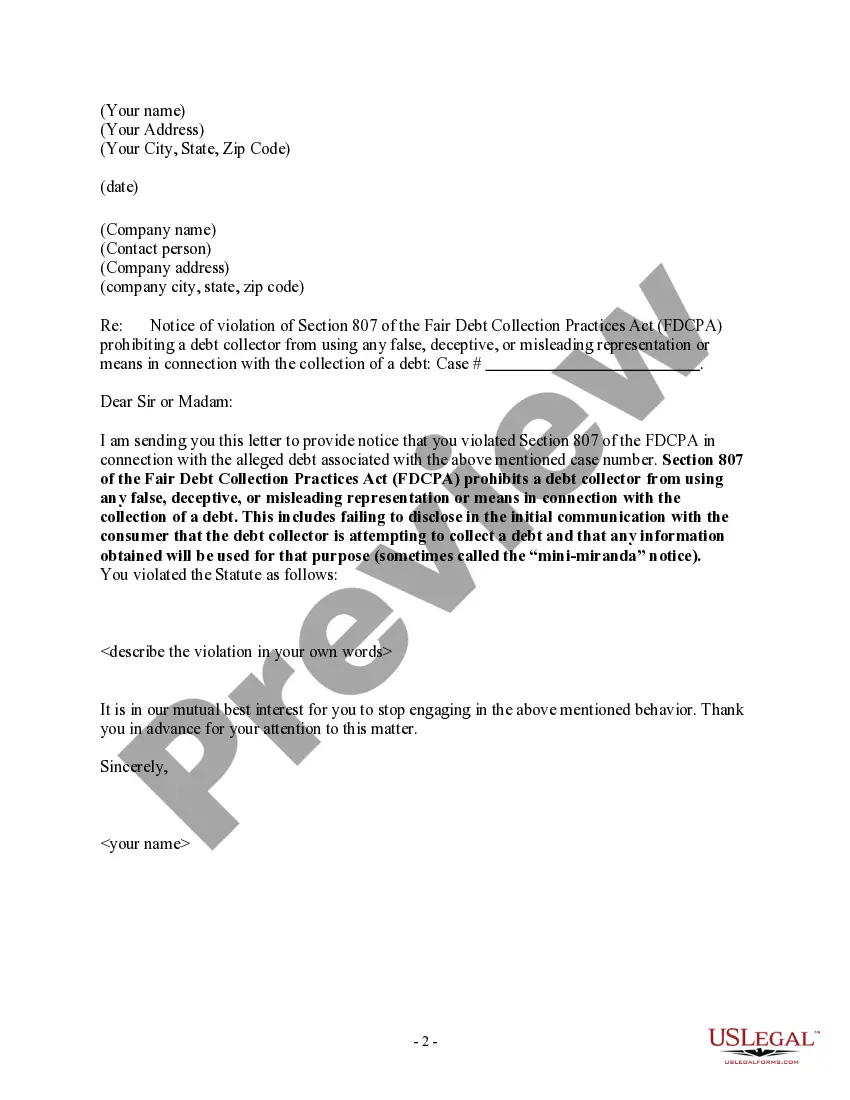

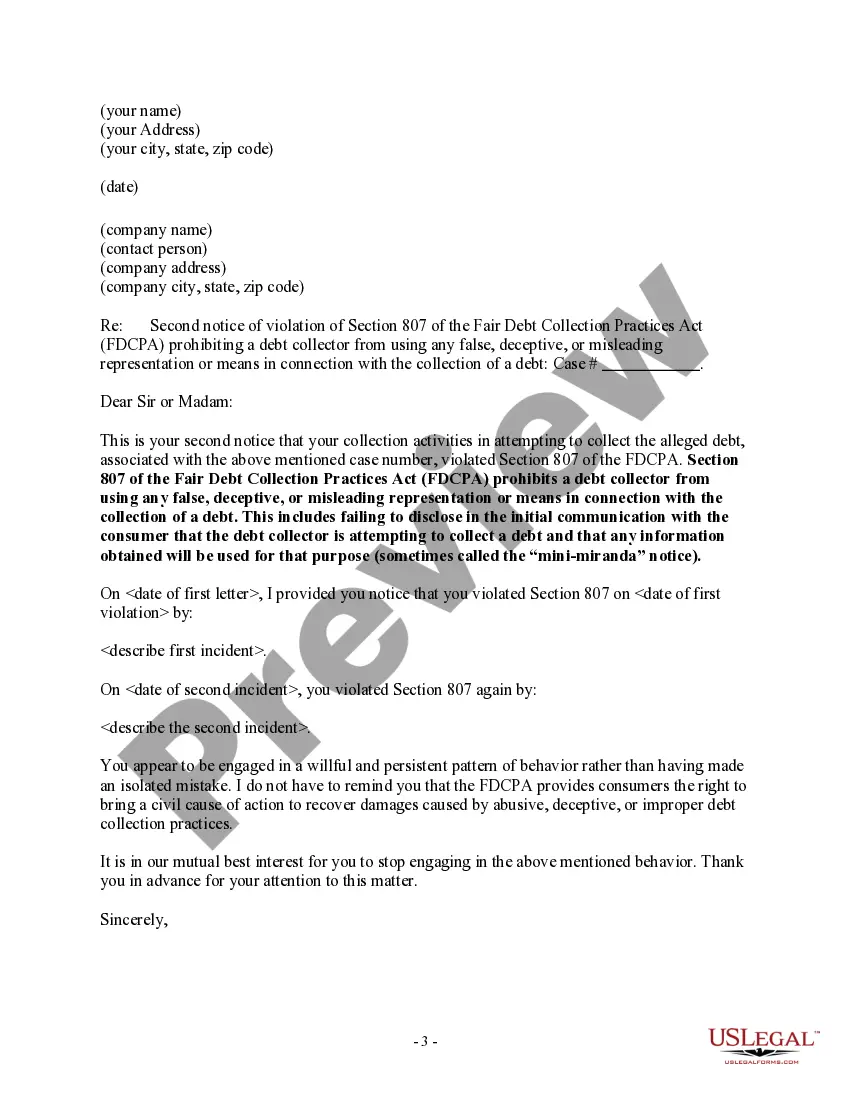

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

New Mexico Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

How to fill out Notice To Debt Collector - Failure To Provide Mini-Miranda?

If you need to acquire, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Benefit from the site's straightforward and user-friendly search function to locate the documents you require.

Various templates for business and personal use are categorized by types and states, or by keywords.

Every legal document template you obtain is yours forever. You can access all forms you saved in your account.

Choose the My documents section and select a form to print or download again. Complete, download, and print the New Mexico Notice to Debt Collector - Failure to Provide Mini-Miranda using US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the New Mexico Notice to Debt Collector - Failure to Provide Mini-Miranda in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the New Mexico Notice to Debt Collector - Failure to Provide Mini-Miranda.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Make sure you have selected the form suitable for your jurisdiction.

- Step 2. Use the Review option to read the content of the form.

- Step 3. If you are not satisfied with the form, employ the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you find the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the New Mexico Notice to Debt Collector - Failure to Provide Mini-Miranda.

Form popularity

FAQ

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Under the FDCPA, debt collectors are required to identify themselves when they attempt to collect a debt as well as note that any information you give them will be used in an attempt to collect the debt. They also must give you the name of their company or agency.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

When a debt collector contacts you, they have to identify themselves as a collector and tell you they're trying to collect on a debt. This is sometimes called a "Mini Miranda requirement. This requirement was created to prevent unfair questioning and practices in the debt collection process.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

The Basic Law: The first notice from the debt collector to the debtor must include a warning known as the "Mini-Miranda Warning," which must state that the communication is from a debt collector and that any information obtained may be used to collect the debt.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.