New Mexico Carpentry Services Contract - Self-Employed Independent Contractor

Description

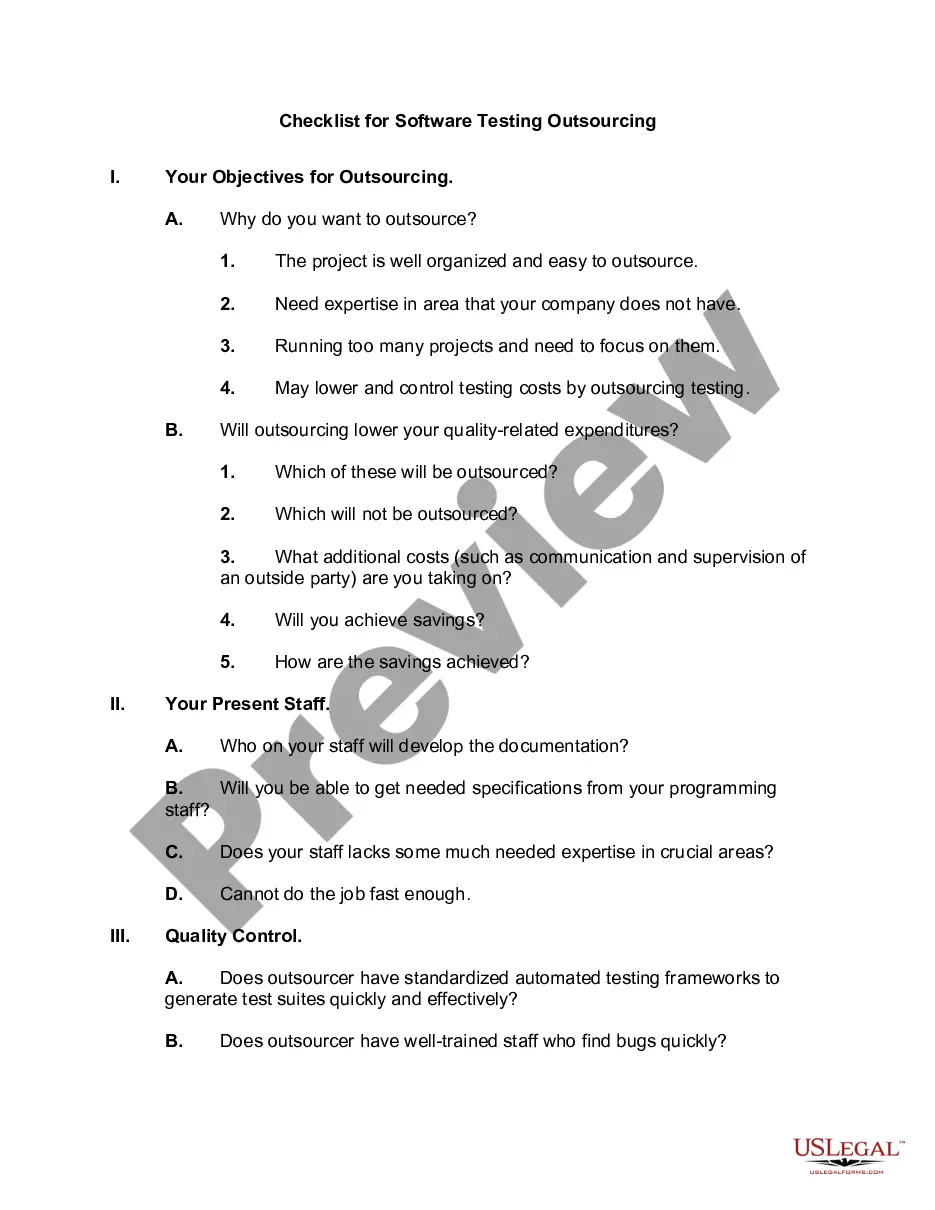

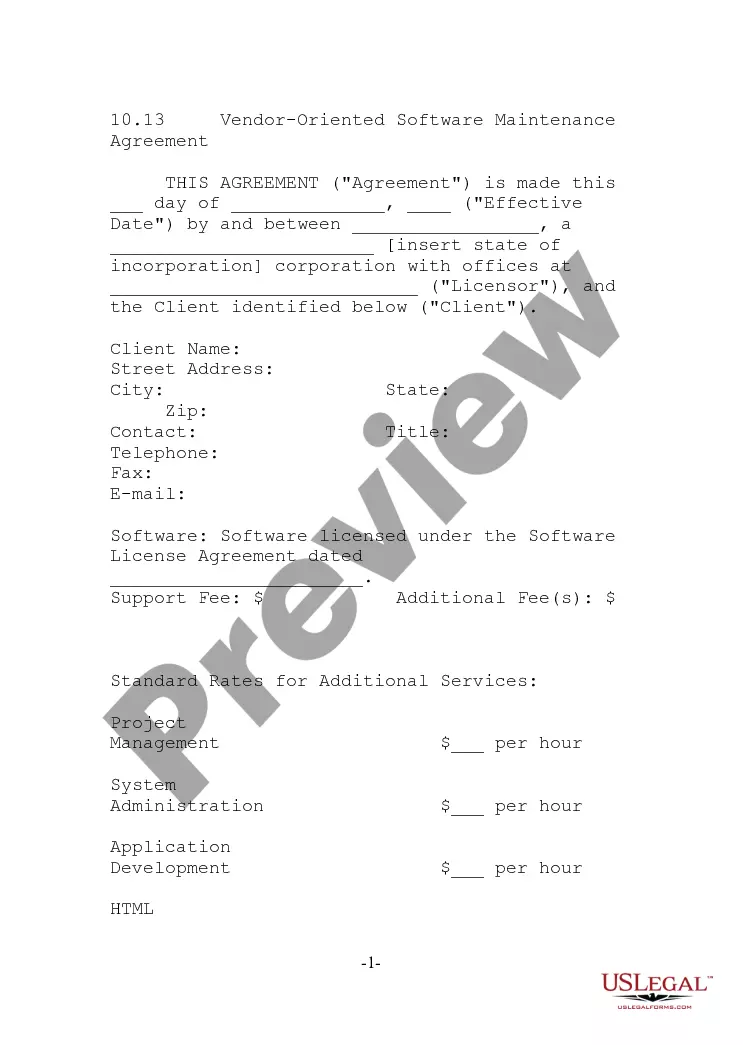

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

You can devote hours online searching for the authentic file type that meets the state and federal requirements you have.

US Legal Forms offers numerous authentic forms that are reviewed by experts.

You can download or print the New Mexico Carpentry Services Contract - Self-Employed Independent Contractor from their service.

If available, use the Review button to check the file type as well.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the New Mexico Carpentry Services Contract - Self-Employed Independent Contractor.

- Every authentic file type you purchase belongs to you indefinitely.

- To obtain an additional copy of any purchased form, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct file type for the area/city of your choice.

- Review the form description to confirm you have chosen the proper form.

Form popularity

FAQ

An independent contractor typically fills out a contract agreement outlining the work, payment terms, and scope. They may also complete tax forms and various compliance documents. Using a New Mexico Carpentry Services Contract - Self-Employed Independent Contractor not only organizes this paperwork but also ensures you meet legal requirements specific to your business in New Mexico.

To fill out an independent contractor form, gather all necessary details about the project, including the scope of work and payment structure. Clearly state the timeframe and refer to any relevant legal terms. Referring to a New Mexico Carpentry Services Contract - Self-Employed Independent Contractor can guide you in completing the form accurately, making the process much more straightforward.

Filling out an independent contractor agreement involves providing the correct information for both the contractor and the client. Start with names, addresses, and a detailed description of the services to be performed. Additionally, make sure to include payment methods and any specific conditions agreed upon. Using a New Mexico Carpentry Services Contract - Self-Employed Independent Contractor template can simplify this process and reduce errors.

