New Mexico Post-Employment Information Sheet

Description

How to fill out Post-Employment Information Sheet?

You can spend hours online searching for the legal document template that meets the national and state standards you require.

US Legal Forms offers a multitude of legal forms that have been reviewed by professionals.

It's easy to download or print the New Mexico Post-Employment Information Sheet from our services.

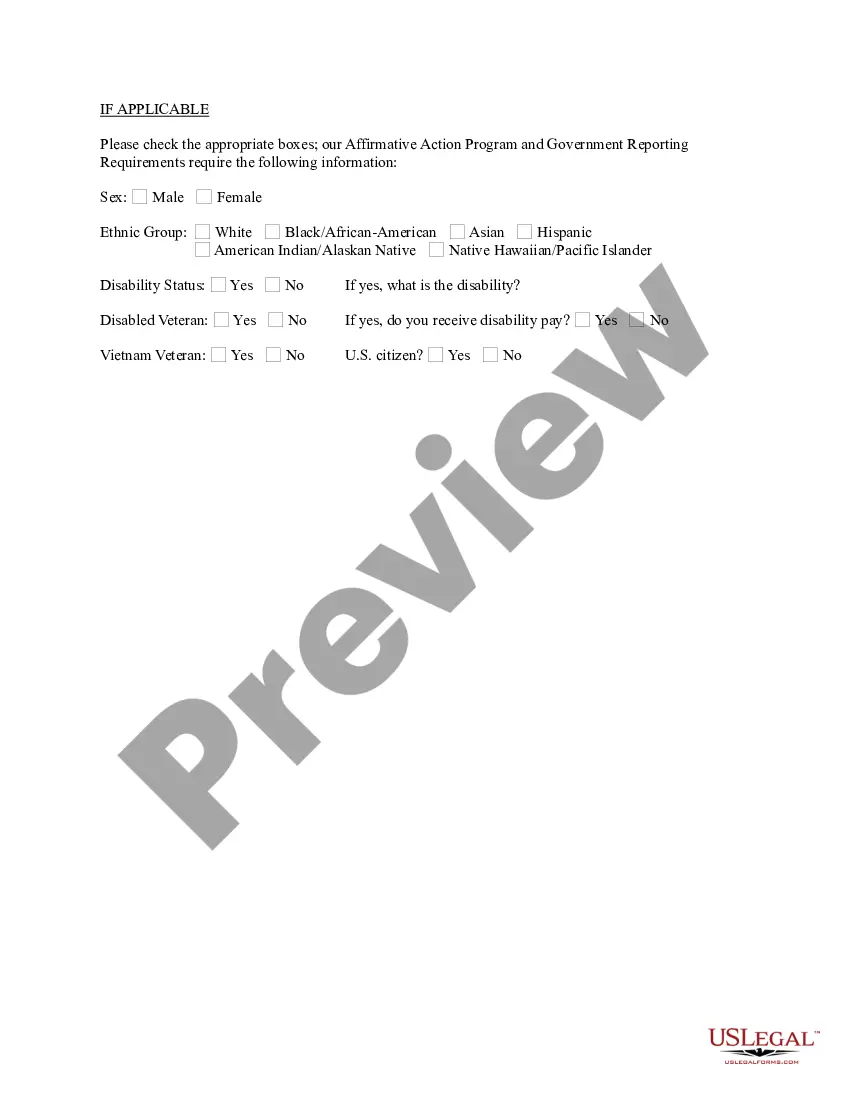

If available, you can use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the New Mexico Post-Employment Information Sheet.

- Every legal document template you purchase is your property for an extended period.

- To retrieve another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you're using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/city of choice.

- Review the form description to guarantee you have chosen the right form.

Form popularity

FAQ

Please know that the ONLY legitimate way to file for Unemployment Insurance benefits in New Mexico is through the New Mexico Department of Workforce Solutions, either online at or by calling 1-877-664-6984. There is NEVER a charge to file for unemployment insurance benefits.

In this section, an employee provides personal data, such as their full name, address, phone numbers, email address, birth date and marital status. It also includes their Aadhaar number, PAN and the contact details of their spouse or family members.

What kind of details should an employee information form contain?Full name.Address and phone number.Social Security Number (SSN).Spouse information.Position and department.Start date.Salary.Emergency contact information.

The Employee Data Sheet is used to notify us of new hires and any changes in employee name, address, pay rate, voluntary deductions, etc.

Unemployment claims are put on hold due to missing documentation, claimant ineligibility or a shortage of state workers to handle the claims.

To know how much income tax to withhold from employees' wages, you should have a Form W-4, Employee's Withholding Certificate, on file for each employee. Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment.

Rules, Regulations, & Statutes For any Unemployment Insurance Tax questions, please contact the UI Operations Center at 1-877-664-6984, Monday through Friday a.m. to p.m. or email uitax.support@state.nm.us.

Q. How can I check my claim status? Check your claim status and payment history at in the Unemployment Insurance Tax & Claims system or contact a Customer Service Agent in the UI Operations Center at 1-877-664-6984, Monday through Friday from a.m. to a.m. Q.

1-877-664-6984 Customer Service Representative Option.

Here are some of the most important things to ask new employees when they fill out your employee information form:Full name.Contact information including email and phone.Address.Date of birth.Job title.Department and supervisor.Office contact information.Start date and salary.More items...?17-Dec-2020