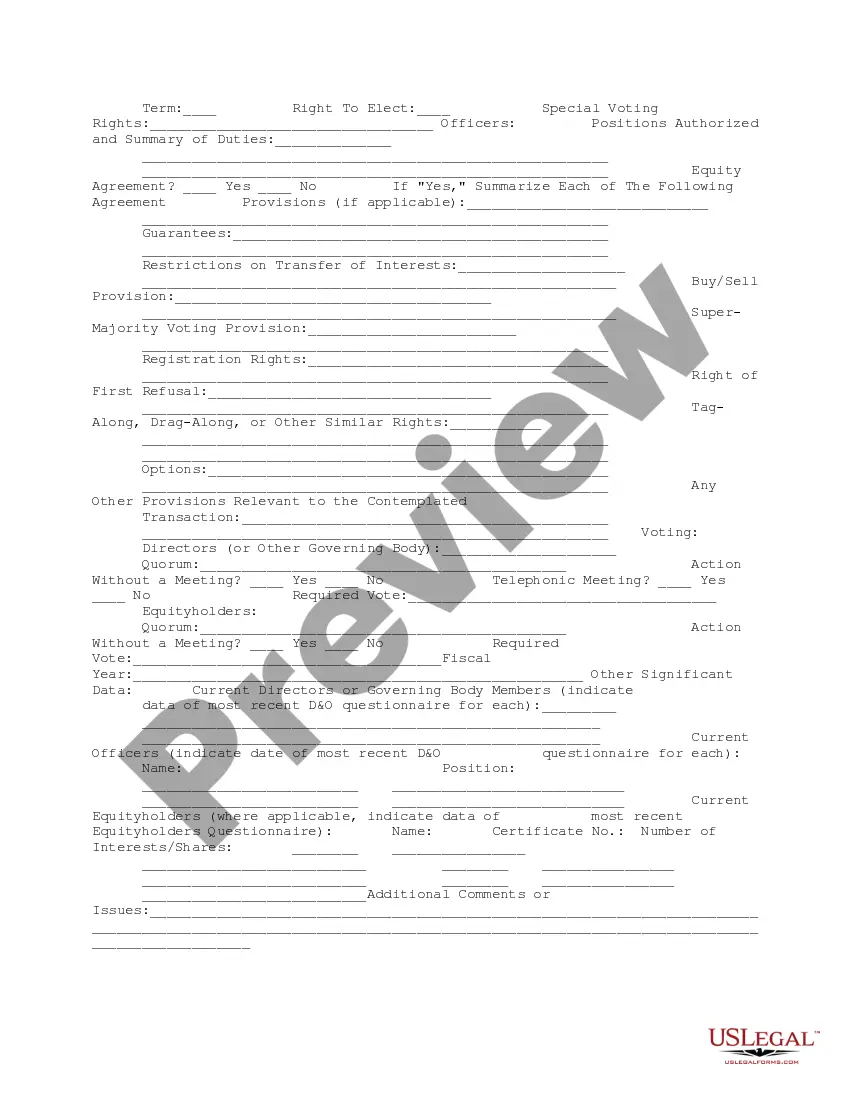

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

New Mexico Company Data Summary

Description

How to fill out Company Data Summary?

You may dedicate time online trying to locate the legal document format that meets the state and federal requirements you have.

US Legal Forms offers a vast collection of legal templates that have been evaluated by experts.

You can certainly obtain or create the New Mexico Company Data Summary from my service.

If available, utilize the Review button to preview the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, generate, or sign the New Mexico Company Data Summary.

- Every legal document format you purchase belongs to you indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the basic steps outlined below.

- First, ensure that you have selected the appropriate document format for the state/region of your choice.

- Check the form description to verify that you have chosen the correct type.

Form popularity

FAQ

To verify if a company is legitimate in New Mexico, begin by searching the New Mexico Secretary of State's business database. This database provides valuable insights, such as the company’s registration status and filing history. Additionally, consider looking for reviews and complaints through online platforms or the Better Business Bureau. By using the New Mexico Company Data Summary as a reference, you can make informed decisions about your interactions with various companies.

To look up a corporation in New Mexico, you can visit the New Mexico Secretary of State's website. The site provides a user-friendly interface where you can search for any corporation by name, ID number, or filing date. This way, you can access essential information like the company's status, registered agent, and business address. Utilizing the New Mexico Company Data Summary helps ensure you get the most accurate data efficiently.

To obtain a NM CRS number, you must complete the registration process through the New Mexico Taxation and Revenue Department. Begin by filling out the CRS Application form found on the department's website, ensuring you provide accurate business details. This process is essential and features prominently in the New Mexico Company Data Summary, helping to streamline your business operations. For a simpler experience, check out US Legal Forms, where you can find helpful resources and forms.

To look up a business license in New Mexico, start by visiting the New Mexico Secretary of State's website, where you can access the business services section. Here, you can search for your desired business name or license information using the New Mexico Company Data Summary feature. This tool provides you with crucial details about the business, including its legal status and licensing information. Additionally, consider using US Legal Forms for easy access to necessary documents and guidance.

In New Mexico, LLCs are not required to submit annual reports. This policy distinguishes New Mexico from many other states and aids in simplifying the business management process. For more insights into New Mexico's business regulations, see our New Mexico Company Data Summary.

Several states do not require annual reports for LLCs, including New Mexico, Wyoming, and Delaware. This lack of requirement allows business owners more freedom and reduces administrative tasks. You can find valuable information about state-specific regulations in our New Mexico Company Data Summary.

To apply for a New Mexico CRS number, you can complete the application online through the New Mexico Taxation and Revenue Department's website. The application process is straightforward and can provide essential resources for your business. For additional guidance in obtaining this number, check our New Mexico Company Data Summary.

No, filing an annual report is not required for LLCs in New Mexico. This simplifies the process for business owners, allowing more focus on growth and operations. For detailed information on maintaining your LLC, refer to the New Mexico Company Data Summary.

Gross Receipts Tax (GRT) and the Combined Reporting System (CRS) are related but not the same. GRT is a tax imposed on the total revenue of a business, while CRS provides a system for businesses to report this tax. Having a clear understanding of these concepts will help you navigate the taxation landscape in New Mexico, which we outline in our New Mexico Company Data Summary.

No, New Mexico does not require LLCs to file annual reports. This feature makes it easier for business owners to manage their companies without the annual paperwork burden. For a comprehensive overview of LLC requirements, consult our New Mexico Company Data Summary.