To write an independent contractor agreement, start by clearly defining the scope of work and the expectations of both parties. Include essential details such as payment terms, deadlines, and any obligations. By using a New Mexico Carpentry Services Contract - Self-Employed Independent Contractor template, you can ensure that all necessary elements are covered without missing important legal points.

employed individual typically earns income by providing services or products directly to clients, rather than through an employeremployee relationship. Factors like business registration, invoicing clients, and managing one’s taxes solidify this status. In the context of a New Mexico Carpentry Services Contract as a SelfEmployed Independent Contractor, these qualifiers help establish your business legitimacy.

The new federal rule clarifies how independent contractors should be classified. It emphasizes the importance of the nature of work relationship and determines whether a worker is an independent contractor or an employee. For those engaging in a New Mexico Carpentry Services Contract as a Self-Employed Independent Contractor, staying informed about such regulations is crucial for compliance.

Yes, if you receive a 1099 form, you are considered self-employed. This form is issued to independent contractors, indicating that you earned income from a client or multiple clients. By operating under a New Mexico Carpentry Services Contract as a Self-Employed Independent Contractor, you ensure compliance with tax regulations that pertain to your earnings.

The terms self-employed and independent contractor are often used interchangeably, but they can convey slightly different meanings. While self-employed indicates a broader lifestyle choice, independent contractor refers specifically to a contractual arrangement for services. For a New Mexico Carpentry Services Contract, using 'Self-Employed Independent Contractor' can provide clear context to clients about your role.

Absolutely, an independent contractor counts as self-employed. They operate independently of an employer, which grants them numerous advantages such as choosing their projects and hours. When you establish a New Mexico Carpentry Services Contract as a Self-Employed Independent Contractor, you solidify this status, empowering you in your business endeavors.

Yes, an independent contractor is generally considered self-employed. This designation means that they run their own business and are responsible for paying their taxes. In terms of a New Mexico Carpentry Services Contract as a Self-Employed Independent Contractor, this status provides flexibility and opportunities for contractors to manage their own projects.