New Mexico Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

Have you found yourself in a scenario where you require documentation for potentially business or individual activities almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the New Mexico Lab Worker Employment Contract - Self-Employed, which are designed to meet federal and state requirements.

Choose the payment plan you prefer, fill in the necessary information to create your account, and complete the order using your PayPal or credit card.

Select a suitable file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the New Mexico Lab Worker Employment Contract - Self-Employed at any time, if needed. Click the desired form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Lab Worker Employment Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific state/region.

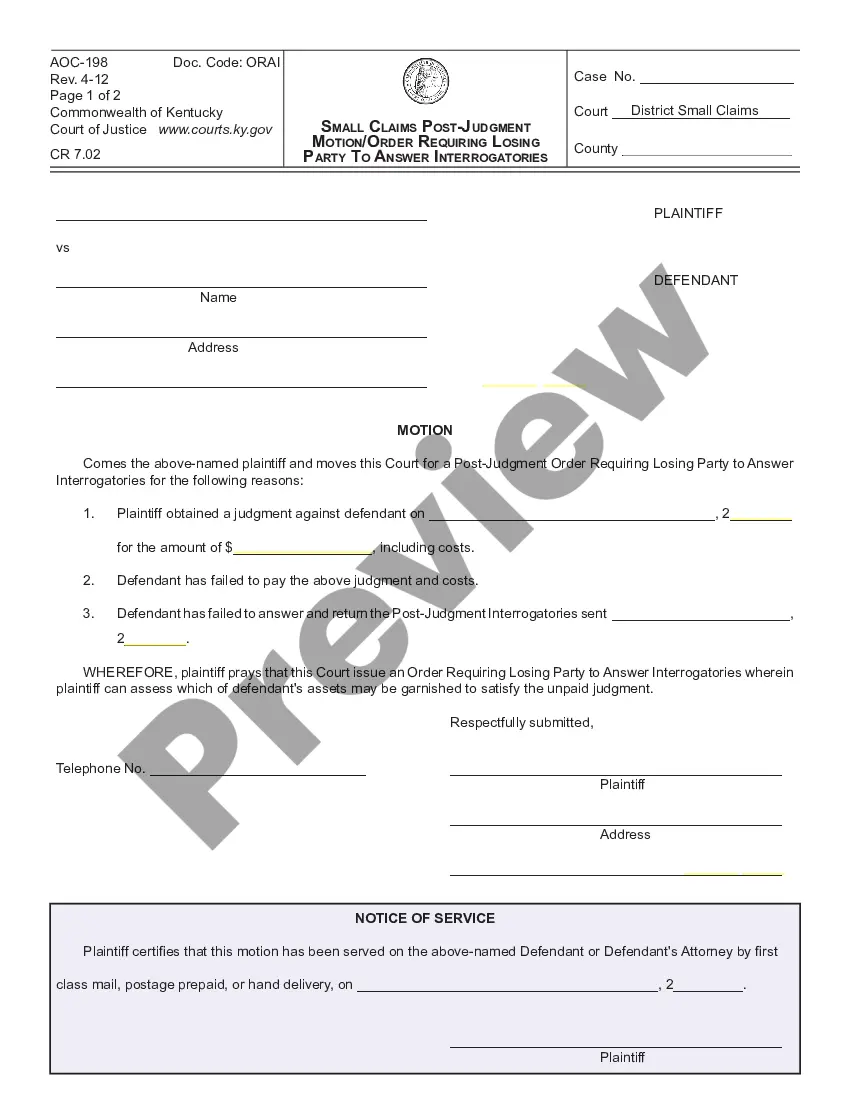

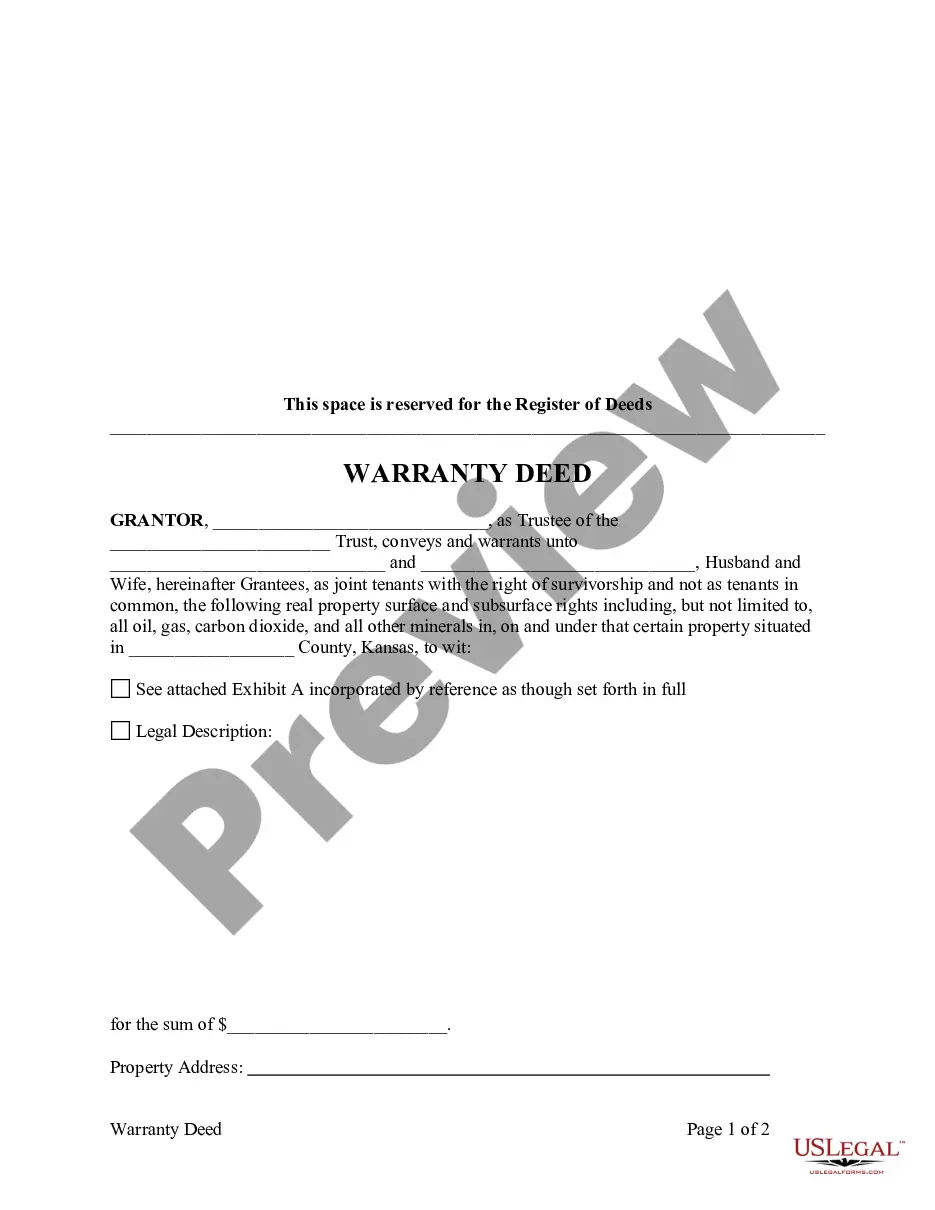

- Use the Preview button to review the document.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you require, use the Search area to find the form that meets your needs.

- Once you find the correct form, click Purchase now.

Form popularity

FAQ

Filing taxes as a 1099 employee involves reporting your income from all clients on Schedule C of your tax return. You will need to keep accurate records of your earnings linked to your New Mexico Lab Worker Employment Contract - Self-Employed. Additionally, you should also account for any business expenses that may lower your taxable income. Explore uslegalforms for tools and templates that can assist you in organizing your records efficiently.

Yes, New Mexico requires filing a 1099 form for independent contractors, including those working under a New Mexico Lab Worker Employment Contract - Self-Employed. If you earn $600 or more from a single client, they must issue you a 1099. This form helps the state track your income for tax purposes, ensuring compliance. Consider using resources from uslegalforms to simplify this process and to learn more about managing your taxes.

When writing a self-employed contract, begin with the names and addresses of both parties involved. Clearly outline the scope of work, payment terms, and duration of the agreement. Additionally, include clauses for termination and confidentiality. For help drafting a comprehensive New Mexico Lab Worker Employment Contract - Self-Employed, consider using resources like uslegalforms to ensure all essential elements are included.

