New Mexico Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Are you currently inside a place the place you need to have papers for sometimes company or specific purposes almost every day time? There are a lot of lawful file layouts available on the net, but discovering versions you can rely is not easy. US Legal Forms offers a huge number of form layouts, such as the New Mexico Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II, that happen to be composed to meet federal and state requirements.

Should you be currently acquainted with US Legal Forms website and get your account, merely log in. Afterward, you are able to acquire the New Mexico Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II design.

Unless you have an account and would like to begin using US Legal Forms, follow these steps:

- Find the form you need and make sure it is for that right city/area.

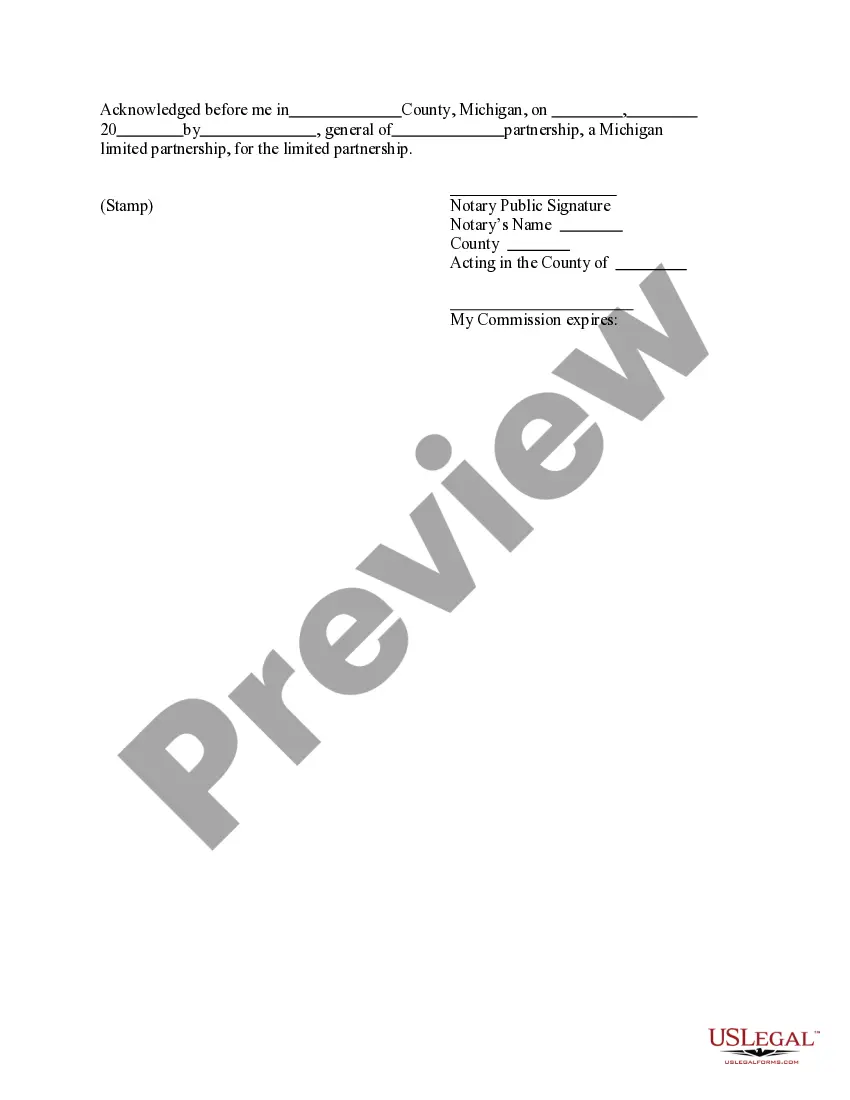

- Take advantage of the Preview button to examine the form.

- Read the description to ensure that you have selected the proper form.

- In the event the form is not what you are looking for, use the Lookup discipline to find the form that suits you and requirements.

- If you obtain the right form, click Get now.

- Choose the pricing program you desire, fill out the desired details to create your account, and buy an order utilizing your PayPal or Visa or Mastercard.

- Select a handy data file format and acquire your version.

Discover all of the file layouts you possess bought in the My Forms menu. You can aquire a additional version of New Mexico Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II whenever, if required. Just select the essential form to acquire or print the file design.

Use US Legal Forms, one of the most considerable collection of lawful kinds, in order to save time as well as avoid faults. The services offers expertly created lawful file layouts that can be used for an array of purposes. Generate your account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Putnam Investment has more than 100 mutual funds and 60 institutional strategies across a range of asset classes and investment styles.

Fund giant Franklin Templeton is buying Putnam Investments for $925 million and receiving a substantial investment from Great-West Lifeco, Putnam's parent company and a subsidiary of Power Corp. of Canada .

Franklin Templeton Establishes a Strategic Partnership with Power Corporation of Canada and Great-West Lifeco; Franklin Templeton to Acquire Putnam Investments.

Putnam is headquartered in Boston, Massachusetts and has offices in London, Tokyo, Frankfurt, Sydney, and Singapore.

Franklin Templeton is acquiring Putnam Investments from Great-West Lifeco, a deal that will combine two of the largest asset management firms in the U.S.

We have offices in Boston and Andover, Massachusetts, as well as in London, Frankfurt, Sydney, Singapore, & Tokyo.

Putnam Investments ? ETFs, Mutual Funds, Institutional, and 529. Putnam is the only fund family ranked in the top 10 by Barron's across all time periods. Barron's list of Best Fund Families, 2023. Out of 47 firms (10 year), 49 firms (5 year), and 49 firms (1 year).

Founded in 1937, Putnam is a global asset management firm with $136 billion3 in AUM as of April 2023. Putnam has offices in Boston, London, Munich, Tokyo, Singapore and Sydney.

In addition to the Putnam acquisition, Franklin Templeton (ticker: BEN) and Power (TSX: POW) are entering into a long-term strategic partnership that will see the Canadian company transfer $25 billion in assets under management to Franklin Templeton over the next 12 months.