New Mexico Proposal to amend stock purchase plan

Description

How to fill out Proposal To Amend Stock Purchase Plan?

You can invest hrs on the Internet searching for the legal document web template that fits the state and federal needs you want. US Legal Forms provides a large number of legal forms that are evaluated by experts. You can easily down load or produce the New Mexico Proposal to amend stock purchase plan from the support.

If you already have a US Legal Forms profile, you are able to log in and click the Obtain button. Next, you are able to complete, edit, produce, or sign the New Mexico Proposal to amend stock purchase plan. Each and every legal document web template you acquire is your own permanently. To obtain one more duplicate of the bought develop, go to the My Forms tab and click the related button.

If you are using the US Legal Forms internet site initially, keep to the easy directions below:

- Initial, be sure that you have selected the proper document web template for the state/metropolis that you pick. Look at the develop outline to ensure you have picked the right develop. If available, use the Preview button to look through the document web template at the same time.

- In order to discover one more version of your develop, use the Look for area to get the web template that fits your needs and needs.

- Upon having located the web template you want, simply click Buy now to proceed.

- Select the rates strategy you want, type in your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal profile to purchase the legal develop.

- Select the formatting of your document and down load it to your gadget.

- Make modifications to your document if required. You can complete, edit and sign and produce New Mexico Proposal to amend stock purchase plan.

Obtain and produce a large number of document layouts utilizing the US Legal Forms Internet site, which provides the largest collection of legal forms. Use expert and express-particular layouts to tackle your small business or specific needs.

Form popularity

FAQ

Can I Sell ESPP Stock Right Away? Yes, you can sell stock purchased through your ESPP plan immediately if you want to guarantee that you profit from your discount. Otherwise, the value of the stock may go up, which increases your profit, or it may go down, causing you to lose money.

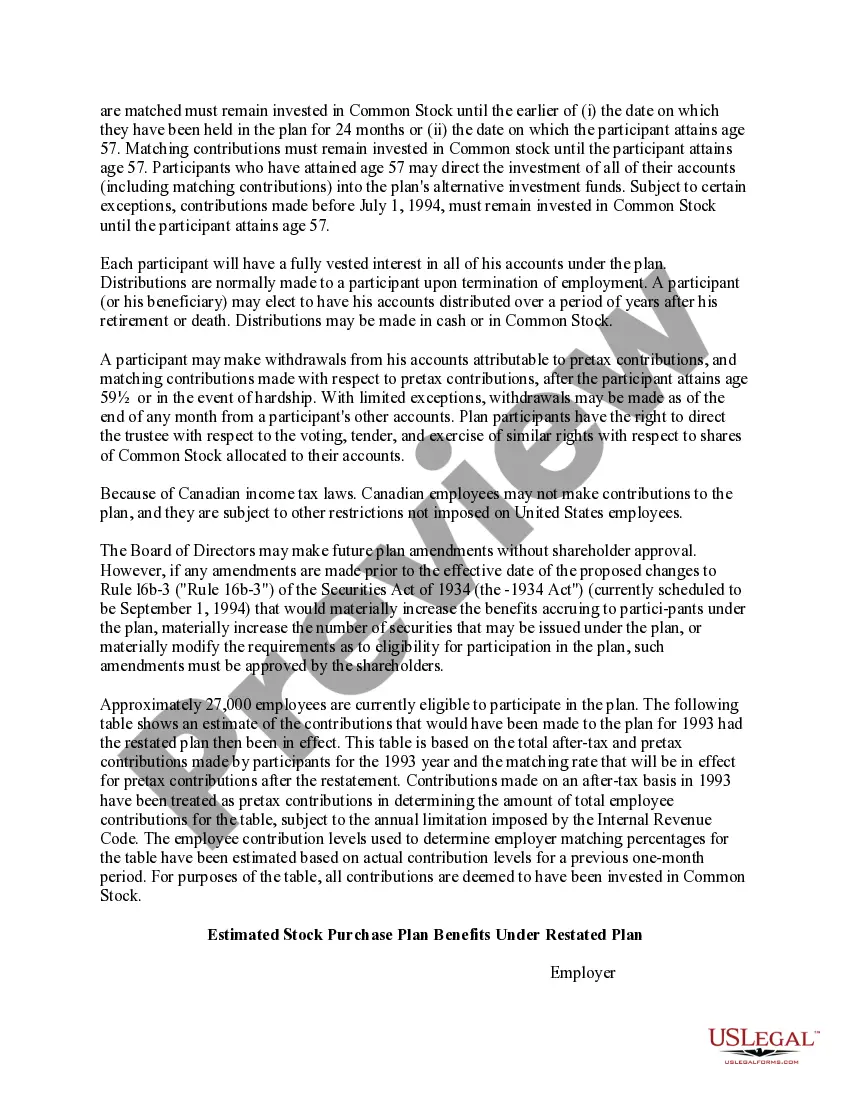

An ESPP must be approved by the stockholders of the sponsoring corporation within the period commencing 12 months before and ending 12 months after the ESPP is adopted by the sponsoring corporation's board of directors.

ESPP Eligibility Cannot participate in an ESPP if an employee owns more than 5% of the company's stock. Must be employed with the company for a specific period of time. (e.g., 1 to 2 years). ESPPs are a benefit.

Under a § 423 employee stock purchase plan, you have taxable income or a deductible loss when you sell the stock. Your income or loss is the difference between the amount you paid for the stock (the purchase price) and the amount you receive when you sell it.

In this situation, you sell your ESPP shares more than one year after purchasing them, but less than two years after the offering date. This is a disqualifying disposition because you sold the stock less than two years after the offering (grant) date.