Yes, a 1099 employee is generally considered self-employed. This classification means that the person is responsible for paying their own taxes and managing their business affairs. When managing contracts like the New Mexico Lab Worker Employment Contract - Self-Employed, understanding this classification is crucial for proper compliance with tax obligations.

Contract work can count as employment, but it depends on the terms defined in the contract. If you work under a contract with specific duties and payment, it establishes an employment relationship, even as a self-employed worker. Clarity in your New Mexico Lab Worker Employment Contract - Self-Employed will help ensure proper recognition of your work arrangement.

Contract work often aligns closely with self-employment, but they are not identical. When you engage in contract work, you may work on a project basis for different clients without being tied to one employer. Whether you are self-employed or a contractor, ensure your New Mexico Lab Worker Employment Contract - Self-Employed clearly defines your relationship with clients.

A contract is not the same as being self-employed. When you are self-employed, you operate your own business and contract your services to clients. However, a contract can outline the terms of this relationship, specifying what is expected from both parties. Understanding these differences is essential when creating your New Mexico Lab Worker Employment Contract - Self-Employed.

To fill out a contract of employment template, start by entering the names and addresses of both the employer and the worker. Next, specify the job title, duties, and hours of work involved. Then, include payment details and any other specific terms relevant to employment. You can find a suitable template on platforms like uslegalforms that cater specifically to the New Mexico Lab Worker Employment Contract - Self-Employed.

Certain jobs in New Mexico are exempt from minimum wage laws. These typically include roles related to agriculture, some seasonal jobs, and specific service professions. If you are a self-employed lab worker, you should review these exemptions when considering the terms of your New Mexico Lab Worker Employment Contract - Self-Employed. Proper understanding ensures compliance and fair compensation.

Yes, a self-employed person can absolutely have a contract. In fact, a New Mexico Lab Worker Employment Contract - Self-Employed is crucial for defining work expectations, payment terms, and rights. Such a contract protects both the worker and the employer by clearly outlining responsibilities. It helps establish a professional relationship, reducing misunderstandings and disputes.