New Mexico Employee Time Report (Nonexempt)

Description

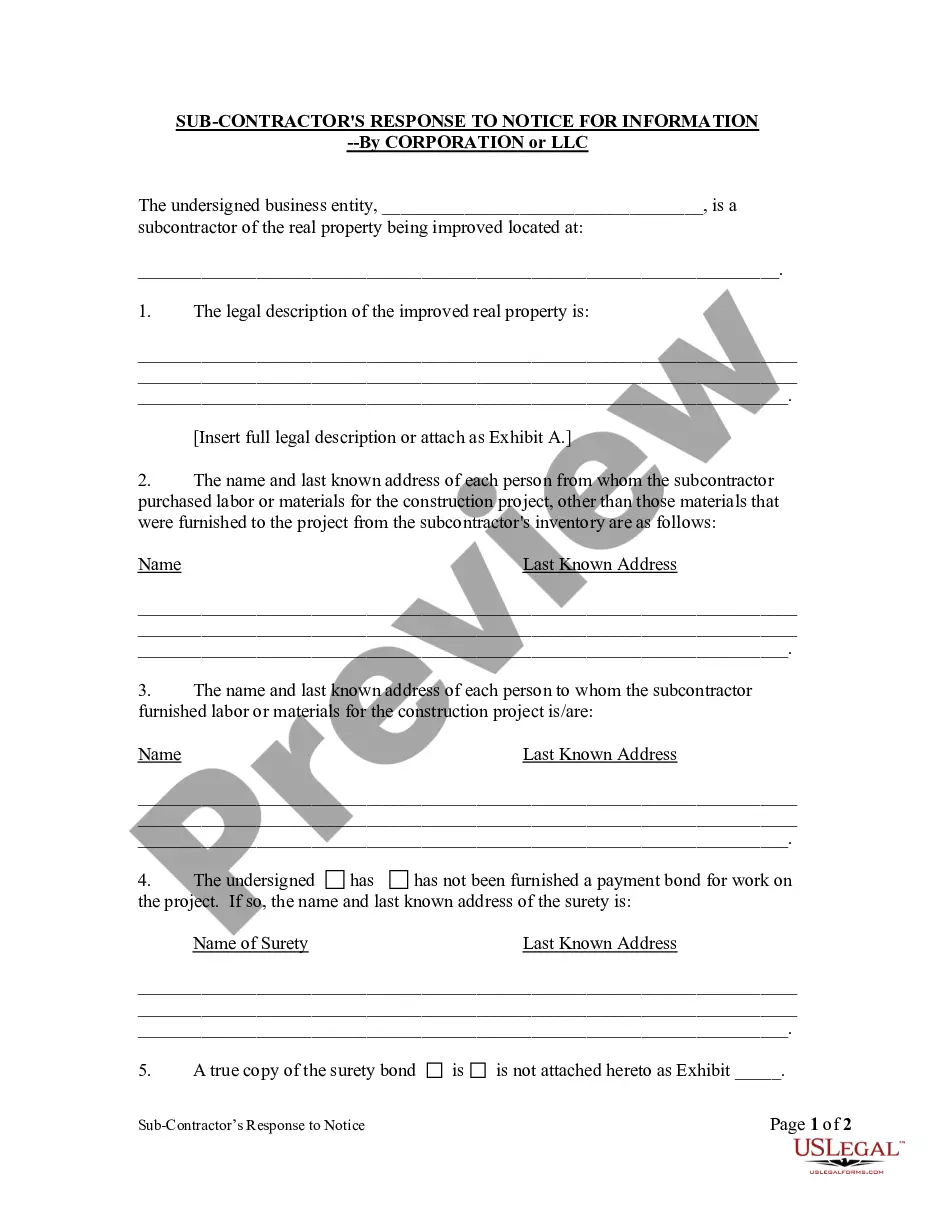

How to fill out Employee Time Report (Nonexempt)?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable versions is not easy.

US Legal Forms offers thousands of form templates, including the New Mexico Employee Time Report (Nonexempt), which is designed to comply with state and federal regulations.

When you find the appropriate form, simply click Get now.

Select the pricing plan you want, complete the required information to create your account, and pay for the order using PayPal or a Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the New Mexico Employee Time Report (Nonexempt) template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct jurisdiction/county.

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to locate the form that fulfills your needs and requirements.

Form popularity

FAQ

The FLSA also defines what kind of behavior can be considered working. For example, the FLSA is the reason you do not get paid for your commute to work, but you should get paid for any work you do, no matter what the time or place.

A. Yes, you are entitled to one hour of reporting time pay. Under the law, if an employee is required to report to work a second time in any one workday and is furnished less than two hours of work on the second reporting, he or she must be paid for two hours at his or her regular rate of pay.

New Mexico employers may not pay you under $11.50 per hour unless you or your occupation are specifically exempt from the minimum wage under state or federal law. If you have questions about the New Mexico minimum wage, please ask us and someone will respond to you as soon as possible. Looking for a new job?

Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

Overtime pay in New Mexico, unless otherwise exempt, is at the rate of 1½ times the employee's regular rate of pay for all hours worked in excess of 40 hours in a workweek. New Mexico exempts farm and agricultural workers as well as part-time cotton ginning workers from overtime pay.

Yes. If an employee is paid by the hour, an employer can require the employee to work overtime but must pay the rate of time and a half the regular rate of the employee's pay for any time over 40 hours in a seven-day period.

$11.50 per hour effective January 1, 2022 (previously $10.50 per hour effective January 1, 2021)

New Mexico exempt the following employees from its minimum wage and overtime requirements: individuals working for educational, charitable, religious or nonprofit organizations where the services are rendered on a voluntarily basis and an employer-employee relationship does not, in fact, exist.

FeffThe Fair Labor Standards Act (FLSA), governs the process that Compensation Analysts use to determine whether a position is either eligible for over-time pay for hours worked in excess of 40 per week (non-exempt) or is paid a flat sum for hours worked, even if they exceed 40 hours within a workweek (exempt).