New Mexico Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

You can spend hours online searching for the legal document template that meets both state and federal standards you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can easily download or print the New Mexico Wage Withholding Authorization from our service.

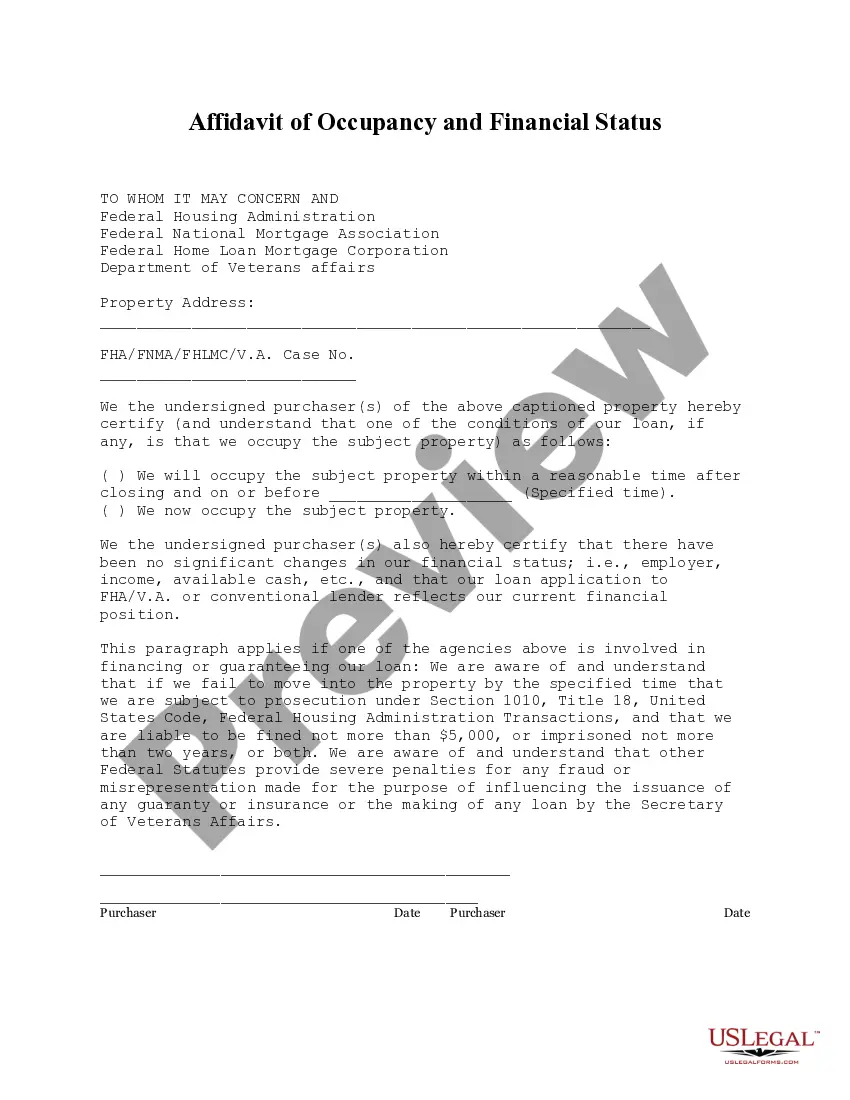

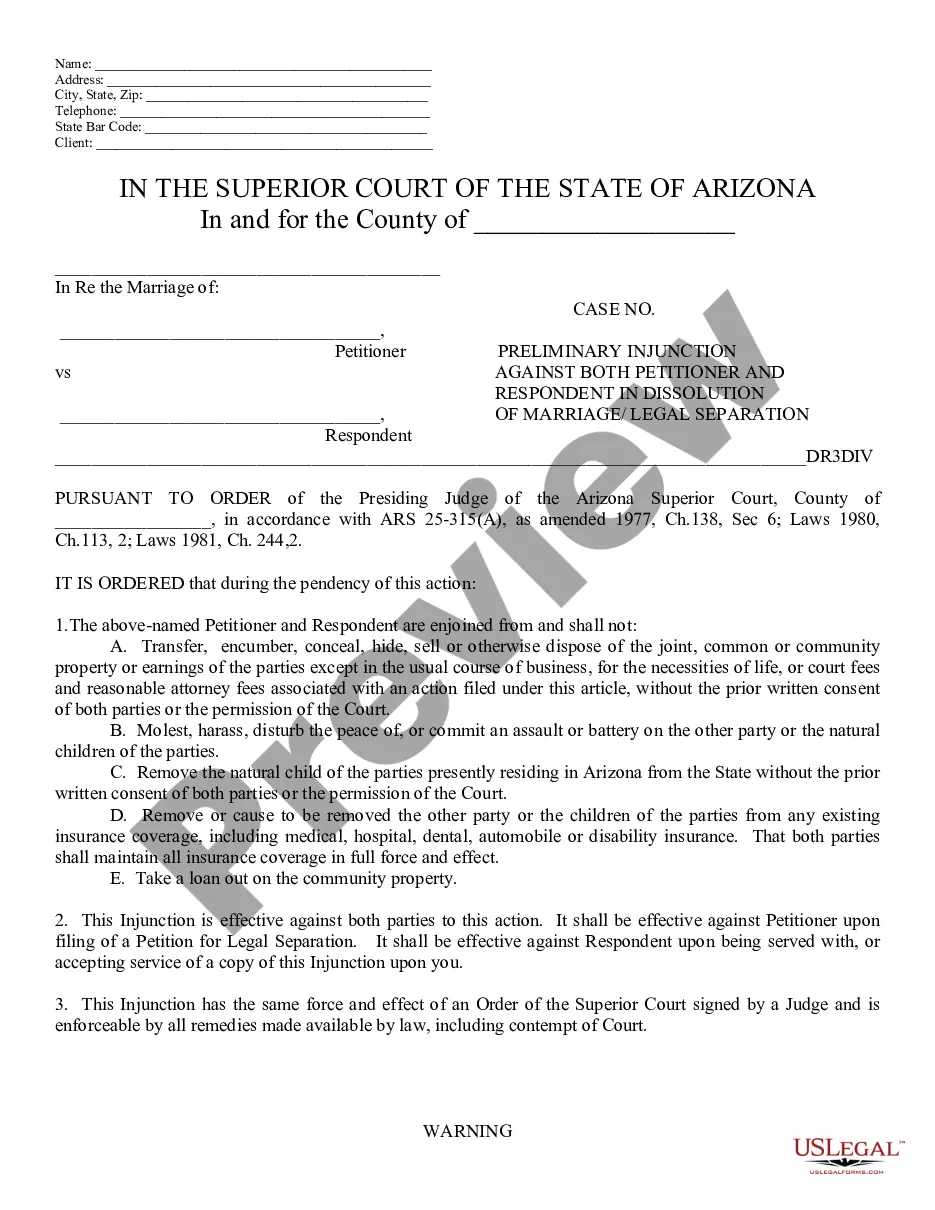

If available, take advantage of the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Get option.

- Then, you can complete, modify, print, or sign the New Mexico Wage Withholding Authorization.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple steps provided below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

Income tax withholdingRegister with the New Mexico Taxation & Revenue Department online. Click Apply for a CRS ID under "Businesses." You should receive your account number and tax deposit schedule the same day after registering online. The CRS Number is 11 digits plus a suffix of "WWT" (Wage Withholding Tax).

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

Payroll tax withholding is when an employer withholds a portion of an employee's gross wages for taxes. Payroll withholding is mandatory when you have employees. The amount you withhold is based on the employee's income. Remit the withheld payroll taxes to the appropriate agencies (e.g., IRS).

New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return. State withholding tax is like federal withholding tax.

New Mexico does not have a form equivalent to the federal Form W-Q. For New Mexico withholding tax you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only.

New New Mexico Employer: Register with the New Mexico Department of Workforce Solutions - (877)-664-6984Register your business with the New Mexico Department of Workforce Solutions.You should receive your Employer Account Number and tax rate instantly after registering.More items...?10-Feb-2021

Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days. This number is also used for NM Worker's Compensation payments and filing.Find an existing CRS ID Number: On Form CRS-1, Combined Report System. By contacting the Dept. of Taxation and Revenue.

The form must be submitted on the 10th calendar date after the month the tax has been withheld. EFPS users (i.e. those who pay their taxes online) can file up to the 15th of the month. The form should be submitted every February, March, May, June, August, September, November and December.

New Mexico does not have a form equivalent to the federal Form W-Q. For New Mexico withholding tax you should use a federal W-4 and write across the top of that form: For New Mexico Withholding Tax Only.