New Mexico Letter to Debt Collector - Only call me on the following days and times

Description

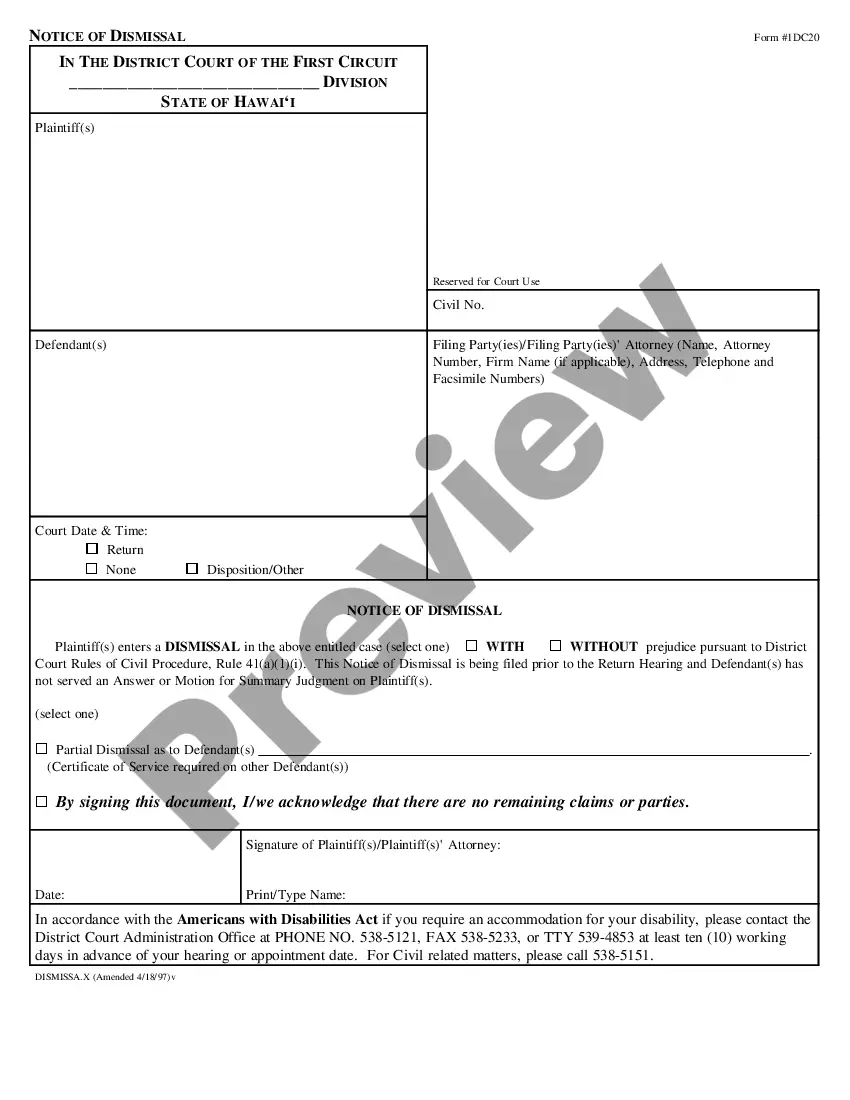

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

It is feasible to spend multiple hours online searching for the appropriate legal document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of valid templates that are examined by experts.

