New Mexico FMLA Tracker Form - Rolling Method - Variable Schedule Employees

Description

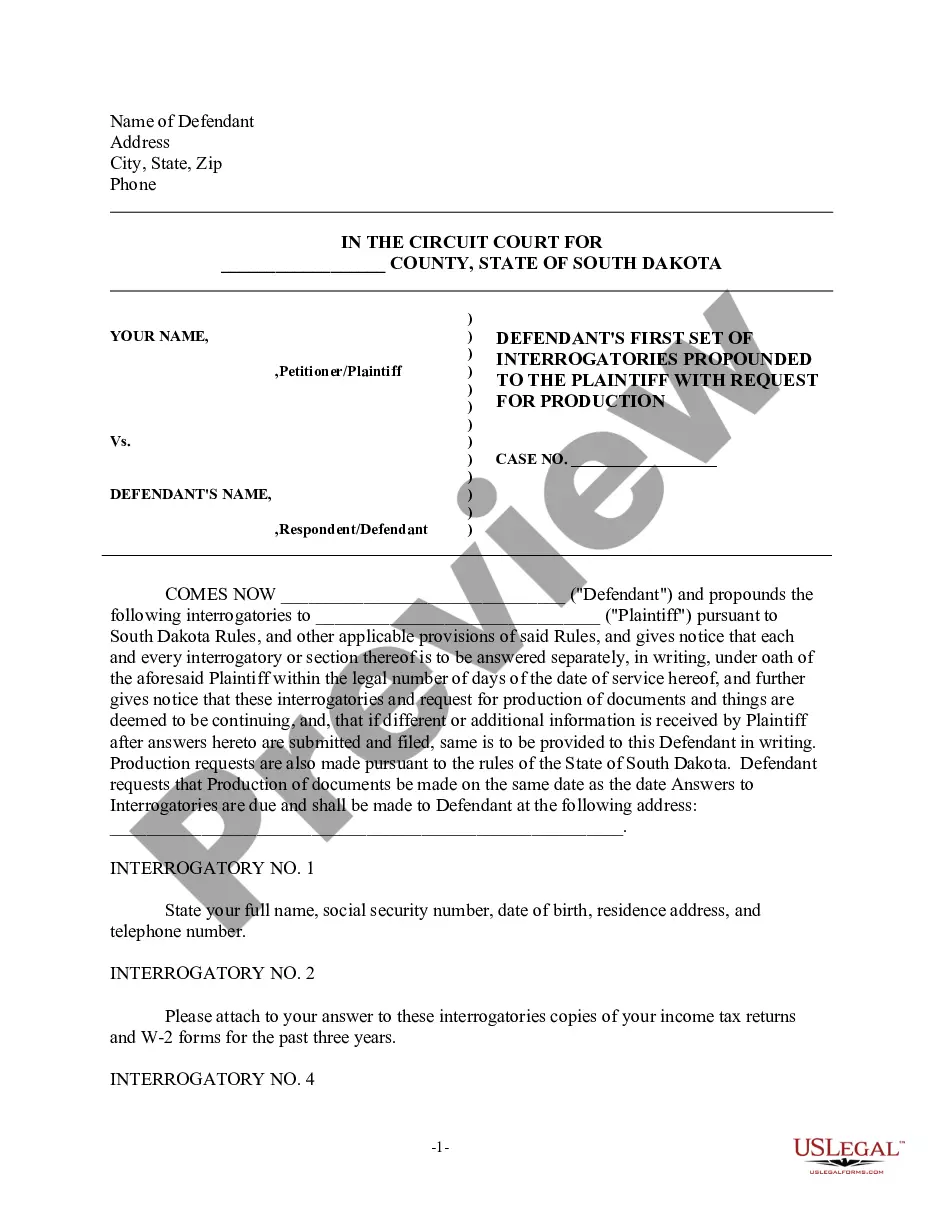

How to fill out FMLA Tracker Form - Rolling Method - Variable Schedule Employees?

If you wish to compile, retrieve, or print sanctioned document templates, utilize US Legal Forms, the finest assortment of legal forms available online.

Use the site’s user-friendly and efficient search tool to find the documents you require.

Various templates for corporate and personal uses are categorized by type and state, or keywords.

Step 4. Once you find the form you need, click on the Purchase now button. Choose your payment plan and provide your information to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the New Mexico FMLA Tracker Form - Rolling System - Variable Schedule Employees with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to retrieve the New Mexico FMLA Tracker Form - Rolling System - Variable Schedule Employees.

- You can also access forms you previously stored from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form’s content. Remember to read the instructions carefully.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal document category.

Form popularity

FAQ

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

For the rolling backwards method, each time an employee requests more FMLA leave, the employer uses that date and measures 12 months back from it. An employee would be eligible for remaining FMLA leave he or she has not used in the preceding 12-month period.

Intermittent leave can be tracked by recording the employee's work schedule and subtracting from it the number of hours they took for FMLA leave. If the employee was scheduled to work 7 hours and only worked 3 hours, then 4 hours of FMLA leave can be counted. Employers must track this information.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

CALCULATION OF LEAVE USAGEThe amount of FMLA leave taken is divided by the number of hours the employee would have worked if the employee had not taken leave of any kind (including FMLA leave) to determine the proportion of the FMLA workweek used.

Using this method, the employer will look back over the last 12 months from the date of the request, add all FMLA time the employee has used during the previous 12 months and subtract that total from the employee's 12-week leave allotment.