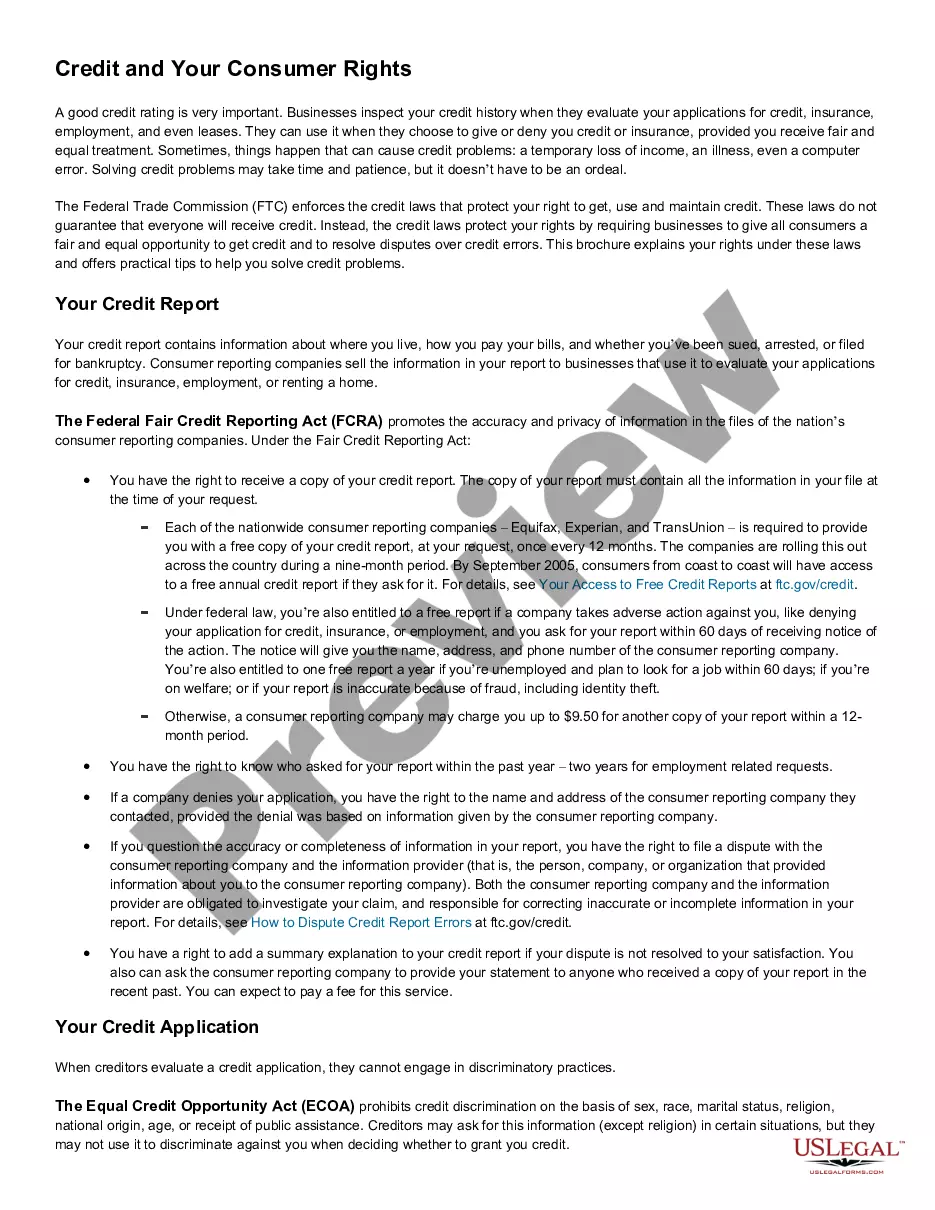

New Mexico A Summary of Your Rights Under the Fair Credit Reporting Act

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

If you have to total, obtain, or produce legitimate papers web templates, use US Legal Forms, the biggest collection of legitimate kinds, which can be found online. Use the site`s easy and hassle-free lookup to get the documents you require. Numerous web templates for company and person reasons are categorized by categories and says, or search phrases. Use US Legal Forms to get the New Mexico A Summary of Your Rights Under the Fair Credit Reporting Act with a number of clicks.

Should you be presently a US Legal Forms buyer, log in to your accounts and then click the Download key to find the New Mexico A Summary of Your Rights Under the Fair Credit Reporting Act. You may also entry kinds you previously saved within the My Forms tab of your accounts.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for that proper town/land.

- Step 2. Utilize the Preview choice to examine the form`s articles. Do not neglect to see the outline.

- Step 3. Should you be unsatisfied using the type, take advantage of the Look for industry towards the top of the display screen to locate other models of the legitimate type format.

- Step 4. Upon having identified the shape you require, click on the Get now key. Choose the rates plan you favor and include your accreditations to sign up for an accounts.

- Step 5. Approach the financial transaction. You may use your charge card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the format of the legitimate type and obtain it on your gadget.

- Step 7. Total, change and produce or sign the New Mexico A Summary of Your Rights Under the Fair Credit Reporting Act.

Each and every legitimate papers format you purchase is the one you have eternally. You might have acces to each type you saved in your acccount. Go through the My Forms area and pick a type to produce or obtain yet again.

Remain competitive and obtain, and produce the New Mexico A Summary of Your Rights Under the Fair Credit Reporting Act with US Legal Forms. There are thousands of specialist and status-specific kinds you can utilize for your company or person requirements.

Form popularity

FAQ

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action.

Step 1: Before you take the adverse action, you must give the individual a pre-adverse action disclosure that includes a copy of the individual's consumer report and a copy of "A Summary of Your Rights Under the Fair Credit Reporting Act" - a document prescribed by the Federal Trade Commission.

Fix Errors on Your Credit Report: 8 Tips for Writing an Effective Complaint Letter to the Credit Reporting Agency Provide identification information. ... Clearly identify the mistake. ... Be brief and to the point. ... Type the letter. ... Don't quote Fair Credit Reporting Act laws. ... Include proof, if you have it. ... Proofread!

Under the Fair Credit Reporting Act, you have a right to: You must have proper identification. You have a right to a free copy of your credit report within 15 days of your request. Protected Access ? The act limits access to your file to those with a valid need.

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

Candidate Rights Under FCRA The candidate may dispute the information provided by the consumer reporting agency. This action allows for the correction of misreported, outdated, or otherwise incorrect data.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

? You have the right to know what is in your file. information about you in the files of a consumer reporting agency (your ?file disclosure?). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free.