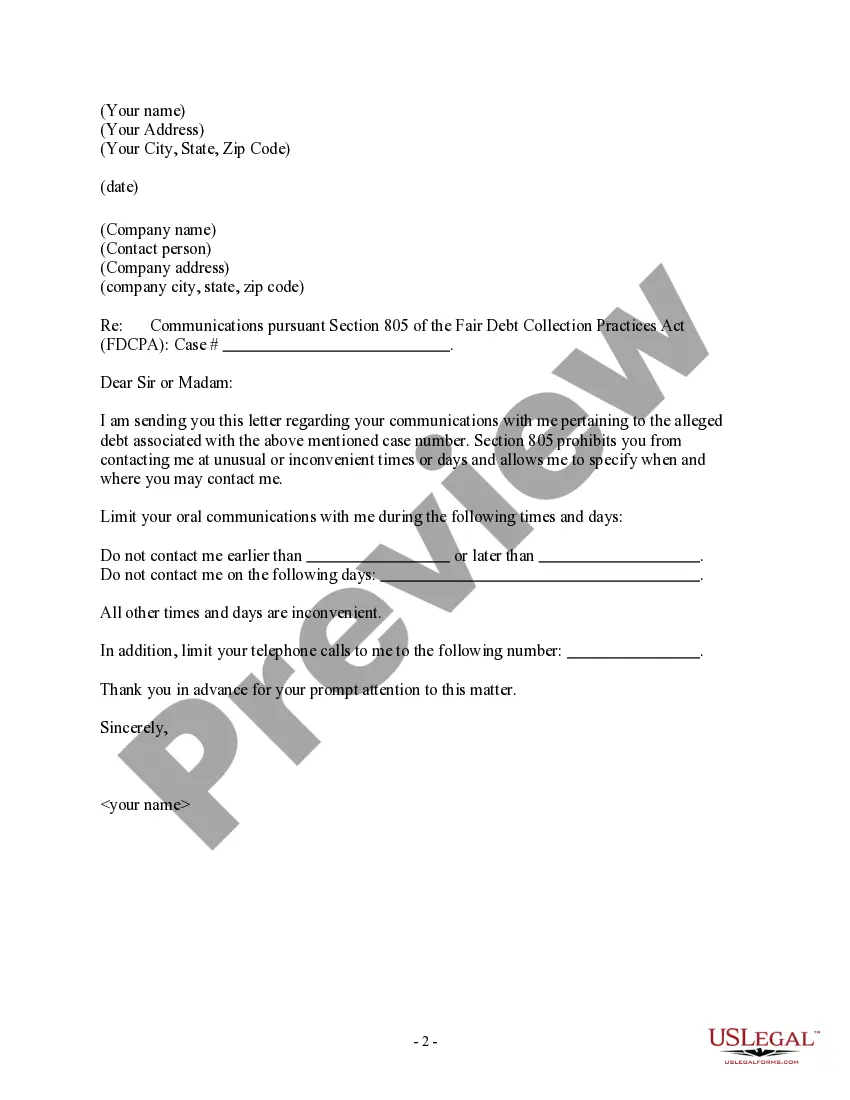

You can obtain or create the New Mexico Letter to Debt Collector - Only contact me on the following days and times from my service.

If available, utilize the Preview button to see the document as well.

- If you have an existing US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you can complete, modify, create, or sign the New Mexico Letter to Debt Collector - Only contact me on the following days and times.

- Every legal document you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure you have selected the correct format for your chosen state/city.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

