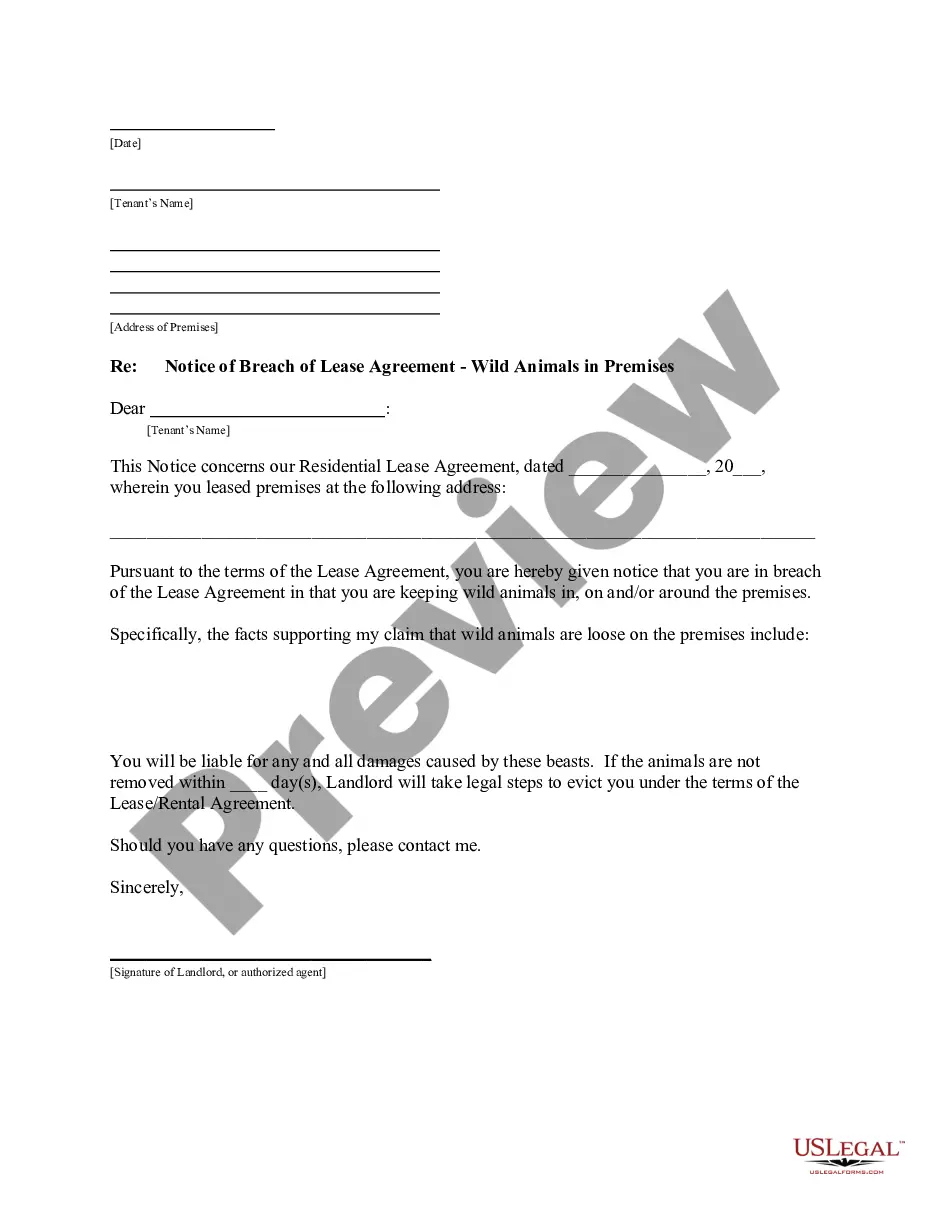

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, complete the necessary information to create your account, and pay for the transaction with your PayPal or credit card.

- Choose a suitable file format and download your copy.

- You can find all the document templates you have purchased in the My documents menu. You can acquire an additional copy of the New Mexico Woodworking Services Contract - Self-Employed at any time, if needed. Click the desired form to download or print the document template.

Form popularity

FAQ

The bonding requirements for a contractor's license in New Mexico depend on the type of license you hold. Typically, a bond of $10,000 to $12,000 is required for most general contractors. This bond serves as protection for clients and ensures that contractors fulfill their contractual obligations. When drafting a New Mexico woodworking services contract - self-employed, addressing bonding details can enhance trust and inform clients of your professionalism.

Yes, most contractors in New Mexico must be licensed to perform work legally, especially if the work exceeds a specific dollar amount or relates to regulated trades. A valid license demonstrates that the contractor meets state standards for safety and quality. To navigate the licensing process smoothly, consider utilizing a New Mexico woodworking services contract - self-employed, as it will aid in clarifying your obligations and compliance.

To qualify as an independent contractor in New Mexico, you must demonstrate certain criteria, including managing your business and selecting your work. You cannot be dictated to on how to complete your assignments; this autonomy is a key factor. Having a solid New Mexico woodworking services contract - self-employed in place can help illustrate your independent status and ensure both parties understand their responsibilities.

In New Mexico, whether you need a license as a handyman depends on the type of work you intend to do. Some minor repairs do not require a license, but if your work exceeds certain monetary thresholds or involves specific trades, you will need a license. It’s crucial to understand the requirements defined by the New Mexico Construction Industries Division. By using a New Mexico woodworking services contract - self-employed, you can clearly define your scope of work and maintain compliance.

Yes, New Mexico requires 1099 filing for independent contractors who earn $600 or more from a single client. This means that if you are working under a New Mexico Woodworking Services Contract - Self-Employed, you should expect to receive a Form 1099 from clients at the end of the year. Filing this form correctly is essential to staying compliant with tax laws and ensuring that your income is accurately reported to the IRS.

In New Mexico, certain services are exempt from sales tax, including many professional and personal services. For instance, labor for the repair or improvement of real property often falls under these exemptions. It's important to review the specifics of New Mexico Woodworking Services Contract - Self-Employed to understand which aspects of your services may qualify for tax exemptions, ensuring compliance while maximizing your earnings.

Filing taxes as a freelance contractor in New Mexico requires you to keep detailed records of your income and expenses. You will typically file a Schedule C with your federal tax return, reporting your earnings under the New Mexico Woodworking Services Contract - Self-Employed. Additionally, be aware of self-employment taxes, and consider setting aside funds regularly to avoid surprises at tax time.

To file as an independent contractor in New Mexico, you first need to obtain a business license and an Employer Identification Number (EIN) if you plan to hire employees. Additionally, you should prepare a comprehensive New Mexico Woodworking Services Contract - Self-Employed that outlines your services, payment terms, and project details. This contract protects both you and your clients, ensuring clarity in your business dealings.

To write a self-employed contract, focus on outlining deliverables, payment schedules, and work timelines relevant to your New Mexico woodworking services. It is crucial to address any specific needs that might arise during the project. Additionally, including clauses for amendments and dispute resolution will enhance clarity. You can simplify this task by using pre-designed contracts available on uslegalforms.

Writing a contract for a 1099 employee in the woodworking services sector involves outlining job responsibilities, compensation, and timelines. Make sure to specify that they are an independent contractor to clarify the tax implications. Including terms for termination and confidentiality protects both parties. Using a template from uslegalforms can streamline this process, ensuring compliance with all necessary regulations.