New Mexico FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule

Description

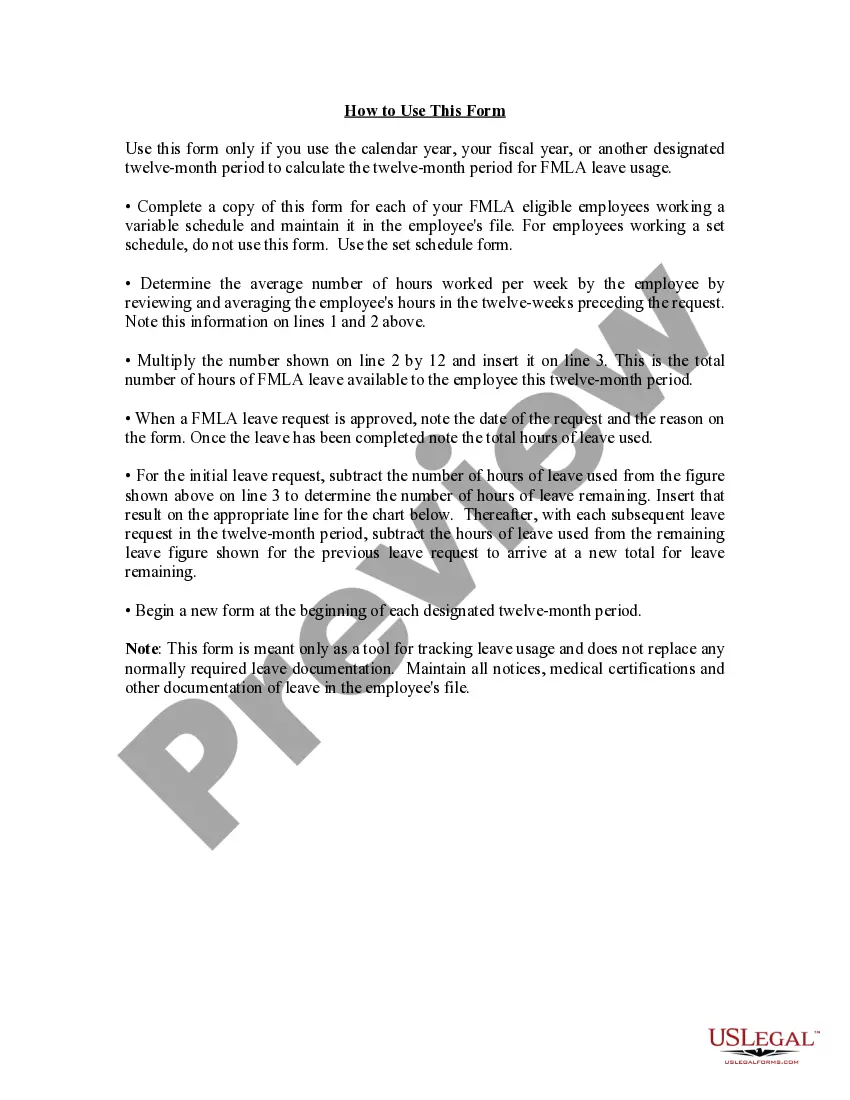

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Variable Schedule?

If you want to fully, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents, available online.

Make use of the site’s user-friendly and convenient search to find the materials you require.

Various templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get it now option. Choose the payment plan you prefer and enter your credentials to sign up for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the payment.

- Leverage US Legal Forms to locate the New Mexico FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule in just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and then click the Download option to retrieve the New Mexico FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule.

- You can also access forms you previously retrieved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read through the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the display to find other variations of the legal document format.

Form popularity

FAQ

The amount of FMLA leave taken is divided by the number of hours the employee would have worked if the employee had not taken leave of any kind (including FMLA leave) to determine the proportion of the FMLA workweek used.

Records pertaining to FMLA leave Intermittent leave can be tracked by recording the employee's work schedule and subtracting from it the number of hours they took for FMLA leave. If the employee was scheduled to work 7 hours and only worked 3 hours, then 4 hours of FMLA leave can be counted.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

An eligible employee may take all 12 weeks of his or her FMLA leave entitlement as qualifying exigency leave or the employee may take a combination of 12 weeks of leave for both qualifying exigency leave and leave for a serious health condition.

Using this method, the employer will look back over the last 12 months from the date of the request, add all FMLA time the employee has used during the previous 12 months and subtract that total from the employee's 12-week leave allotment.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

For the rolling backwards method, each time an employee requests more FMLA leave, the employer uses that date and measures 12 months back from it. An employee would be eligible for remaining FMLA leave he or she has not used in the preceding 12-month period.

The next 12-month period would begin the first time FMLA leave is taken after completion of any previous 12-month period. As an example, if the employee begins FMLA leave on June 1, 2019, then the next 12-week period would begin again on June 1, 2020.