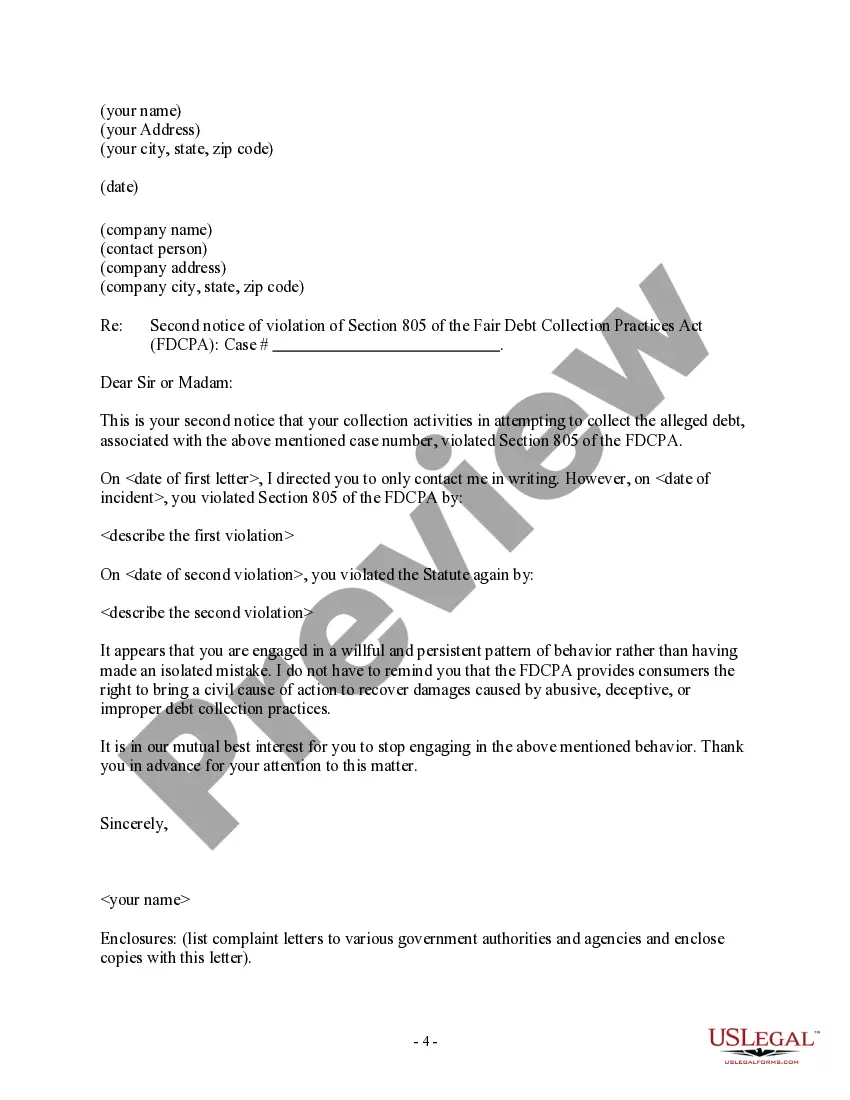

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

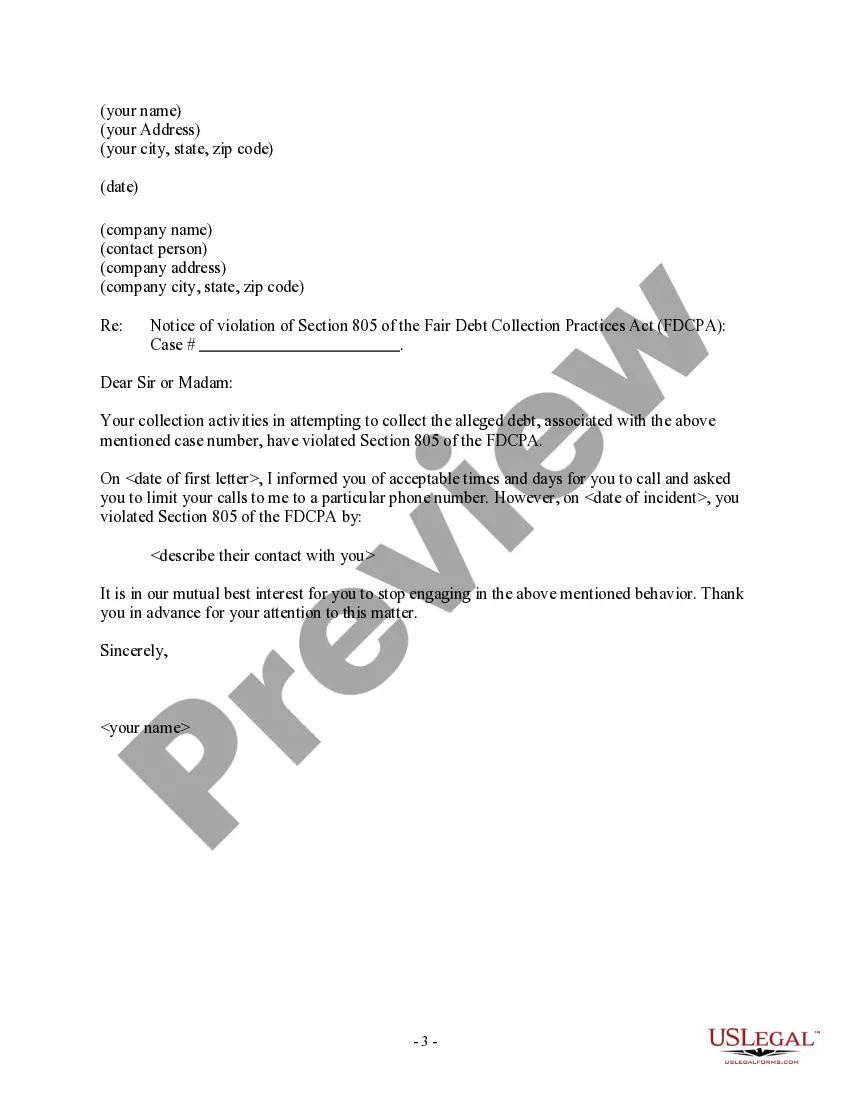

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

The only permissible means of communicating is by regular mail. Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Although debt collectors can leave a message on your machine, they cannot necessarily do it legally. The FDCPA exists in order to protect your privacy and prohibits debt collectors from disclosing your information to third parties. Third parties include your family, friends, boss, or anyone other than your spouse.